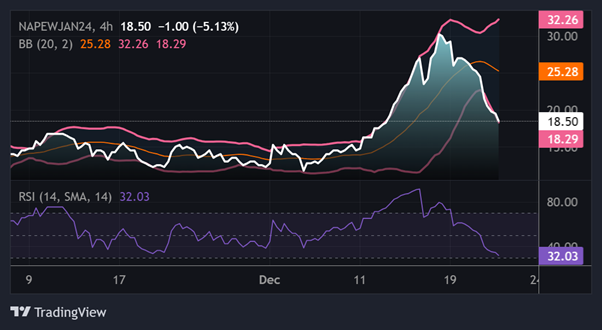

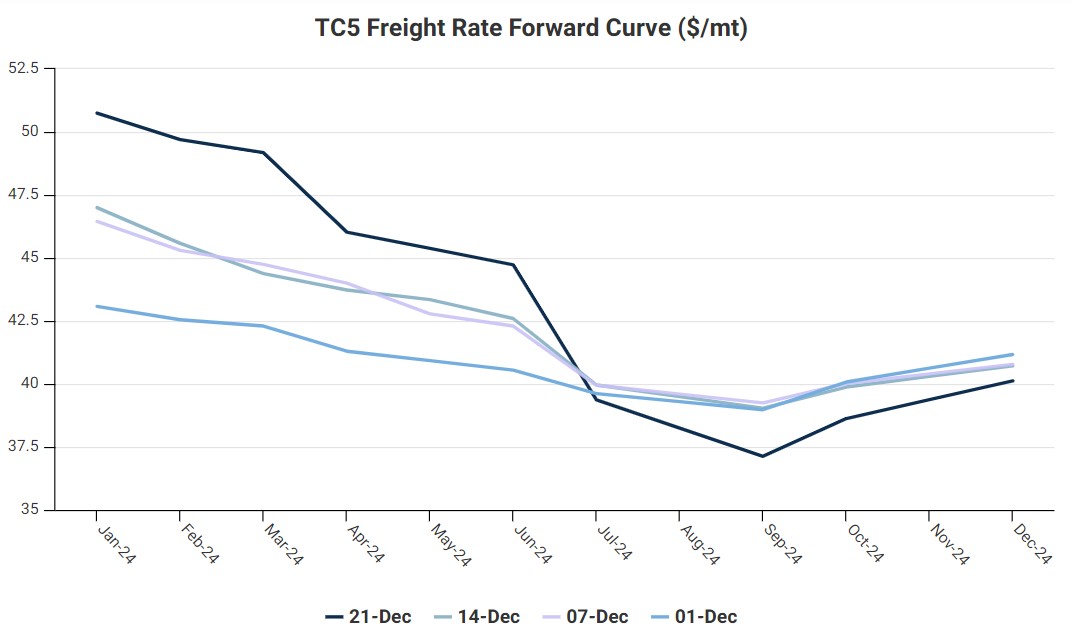

Last week we saw the naphtha EW roof, fuelled by the skyrocketing TC5 freight rate (which passes through the Bab al-Mandab strait, the bottleneck of the Red Sea). Turmoil in the Red Sea has allowed for the TC5 freight rate to rally significantly and into December, players piled into the naphtha E/W. Open interest in the prompt contract has shot to over the usual level it is at expiry and the monthly tenors to Jun are seeing OI higher than the 5-year average. But this week as the news continued to peak, prices dropped as the geopolitical risk premium seemed to have been priced in as prices in the prompt dropped to $18.50/mt on Dec 22 and the RSI indicator fell to near oversold.

