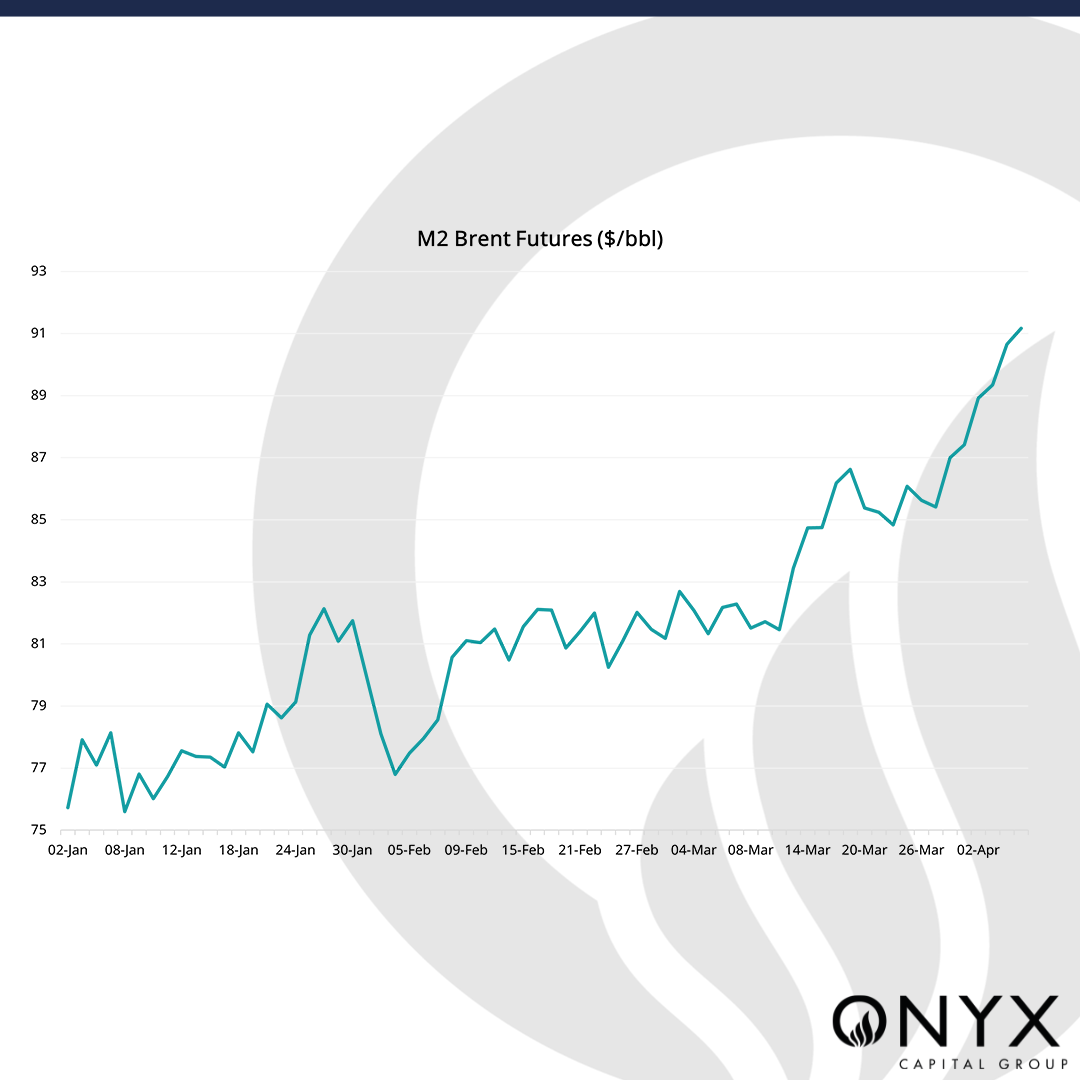

Oil prices clocked in a momentous week with the June Brent futures contract jumping from $88.80/bbl at 17:00 BST on Apr 04 to the sanctified $90/bbl marker just two hours later and ending the week coming close to $92/bbl. However, this morning, oil prices slid to $89.00/bbl at 02:00 BST. This decline stems alongside an observation of players reluctant to hold short risk over the weekend amid the current geopolitical uncertainty and choosing to instead enter these positions at the start of the week. As prices dipped, we likely saw these players take profit, propelling the futures back to $90/bbl a few hours later. We expect to continue to see support around the low $89/bbl handles and hold a neutral-to-bullish view of the outright benchmark contract.

