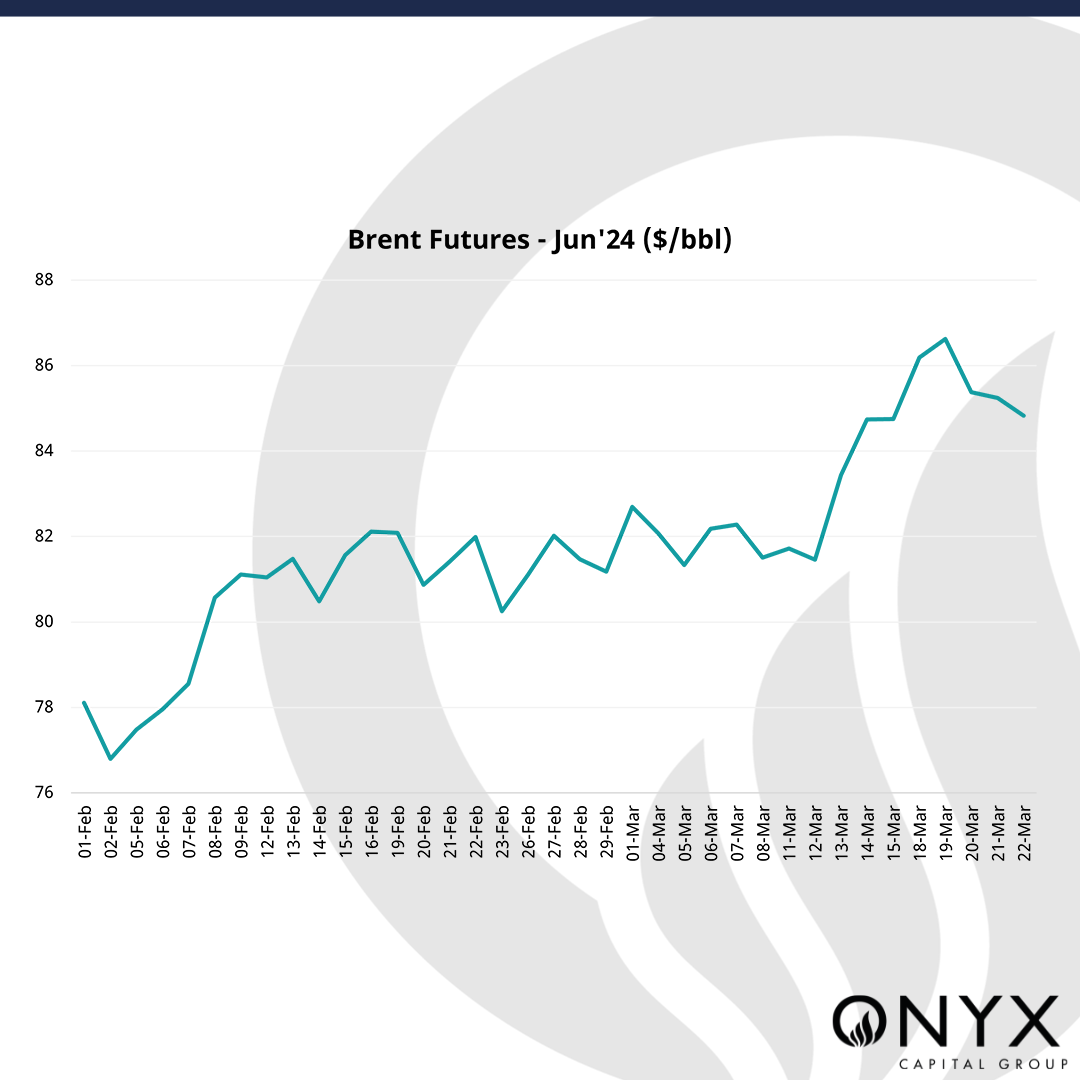

Oil prices registered some strength overnight on the back of support generated in the early hours of Asian trading with the Jun Brent futures climbing to $85.40/bbl at 03:20 GMT. The futures eased to $85.35/bbl come 09:20 GMT, but remain elevated compared to last Friday’s plummet into the sub-$85/bbl handles.

The strength noted early this morning arose alongside fears of tighter global supply amid the ongoing conflicts in both the Middle East, as well as between Ukraine and Russia. In the Middle East, the possibility of an instantaneous ceasefire appears deflated following Russia and China vetoing a US-backed resolution calling for “immediate and sustained ceasefire” in Gaza. Israeli forces reportedly besieged two hospitals in Gaza on Sunday, stating that they had captured 480 militants at Gaza’s Al Shifa hospital. In Ukraine, following last Friday’s largest aerial bombardment in more than two years of war, the Kremlin hit 57 additional missiles and drones on Kyiv and the western Ukrainian region of Lviv on Sunday. At the same time, Ukraine reported that it hit infrastructure used by Russia’s Black Sea fleet in Crimea. Additional concerns of supply tightness generating out of this conflict come from US sanctions on Russian fuel, over which Indian refineries are now refusing to take Russian crude carried on PJSC Sovcomflot tankers. Russia was further left reeling from a terrorist attack, for which ISIS claimed responsibility, at a popular concert venue in the outskirts of Moscow which killed more than 130 people.

