Rebalancing and Mixed Demand

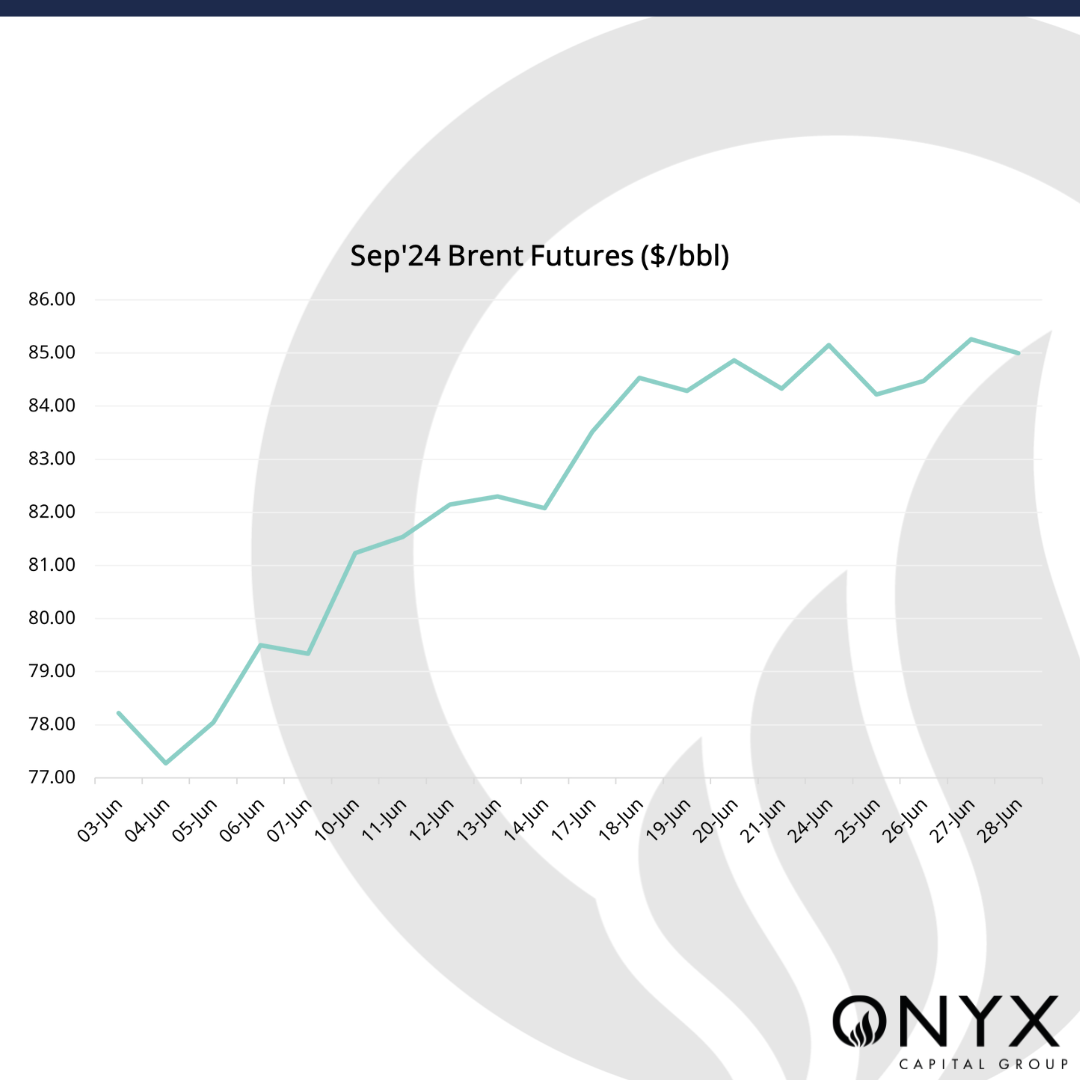

We expect Brent to inch up over the week with speculative positioning that is less saturated, following what appears to be a squeeze of the overly short market. We are looking for the front month September contract to finish the week between $85.50-86.50/bbl. This call is predicated on three main drivers:

- The future of Chinese and US demand concerns.

- Softer dollar

- Managed by money net length increasing

There has been mixed economic news out of China last week. In June, China’s manufacturing activity declined for a second consecutive month, with the PMI at 49.5; this signalled contraction and prompted calls for additional stimulus, as the services sector also hit a five-month low amid weak domestic and external demand. Although exports exceeded forecasts in May, ongoing trade tensions and a prolonged property crisis continue to weigh on the economy. If the government responds by creating more support measures, this may reassure the market, despite limited room for monetary easing due to currency pressures. Potential expectations exist for more debt issuance to boost demand ahead of key economic policy discussions at the upcoming Third Plenum in mid-July.

Demand concerns underpin the US story, too; consumer spending grew at the slowest rate in 18 months, and there was an unexpected build in crude and gasoline stocks in the week to 21 June, as well as a drop in refinery utilisation. There is hope for impressive demand stats around 4 July and the domestic travel that comes with that. It is forecast that Saudi Aramco may reduce the OSP (official selling price) of Arab Light to Asia by an estimated 90c/bbl. This may be perceived as bearish when formally announced as Saudi Aramco. This may be seen as having to cut prices to allow for better demand in Asia, which would paint a concerning picture for Asian buying appetite and point to potential overextension of Dubai.

