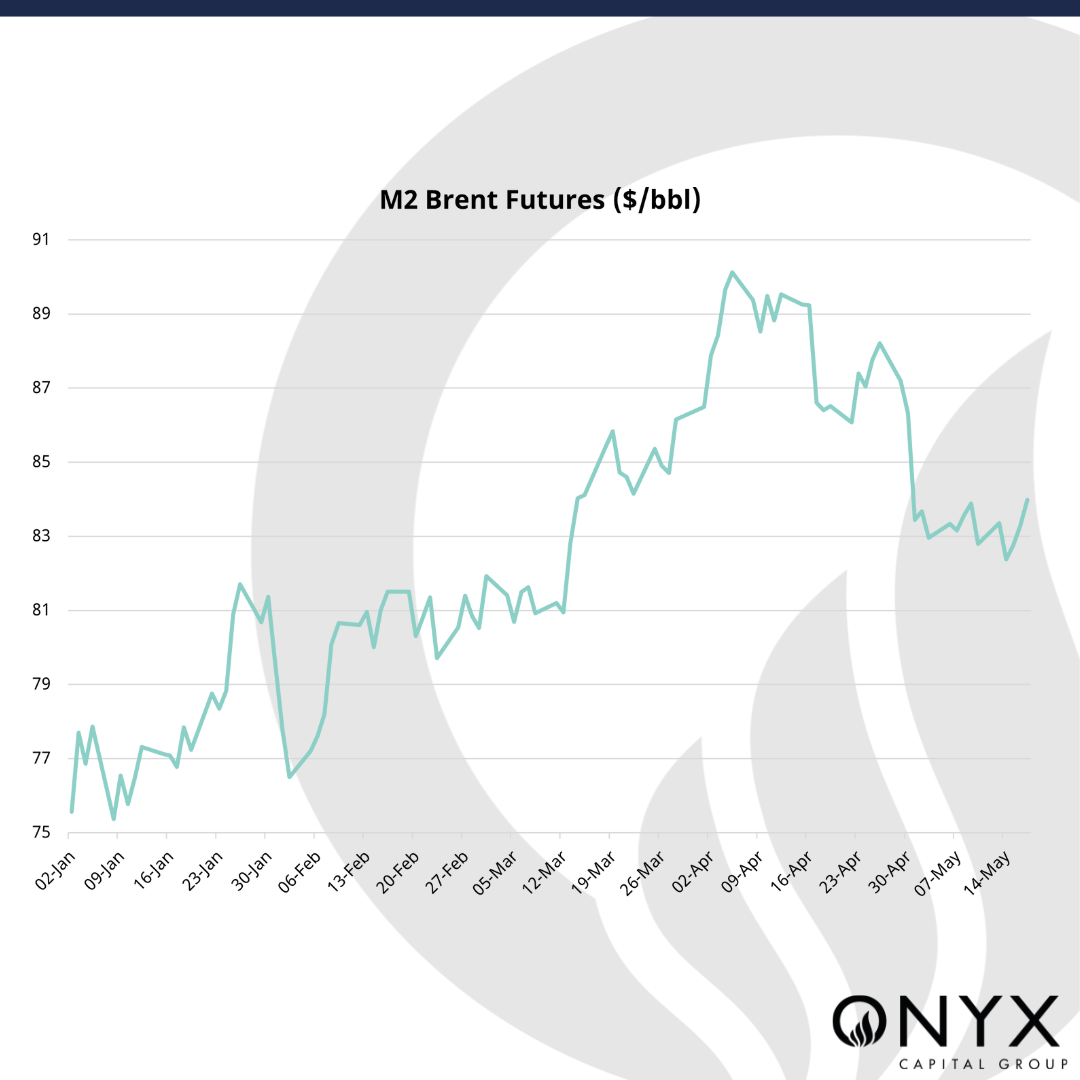

The prompt Brent futures flat price strengthened to $84.30/bbl at the start of the week to May 20 (as of 08:15 BST), supported by political uncertainty in vital oil-producing economies in the Middle East. Iranian President Ebrahim Raisi, previously seen as a potential successor to Supreme Leader Ayatollah Ali Khamenei, was killed in a helicopter crash near the Azerbaijan border. In addition, Saudi Arabia has notified that its King Salman bid Abdulaziz will be undergoing treatment for lung inflammation. Despite the risk emanating from these developments, both nations stress that no disruption should surface in their respective oil supplies. In other news that could possibly impact oil supply, Ukraine has reportedly launched a 62-drone attack on Russia, forcing the Slavyansk oil refinery to halt operations.