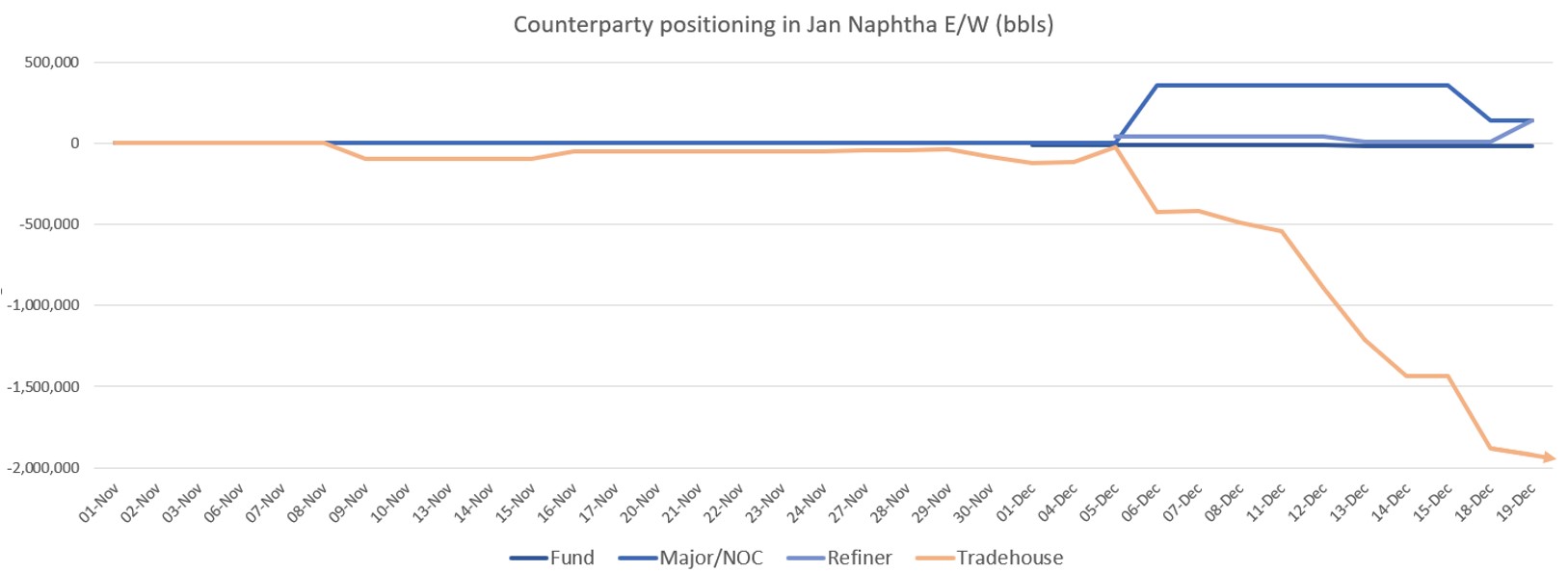

November ended with the market uninspired in naphtha as Jan EW bounced between $12-16/mt. Recently, we persistently see the same trade houses control a great deal of the naphtha trading out of the Black Sea. Russian naphtha, abundant and well controlled by these trading entities has allowed for them to be able to sell the East/West at flat and still take profit as they benefit from the optionality of trading the physical. As these cheap Russian barrels are priced off MOPJ (the Asian naphtha benchmark) these players were positioned pretty short.