The USD is a little softer. The US Dollar Index fell 0.2% in Asian trade, extending losses after the PCE price index suggested a mild easing of inflation in May and fuelling speculation of a 25 basis point Fed rate cut in September. The softer dollar – which boosts oil demand and risk appetite – sets the stage for Tuesday’s speech by Fed Chair Jerome Powell and the release of the June meeting minutes on Wednesday. Friday’s nonfarm payroll data will also be pivotal, as the labour market remains a crucial factor in the Fed’s interest rate decisions. The outcome of the French elections may also impact strength.

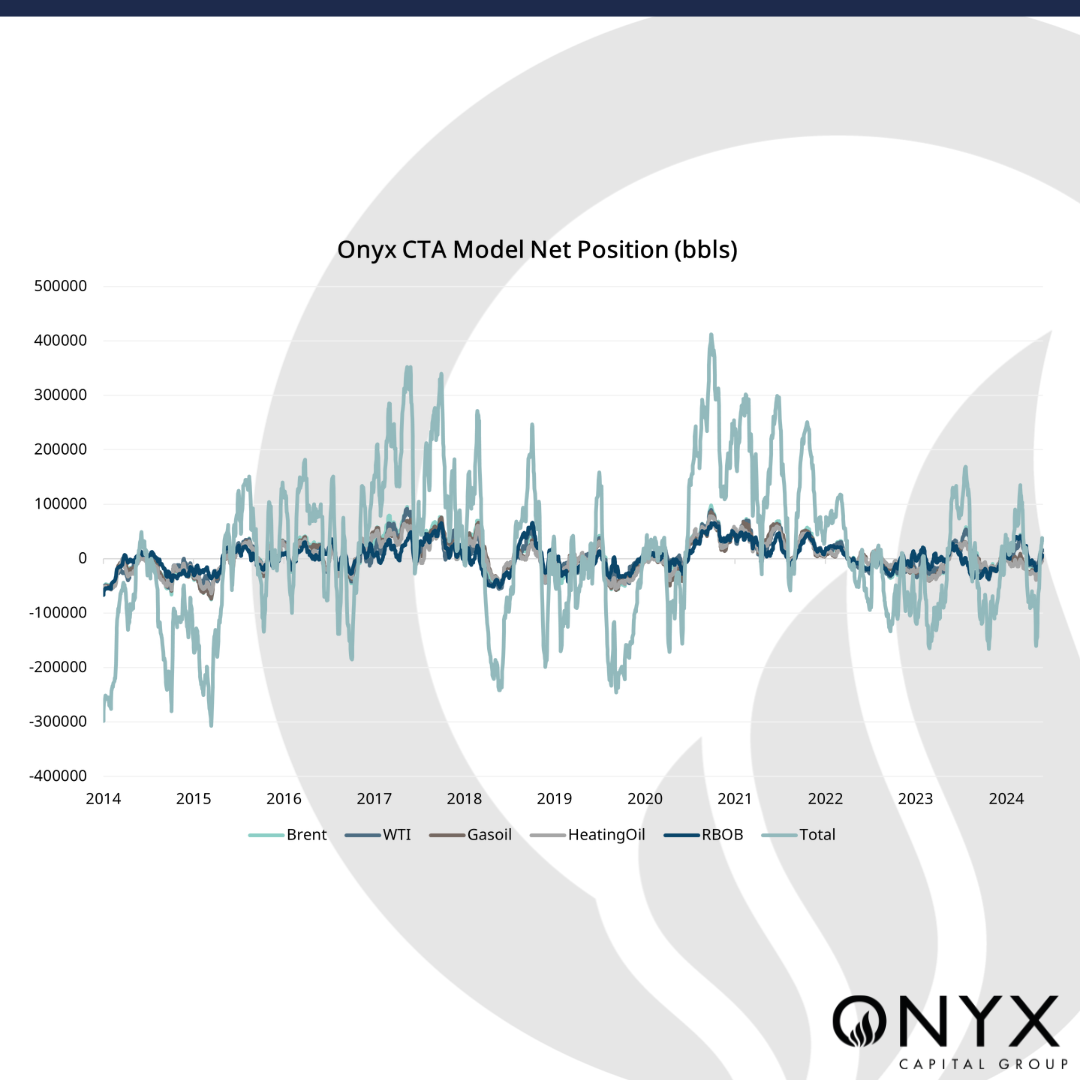

Looking at the COT data from ICE, managed by money players, we see that they have added length in Brent futures. There was a 4.25% increase in length from funds in the week to 25 June. Combining this with our Onyx proprietary net positioning model for CTAs shows that the market’s strength may be derived from a short squeeze. The market is now more even, in the middle of the net positioning range. This may allow for a more reactive and less stifled market as the sell-side saturation has been somewhat alleviated and there is better buying.