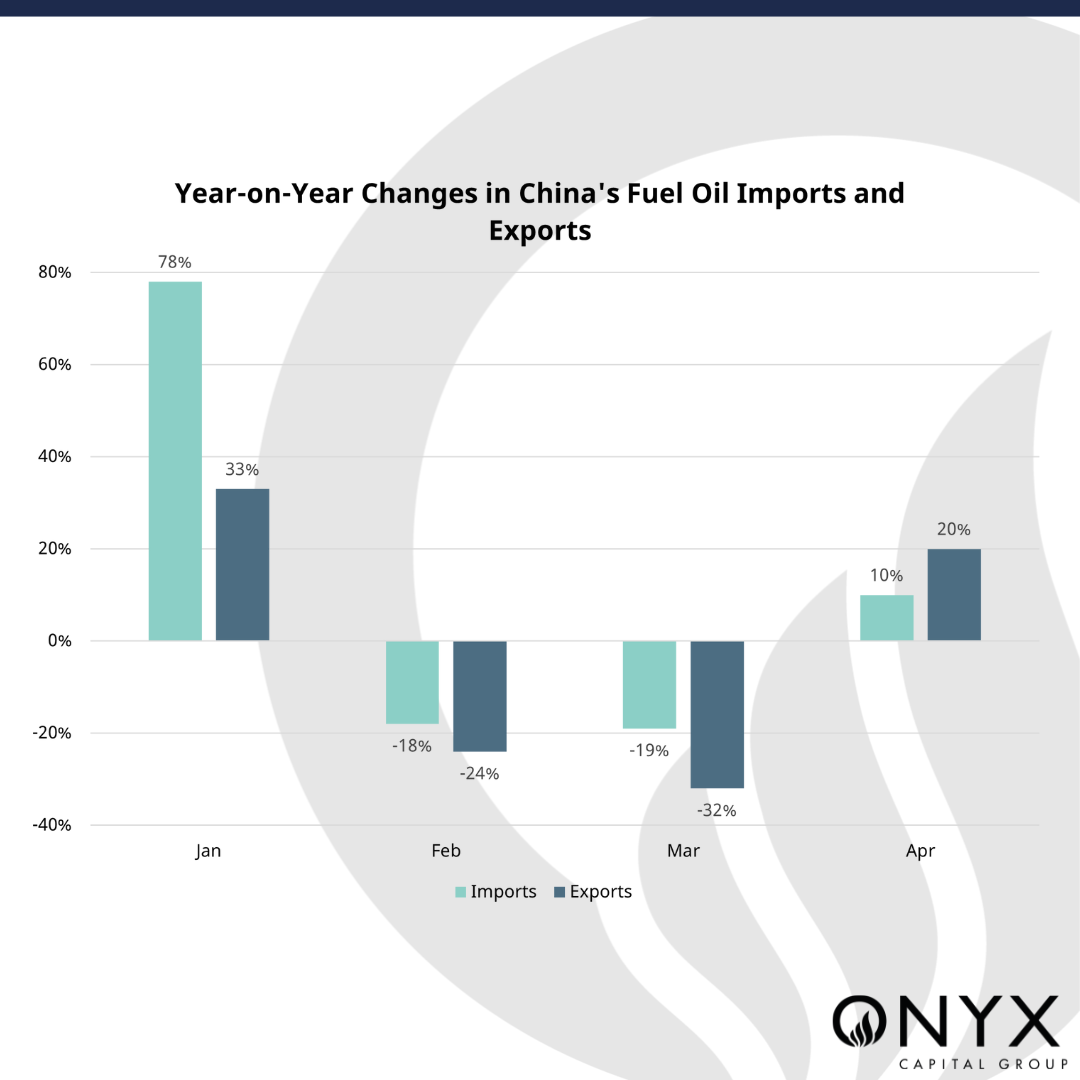

On the demand side, China’s industrial output climbed 6.7% in April against expectations of a 5.5% rise. Furthermore, China’s fuel oil imports increased 10% in April relative to the previous year to 2.93 million tonnes amid traders purchasing more shipments from Venezuela and Iran. Finally, the Chinese government unveiled a stimulus package worth $138 billion on Apr 17 to sustain the country’s struggling property market – including removing a floor on mortgage payments and readying $42 billion of funding to buy unsold homes. The United States, however, continues to underline mixed economic data despite showcasing an easing of the CPI to 3.4% y-o-y in April, down from 3.5% in March. The US Conference Board Leading Economic Indicator has continued to fall by 0.6% in April to 101.8 after decreasing by 0.3% in March – accentuating that softer economic conditions lay ahead. That said, traders will want to watch the thunderstorms in Southeast Texas for possible supply-side constraints that could help support prices.

