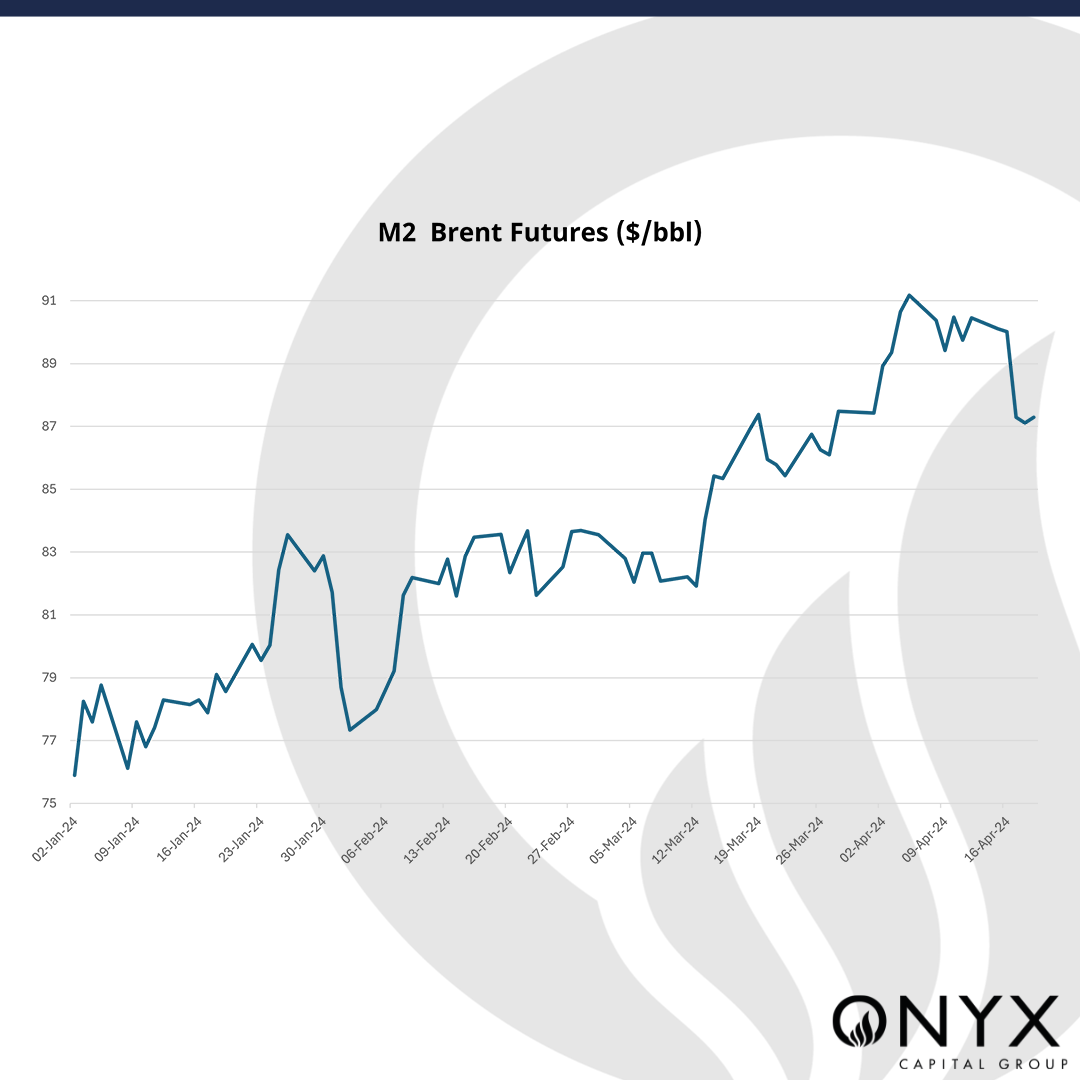

The Jun Brent futures flat price witnessed a sharp rally last Friday (April 19), surging back into the $90/bbl region before easing off to $87.20/bbl handles the following evening. The futures contract has seen little luck since then, dropping further to $85.80/bbl at around 08:15 BST on April 22nd, where we finally recorded support for Brent.

April 19’s strength – albeit via an incredibly choppy price trajectory – likely emerged out of news of explosions in the Iranian city of Isfahan, reportedly due to an Israeli attack. However, these gains subsequently eased, with Iran downplaying the attack’s significance and reporting that it had no existing plans to retaliate. Despite this, we see trepidation among market participants, who continue to hold long risk over the weekend due to all the geopolitical uncertainty. This morning’s come-off in price action was likely on the back of length liquidated after being held all weekend. Looking at the risk aversion in the face of these tensions, we continue to find support for Brent on the back of these geopolitical apprehensions – especially with groups like Hezbollah continuing to be in the mix, and with the United States now planning further sanctions on Iran alongside new sanctions on a unit of the Israeli military on evidence of serious human rights abuses.

