For the lay follower in the oil markets, crude oil prices have been rather boring so far this year, sitting comfortably around $80/bbl levels. The market is in equilibrium and balanced by counteracting forces. On the bullish side, Red Sea attacks and OPEC+ production have supported prices, while lacklustre demand, economic headwinds, and increasing non-OPEC production provide the bearish case.

But flat price is just the tip of the iceberg, and there is a whole new world underneath (figure 1).

Figure 1: Brent Crude Derivatives Iceberg

If you are Brent futures, then Dated Brent futures is the guy she tells you not to worry about. Or perhaps Dated Brent, is the protagonist of the story, demonstrating resilience against the face of adversity and its bearish critics.

Niche Markets

This year, traders have flocked to this esoteric corner of the oil market. With a variety of bespoke derivative contracts offered by futures exchanges, it is possible to express their views that criss-cross through space and time: between geographies and different time horizons.

Amid the Red Sea attacks, Panama Canal delays, attacks on Russian oil infrastructure, and the US Deep Freeze, there has been no shortage of trading activity in the niche oil futures space, with open interest surging beyond levels seen in previous years.

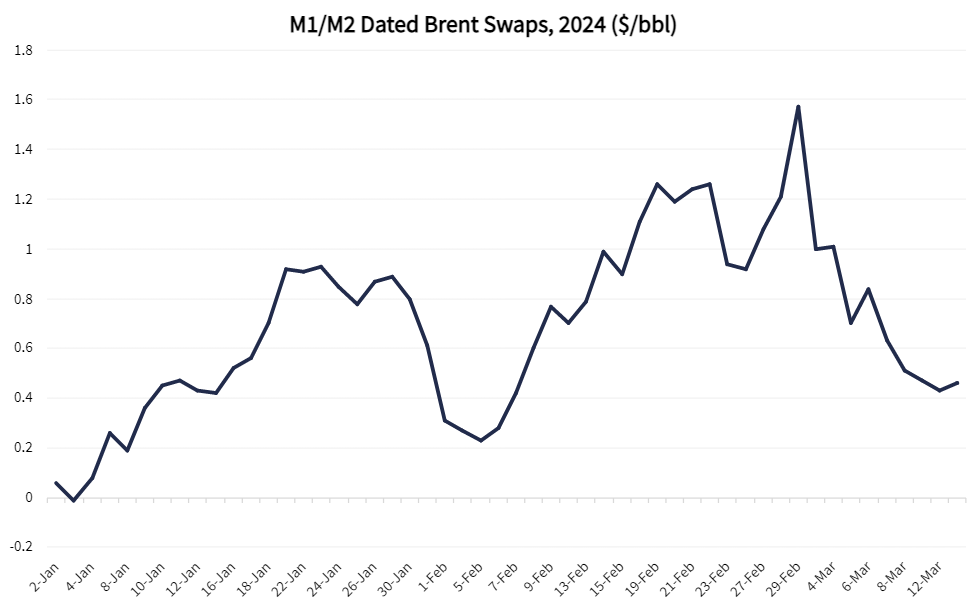

Just look at the North Sea crude market. Dated Brent saw an outstanding performance so far this year (figure 2). It holds significant importance, for the price of two-thirds of the world’s traded oil is derived from it. In fact, the settlement of the heavy financialised Brent futures contract relies heavily on the physical trading activity surrounding Dated Brent.

Figure 2: M1/M2 Dated Brent Swaps ($/bbl)

Dated Brent is priced based off physical cargoes of crude oil in the North Sea that have been assigned specific delivery grades.

Based off six crude streams – Brent, Forties, Oseberg, Ekofisk, Troll, and WTI Midland (BFOETM), in total, these represent over 2.5mbpd of production. The most competitive (cheapest) grade of the day sets the price.

Supply Disruptions

Initially, the prevailing market sentiment was a bearish one, given the persistent weakness that extended from the end of December. This was in part due to the closed arb between Europe and Asia on the back of Red Sea tensions, hindering the clearing of Forties barrels.

Traders were initially positioned short in Dated structure. However, since the pricing of Dated Brent reflects North Sea fundamentals, the sudden and localised supply tightness would cause the previously overhung prompt barrels to clear rapidly.

Production disruptions in Libya on the back of the force majeure declaration at Sharara oil field, the largest in the country. Over 200kbpd of production capacity would be shut down.