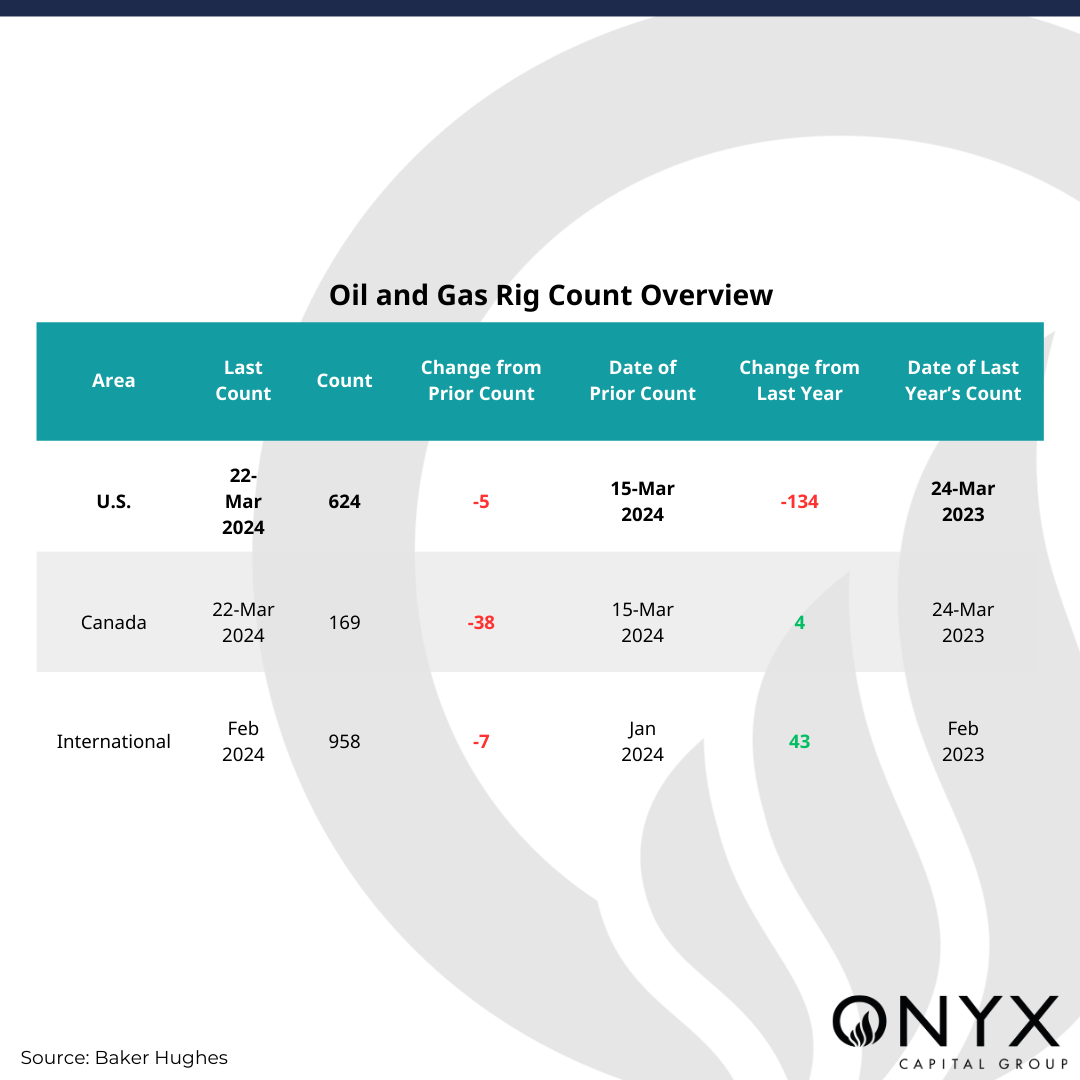

Outside of the geopolitical risk narrative, the US oil rig count fell by one to 509 in the week to Mar 22. This decline places the total oil and gas rig count to 624,134 (19% short of levels seen this time last year).