Brent’s overnight decline emerged alongside an easing down of the tensions in the Middle East, with Israel withdrawing more soldiers from Southern Gaza, reportedly committed to fresh talks surrounding a potential ceasefire. However, uncertainty continues to loom vis-à-vis Iran’s role in the conflict and with US forces destroying further missile systems in Houthi-controlled Yemen. In addition, Saudi Arabia raised the official selling price (OSP) for all its crude grades to Asia in May due to a noted tightness in heavy oil supply.

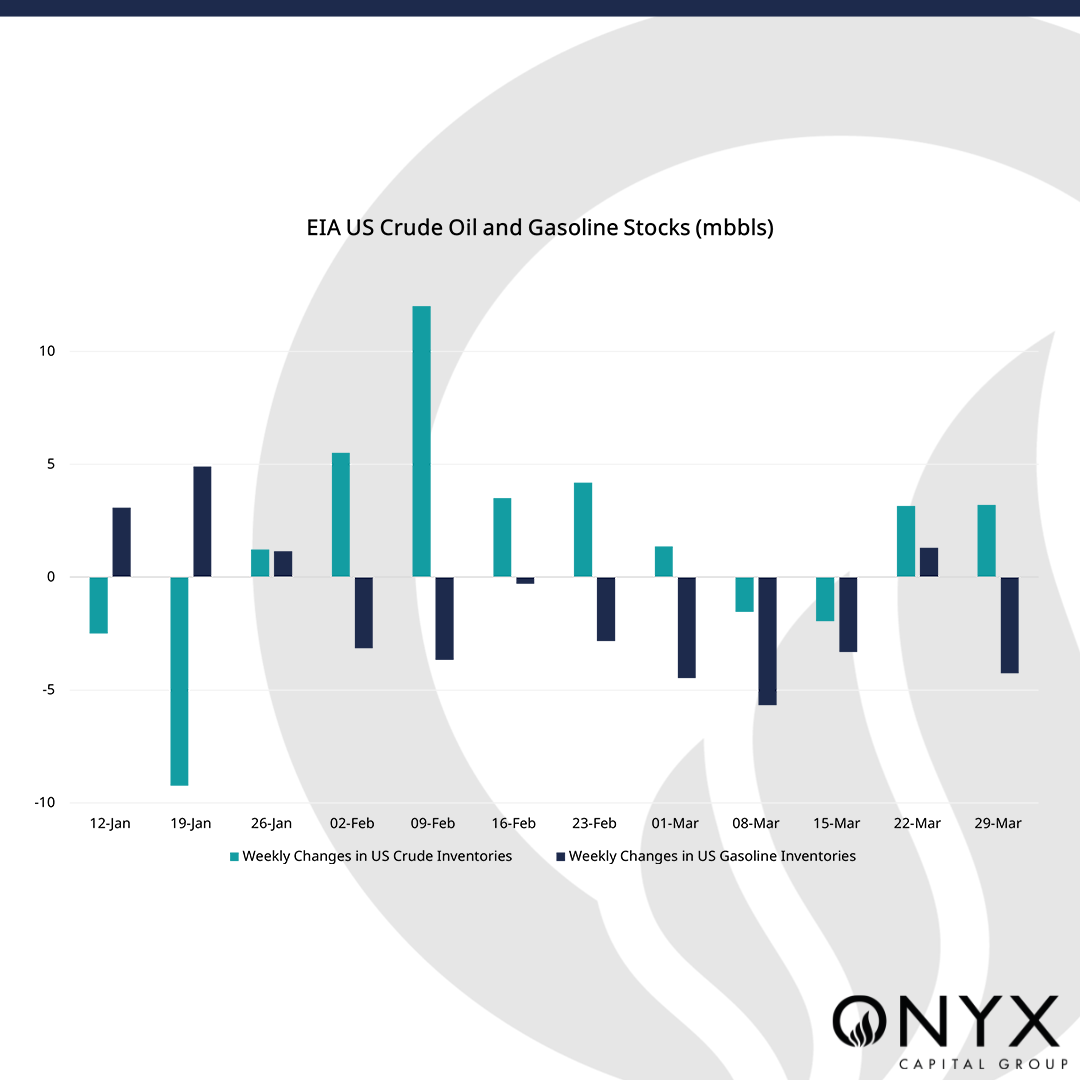

Nevertheless, Baker-Hughes reported a weekly rise in US oil rigs, and the EIA has announced two back-to-back builds in US crude inventories despite expectations of a draw, bringing some bearishness to the otherwise bullish Brent. Nonetheless, a significant draw in US gasoline stocks brought some respite to sentiment surrounding American fuel demand. Looking at the economy, we saw strong US labour market data for Q1 released last Friday, displaying a rise of over 300,000 new jobs in March against an expected 200,000. However, the growth was driven by part-time workers rather than full-time ones, the latter of which fell by 6,000 in the month (-1% y-o-y). Market participants will now wait in anticipation of Wednesday’s CPI data for further indication of where the US economy is headed in terms of both inflation and resultingly, in terms of interest rates.