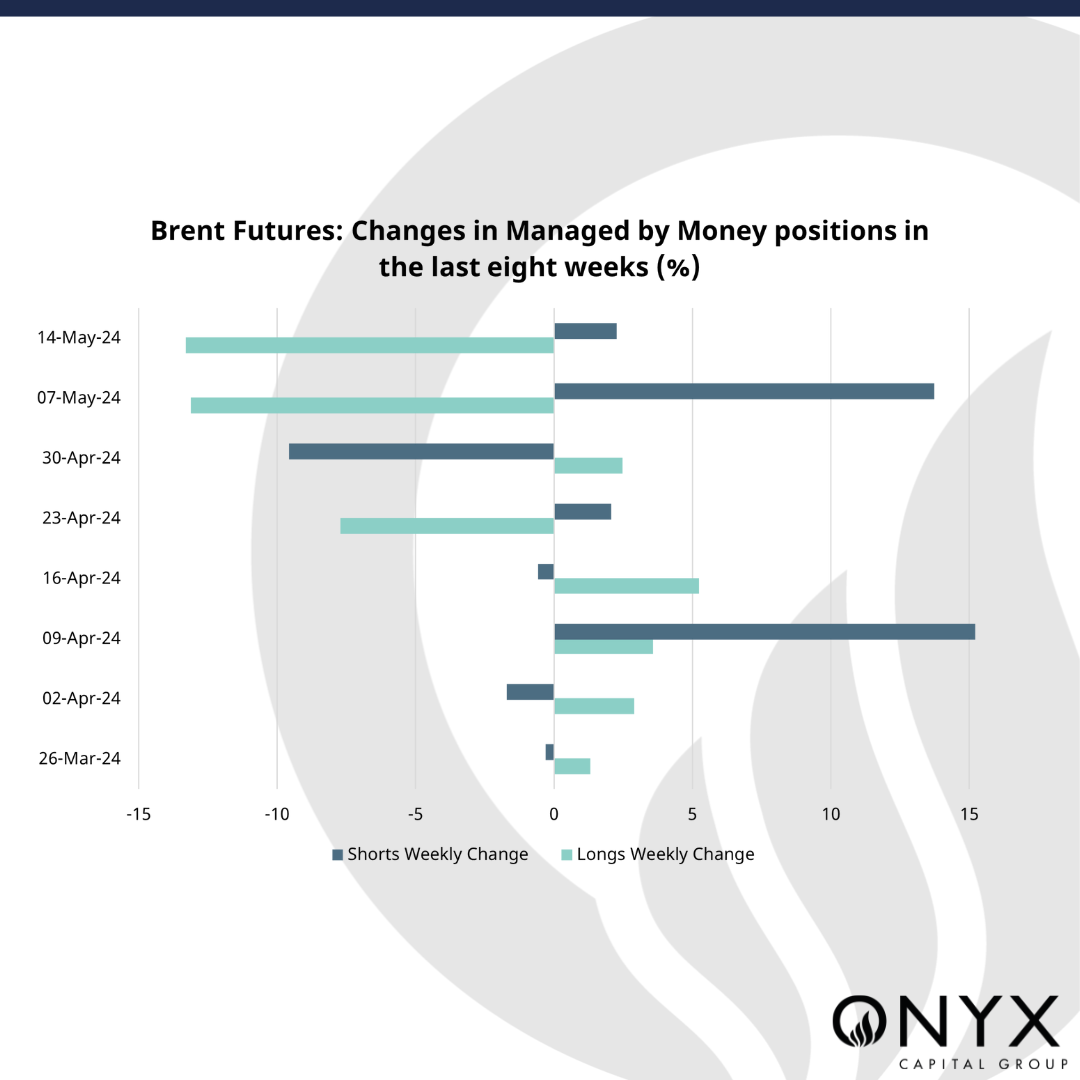

Despite the aforementioned forces of geopolitical risk premia, the mixed economic outlook and continued removal of longs from a previously overextended speculative length bring short-term neutral-to-bearish tides for the benchmark futures. In line with this, CFTC data for the week to May 14 flag a liquidation of nearly 45mbbls of length (-13.30% w-o-w) alongside an addition of almost 2mbbls of new short positions. Hence, we expect prompt Brent prices to print between $82-84/bbl come Friday.