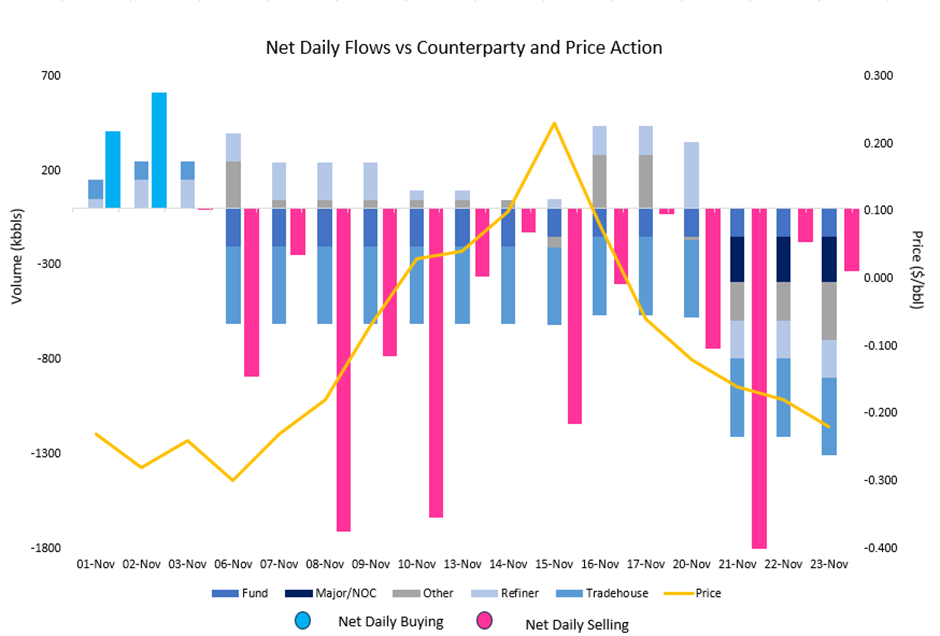

Daily net flows in Jan Brent/Dubai have been heavily skewed toward the sell-side from the middle of November with the 7-day trading split sitting 30:70 on a long:short basis. Market dynamics are tentative as the looming OPEC+ meeting dominates sentiment, especially considering the meeting has been delayed four days to December 30th with the organisation not providing a reason for the delay but Saudi Arabia is struggling to convince Angola and Nigeria to accept lower output targets.

A key observation during this period has been the strategic shift among refiners. Initially favouring buying positions in the Jan contract earlier in the month, they markedly switched to selling from November 21st. This shift occurred alongside increased selling activity from major oil companies and national oil corporations.

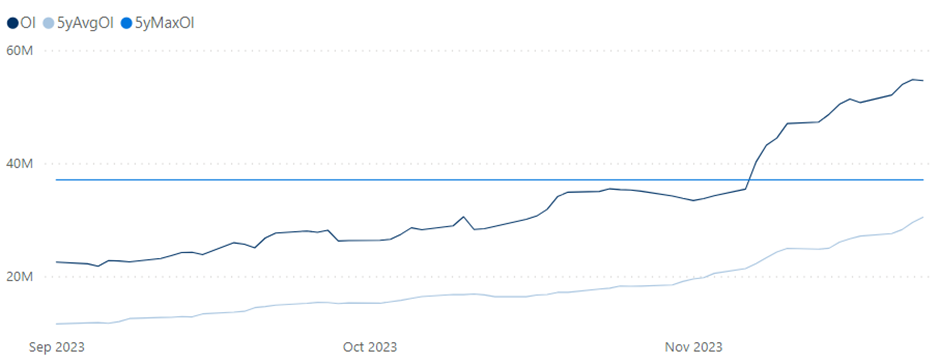

At the same time, there has been a notable levelling off in Open Interest for these contracts after a period of consistent growth. This plateauing likely reflects some traders with profitable short positions choosing to realise their gains at current levels, while also awaiting further clarity on supply dynamics that could emerge from the OPEC+ meeting. Overall, market positioning in the Jan Brent/Dubai contract is seeing an overall long:short split of 45:55, highlighting how although there is a sell-side skew, there is still plenty of scope for a move lower.

Most analysts’ view is that OPEC+ will extend current cuts into 2024 though given current market conditions, they would not rule out further cuts. It will be interesting to see how the speculators position in the coming days ahead of the meeting or if they take a more risk-off stance.