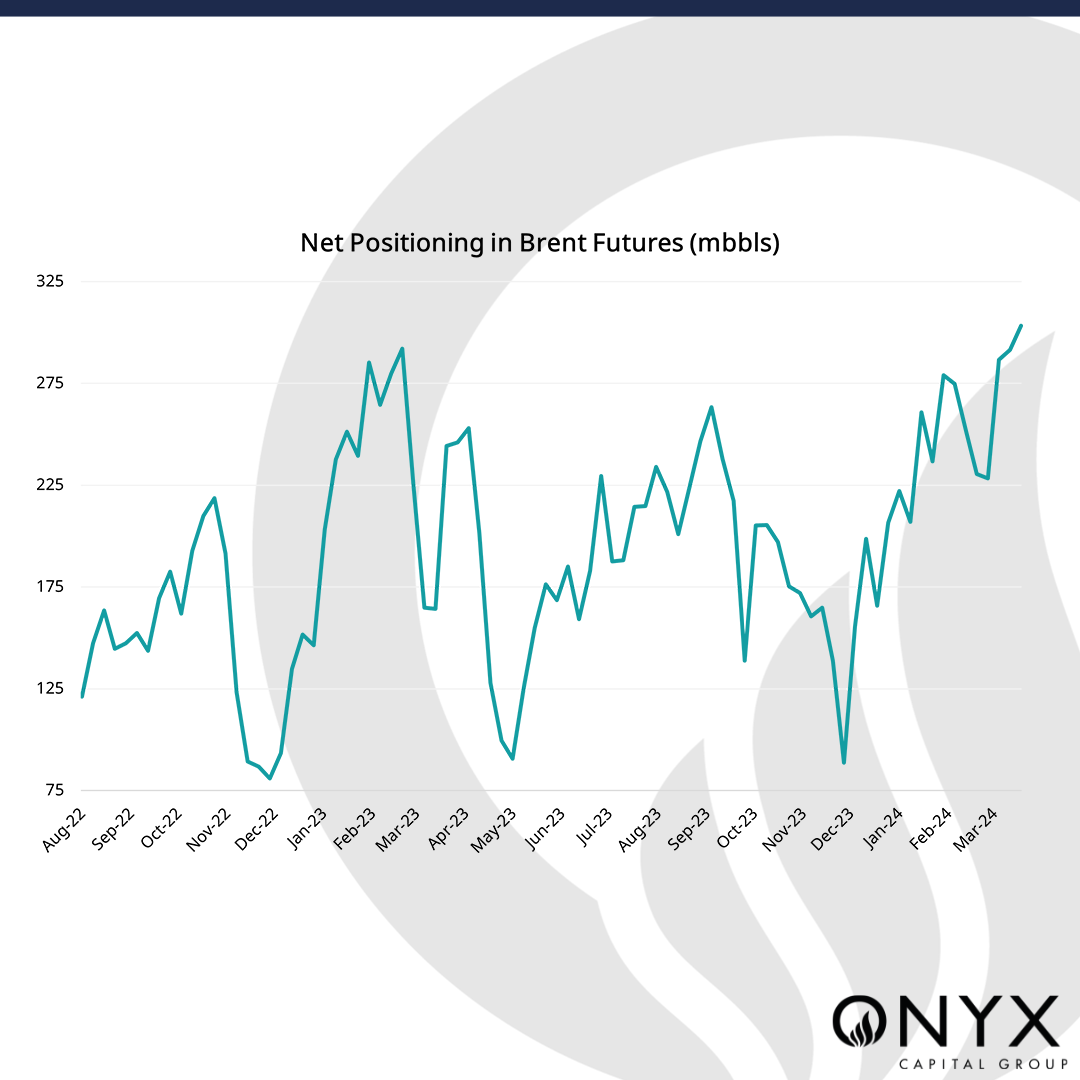

Finally, amid all of this, the market continues to be positioned long. CFTC data for the week to Apr 02 highlighted a 2% w-o-w rise in long positions and a nearly equivalent decline in long money-managed positions in Brent – taking net positioning to its highest recorded level since September 2021. In the same week, we also witnessed the largest removal of prod/merc long and short risk on a percentage basis since January 02, allowing further room for new long risk and another potential rally in the benchmark futures. Coupling this with the support seen around the low $89/bbl handles, we expect Brent to be choppy and move around $89.50 to $92/bbl to finally sit around $91-93/bbl by the end of the week. However, should further bearish news emerge on fuel demand (e.g., a build in gasoline stocks) or further developments surrounding a ceasefire, we may see oil prices fall from these highs to below $89/bbl.