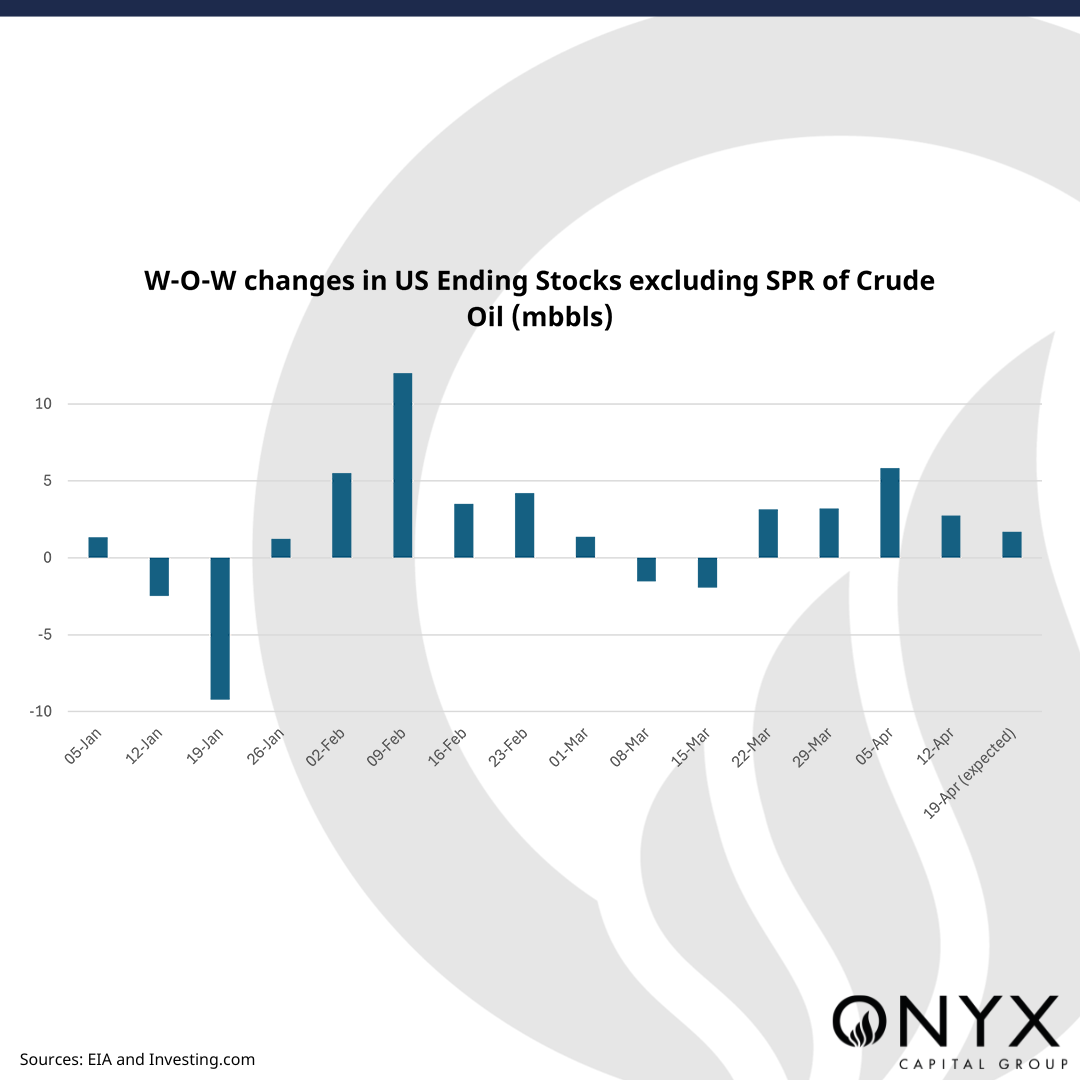

On the other end, the EIA disclosed a build of over 2.7mbbls in US crude oil inventories last week against median estimates of a build of 1.6mbbls, forging a bearish picture in crude. In addition, an exceptionally weak gasoil complex continues to dampen refinery margins. With gasoil comprising a substantial component of these margins, we risk a possible supply overhang in crude oil should fewer refiners produce gasoil or diesel.