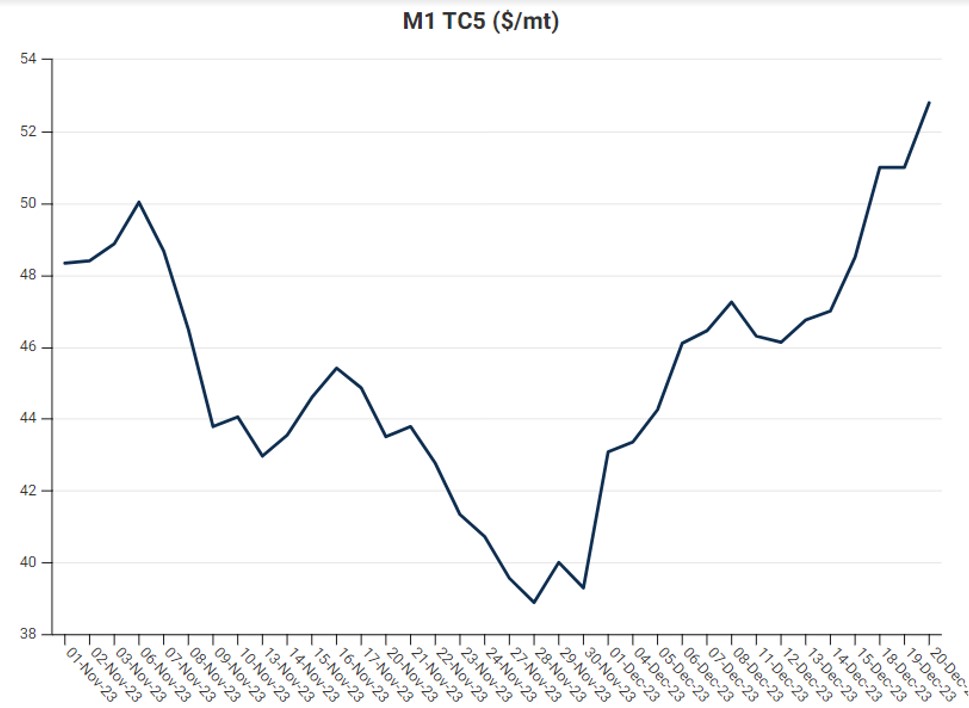

The freight rate that is associated with the naphtha East/West is the TC5 route. The December contract was heavily shorted at the end of last month as players expected the Arab Gulf refinery maintenance to withdraw some naphtha supply supporting Eastern prices but pressuring the TC5 FFA as there was little demand for the vessels to move product East.

As we entered December the Houthi rebels began to attack ships in the Bab al-Mandab strait. Major shipping companies like the Mediterranean Shipping Company and Maersk are redirecting their vessels to a longer route around Africa’s Cape of Good Hope.

In the week leading up to the news that some big shipping lines would suspend transit through the Red Sea, and after weeks of sideways price action in EWs, we saw trade house buying in good size in the prompt quarterly EW, which given the circumstances was quite out of place (unless, of course, they knew of the suspension before it was announced…). These large trade houses covered their short positions in Bal-Dec23 TC5 which rallied by $14/mt.

