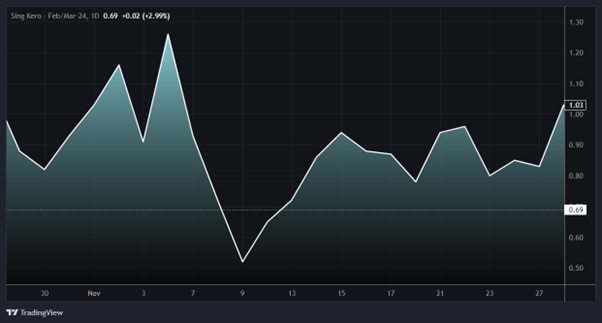

Despite the cold snap in the northern hemisphere, gas-to-oil switching has been largely absent in heating demand adversely impacting demand for gasoil in Europe. As a result, stocks usually expected to be purchased from Asian refiners for European stockpiling purposes have stayed put in Asia – triggering a wave of weakness for Sing 10ppm gasoil. Amid this weakness in the middle distillates complex, kero spreads found strength over November. Specifically looking at the Feb/March spread, prices went from $0.52/bbl on the 9th of November to $1.03/bbl on the 28th of November.

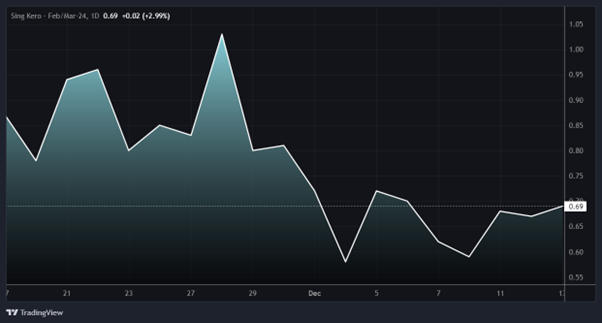

This strength in regrade emerged from robust fundamentals such as aviation demand rising on the back of the festival season and then the Cricket World Cup in India, and more significantly, heating demand climbing up in Japan. However, kero spreads weakened into December. After hitting a peak at the earlier mentioned $1.03/bbl mark on Nov 28, the spread traded in the $0.60/bbl handles on the 7th of December. This retracement lower stemmed from increasing kero production over Asian refiners switching to kero from gasoil in search of attractive margins.

Despite this rise in kero production and recent weakness, kero is likely to find support into the new year over a strengthening fundamental picture. Aviation demand should likely pick up around Lunar New Year celebrations in Asia this February. Furthermore, kero demand is likely to remain strong if expectations of temperatures remaining low in Asia, especially Japan, hold – bringing about further support for heating demand. Looking at the technicals, while the RSI steadily remains in neutral territory, the PPO chart displayed a sudden dip at the beginning of December – perhaps indicative of investors pricing in the increase in kero production. However, the PPO line has been on the rise since, another signal of bullish sentiment in the Feb/March spread.

Amid the positive outlook, we continue to see a few caveats – namely, expected weakness in the more prompt Jan/Feb kero spread, which will likely take the brunt of the increase in kero production by refiners. This weakness may impact spreads down the curve, consequently impacting the Feb/March spread. Finally, despite heating demand in Asia positively contributing to the kero fundamental picture at present, market players would be advised to be cautious about the still at-large El Nino phenomenon threatening to snap the cold out of Asia. Japan’s weather bureau reported a 90% chance of the El Nino phenomenon continuing during the northern hemisphere winter on Monday. The bureau also stated a 50-50 between standard normal weather patterns returning after the winter and El Nino continuing into next year’s spring.

Notwithstanding these warnings, we are bullish on Feb/March kero based on the strong demand picture into the new year and thus recommend going long this spread. A final note on this idea is that this is a mid-term trade considering the forewarning on prompter kero spreads possibly weakening further. Thus, we recommend a higher entry price, at $0.85/bbl to be able to capture the upward trend in the spread once the strong fundamentals have been priced in by the market, alongside a target and stop-loss point at $1.15/bbl and $0.70/bbl, respectively.