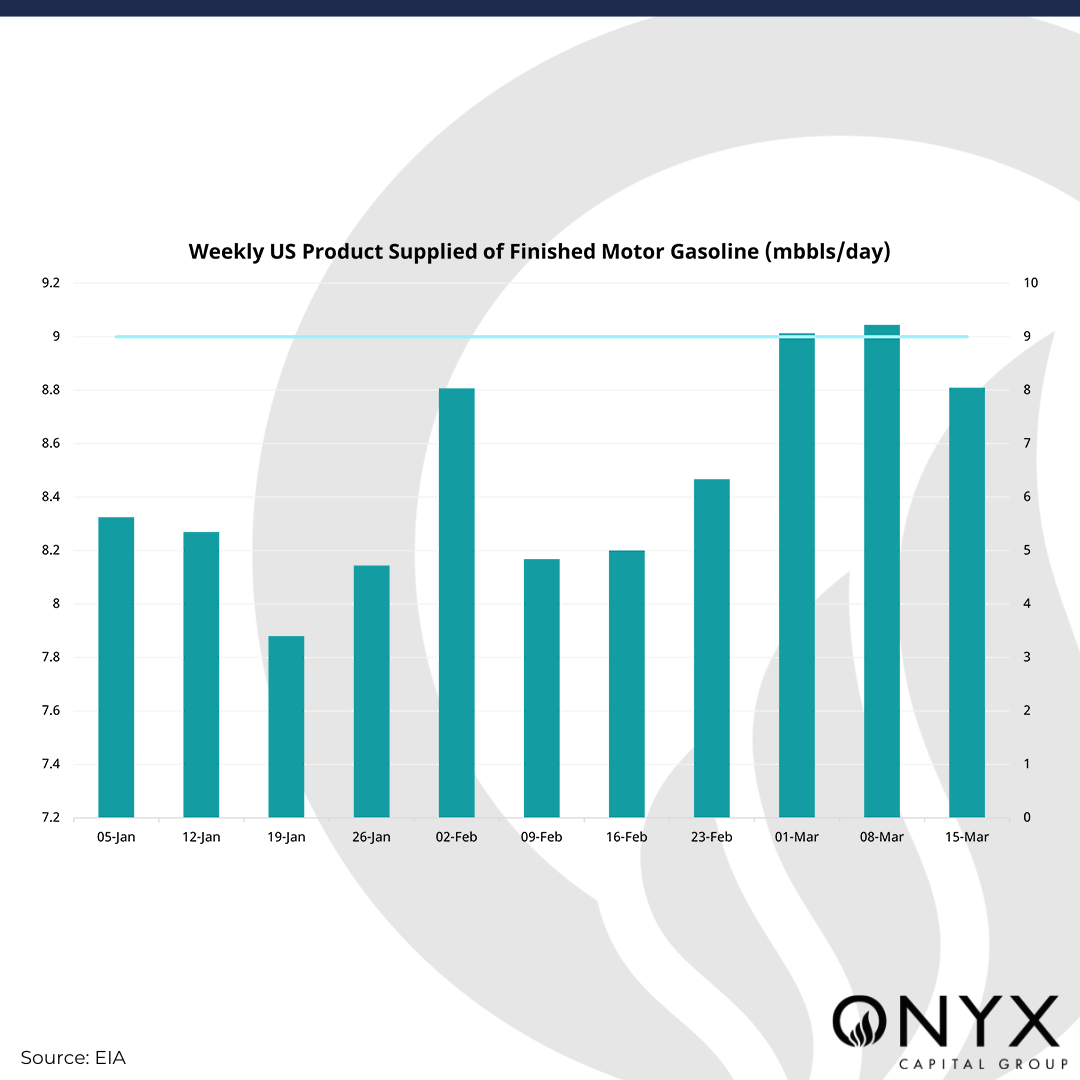

While this supply-side story paints a bullish picture for Brent futures, we continue to see mixed demand-side signals. EIA data for the week to Mar 15 highlighted that despite a seventh consecutive draw in gasoline stocks, finished motor gasoline supply – a proxy for demand – fell from 235kbbls/day to 8.8mbbls/day. This plummet marked the first time this metric dropped below 9mbbls/day in three weeks. Looking to macroeconomic data, we see some bullish signals – such as the possibility of an ECB rate cut in as early as June, as per Bundesbank President Joachim Nagel. However, while we also witnessed a dovish US Fed last week, we saw the US dollar strengthen over the week. A stronger dollar makes oil expensive for holders of other currencies, depressing demand.

Hence, we’ll be looking for further cues for a clearer demand narrative in the upcoming US data on consumer confidence (due on Tuesday), Q4 GDP (due on Thursday) and finally, Feb PCE data (due on Friday). Until then, we hold a neutral-bullish view for oil prices, and expect them to sit in the $86-$87/bbl handles at the end of the week.