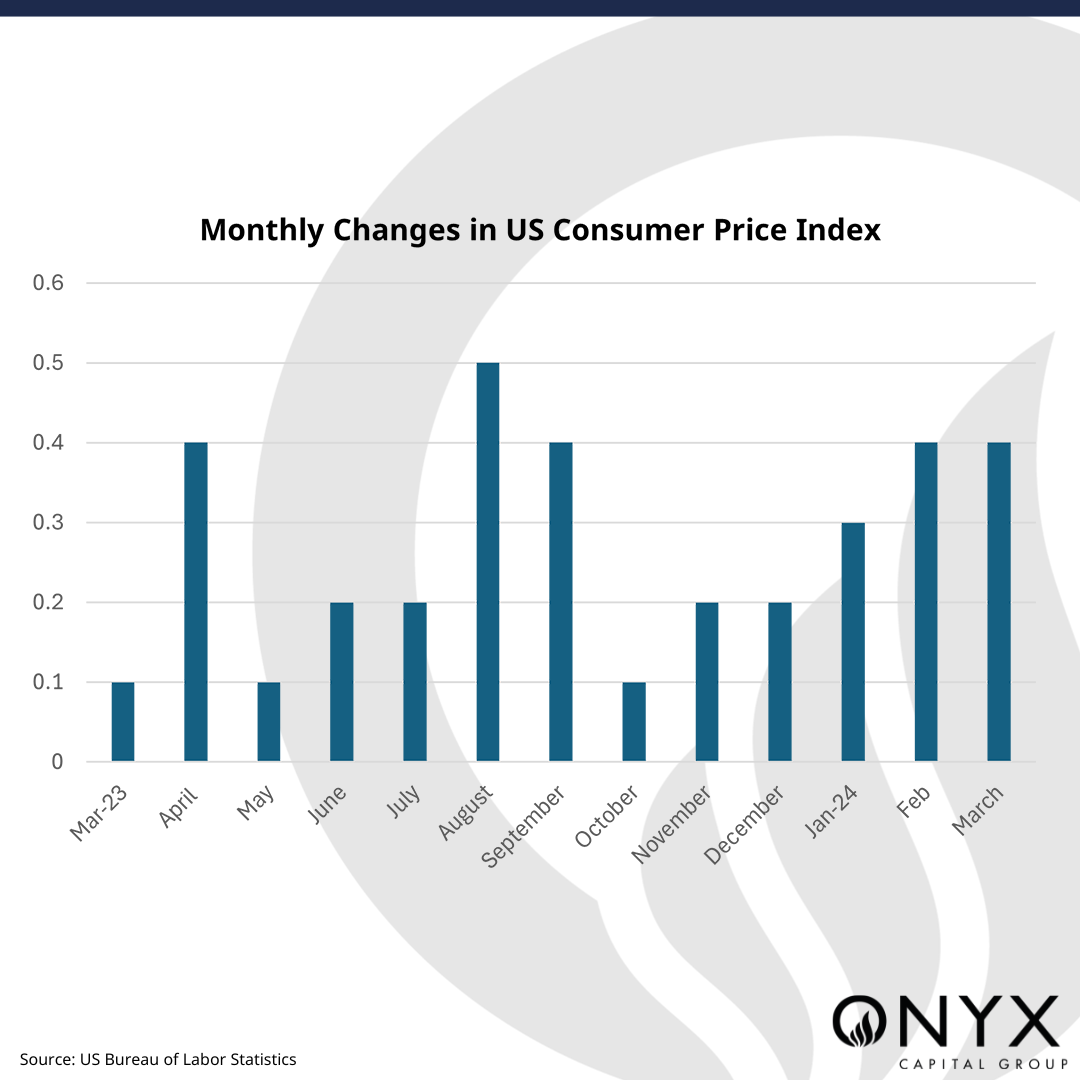

Exacerbating this further, China’s exports of marine fuel oil experienced a significant decline of 32% y-o-y in March, totalling 1.32 million metric tonnes. Import volumes for March stood a 1.98 million tonnes, down by 19% from March 2023. Finally, further bearishness stems from the US Fed, with the OIS now pricing just 39bp cuts this year as US inflation remains sticky.

However, the market will want to keep an eye out for this week’s EIA stats (out on April 24) amid forecasts of a 1.6mbbls build in US crude oil stocks. These players will also perhaps be on the lookout for Friday’s PCE inflation data and on the sale of US Treasuries, with the latter revealing the world’s appetite for American debt. Should we see a failed auction this week, the Fed may be forced to step in, creating further inflationary pressure and boosting oil prices up. This may strengthen the dollar further, which may dampen sentiment more. Finally, we will also be on the watch for any changes to the situation in the Middle East, where any level of severity would elicit a bullish response.

In light of these factors, we expect prices to hover around a range of $85.50 and $89, possibly hitting a high at $90/bbl, but ultimately printing between $85-87/bbl come Friday.