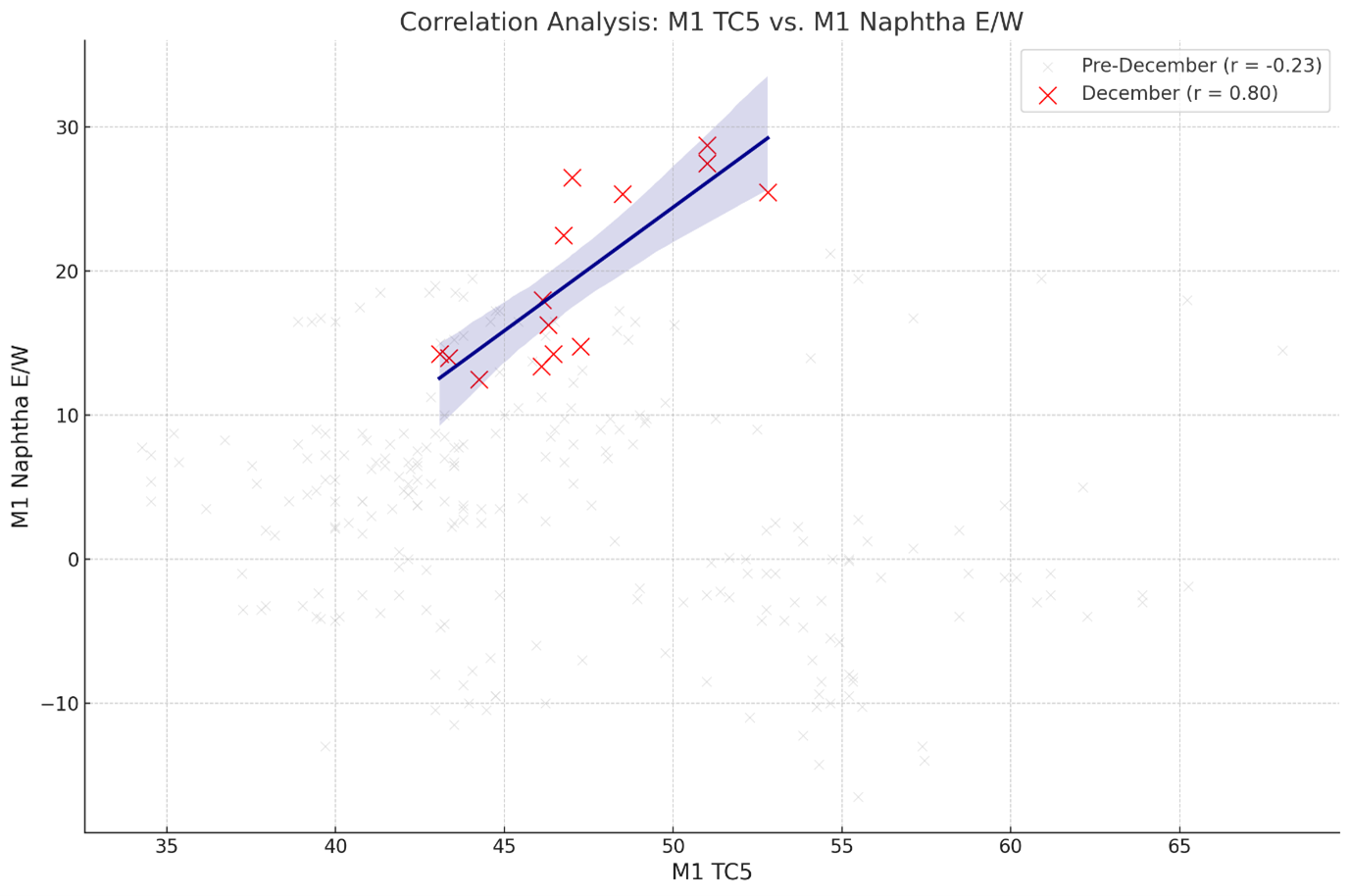

The effect of the rallying TC5 can be seen in the huge increase in the correlation between the M1 TC5 FFA and the M1 naphtha E/W contract. The r value rose from -0.23 for the year to December to 0.80 for the first 2 weeks of December.

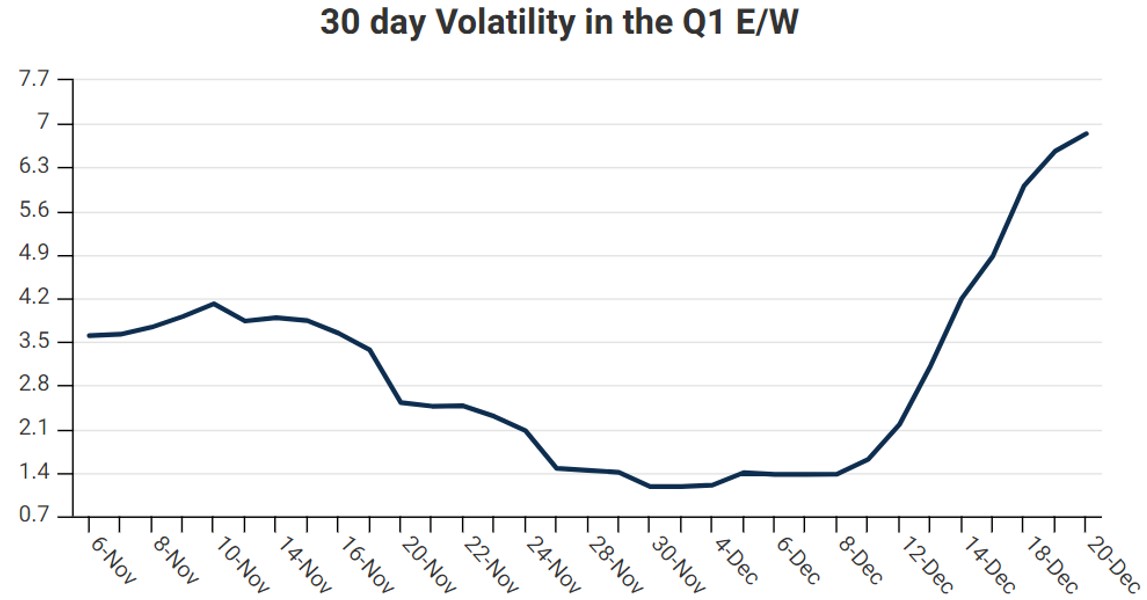

Short covering flows spurred speculative bullish interest in the E/W, and many players were going long in Q1 E/W on Dec 4-12. There was decent selling into this as the longevity of Eastern strength is not concrete in 2024. It seems as if trade big names got wind of the suspension of Red Sea transit before it was announced to the public and the price gapped up in the low liquidity.

High prices encouraged good selling with fundamentals weak in the naphtha market (on land anyway). Players were long and sold the news as it seems this is the most disrupted the Strait can reasonably be, there are few reasonable bullish bullets left, so the disruptions are priced in and prices crashed from their technical overbought levels.