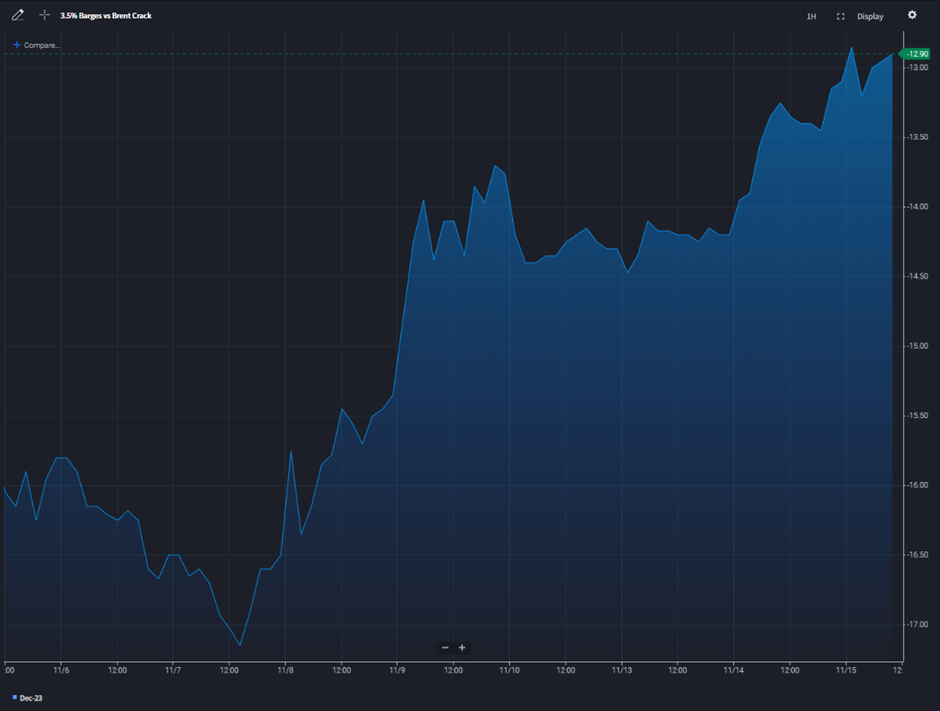

We have seen strength in HSFO market recently with the European benchmark experiencing a robust ascent. Notably, the front crack has now reached -$12/bbl handles, indicating a notable shift in market dynamics having failed to find much traction last week.

This upward trajectory can be attributed to a complex interplay of regional supply variations and geopolitical influences. In Asia, the supply landscape remains relatively saturated, bolstered by consistent inflows from Russia and the Middle East. Conversely, Europe’s supply chain has tightened, largely due to the imposition of sanctions against Russia, which was previously a principal supplier of 3.5% sulphur fuel oil to the continent.

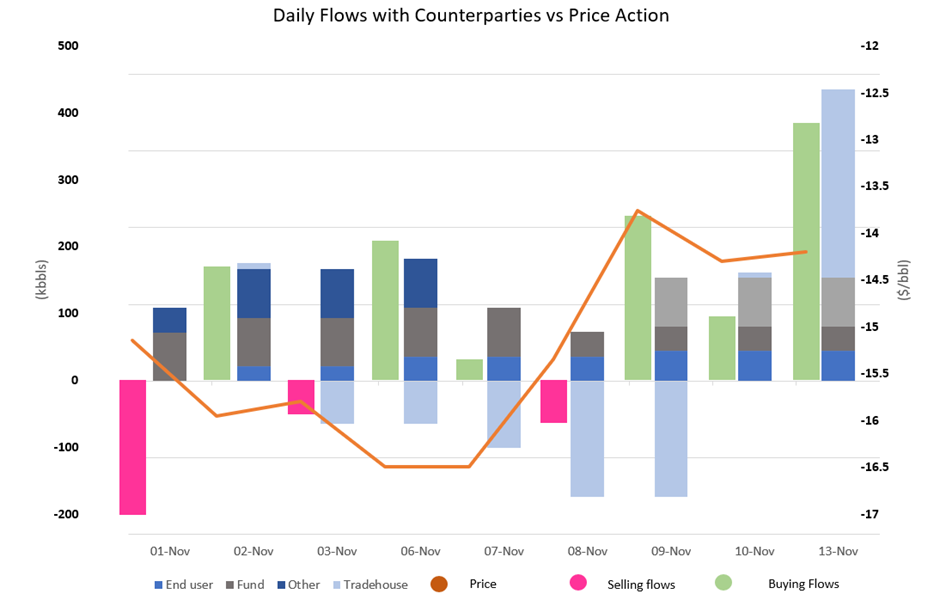

Compounding this supply disruption are the ongoing production cuts by Saudi Arabia, which have further exacerbated the supply constraints, propelling the market higher. The beginning of November has seen a diverse array of market participants on the buying side, including trading houses, major oil companies, end-users, and investment funds. Notably, trade houses were previously on the sell-side of the prompt crack, flipping to the buy side on the 10th of Nov which has clearly been the key supporter of prices.

The HSFO volume anticipated to reach European markets in the latter half of the month, as per the insights provided by KPLR data, presents a potential inflection point. Market speculators might seize this opportunity to capitalise on the current elevated price levels, possibly leading to a realignment of market positions.

On the other hand, OPEC+ are set to meet on November 26th and speculation of further cuts could see these players continue to pile into length. Market flows according to Onyx dashboard have a slight buyside bias in the Dec contract though are not overly saturated. Moreover, the M1 contracts is still well below historical highs and so on a psychological level, participants will hold the belief that in the right environment, prices will have scope to move up.

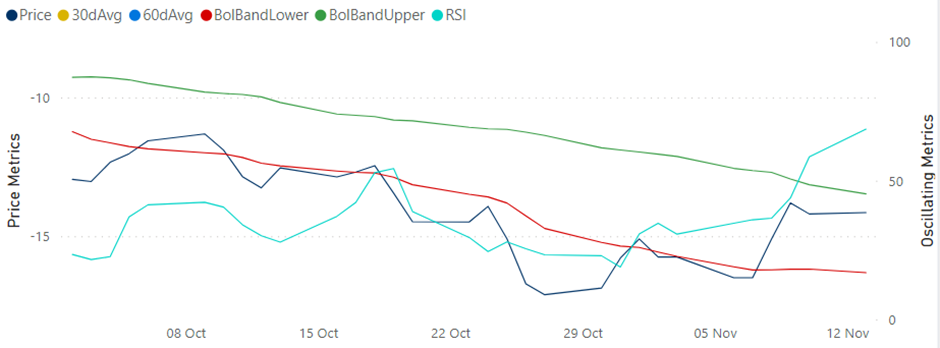

Looking at the technicals for the Dec 3.5% barge crack, we can see the RSI has moved higher aggressively though is still not into overbought territory while levels remain firmly between the upper and lower Bollinger bands which have been narrowing, indicating less volatility.

Monitoring the flows in the HSFO market over the coming days is indeed crucial, particularly in light of the current speculative dynamics. If those holding speculative long positions begin to take profits, it could trigger a cascade effect, where other players who are also positioned long might feel compelled to sell, in an effort to secure their gains or minimise losses. Such a wave of selling by long-position holders could significantly amplify a downward price movement.

This is a classic example of how market psychology and the actions of a few can influence broader market trends. This careful monitoring will be key in determining the right timing for entering or exiting positions, especially in a market that is poised on the cusp of potential volatility.