With freight prices also surging during this time on the back of Red Sea disruptions, few WTI Midland cargos were making their way into Europe, so Forties would be setting the price.

It just so happened that issues in the Finnart Forties pipeline led to increasing premiums for North Sea physical crude, further contributing to prompt strength.

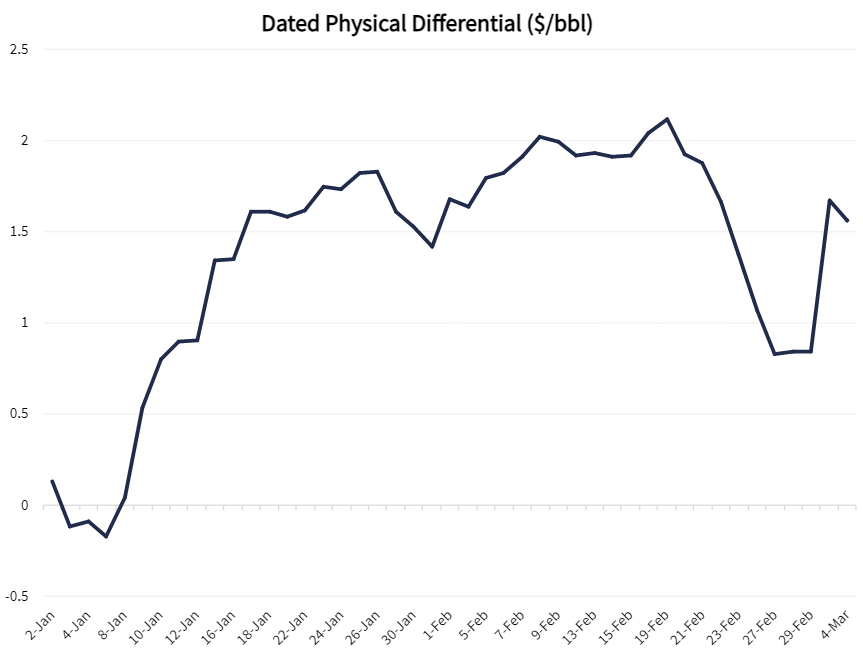

During this time, Dated physical differentials rallied from -15c/bbl to +80c/bbl within a week and firmed to +160c/bbl going into the end of January (figure 3).

Figure 3: Dated Physical Differential

Refinery Margins

Going into the month of February, the market would have priced in this disruption. The March-loading cycle was projected to experience an overhang, given the closed arbitrage into Asia as well as lower demand expectations and refinery maintenance considerations.

The market was positioning short in anticipation of this, but Dated Brent was not having any of that. As opposed to the January rally, which was driven by supply shocks, the February rally was instead driven by fundamental strength, sprinkled with a bit of French love.

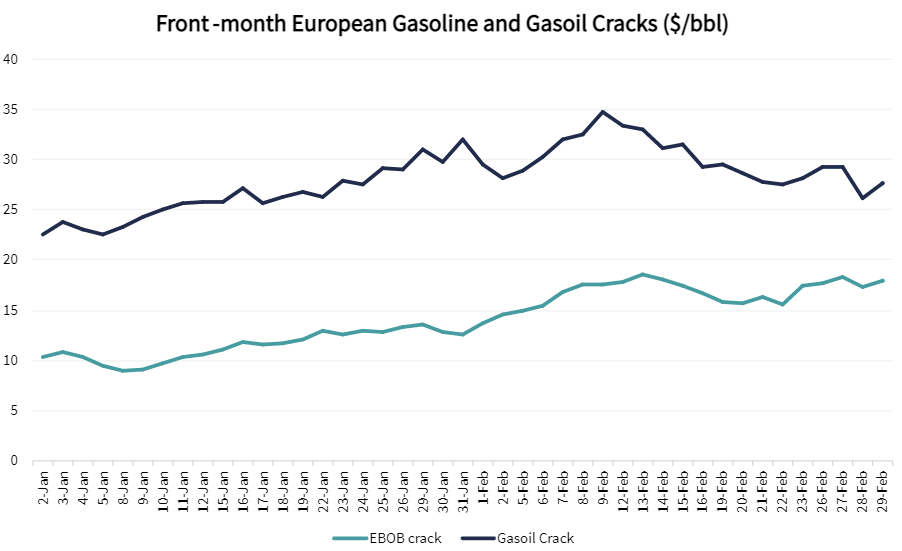

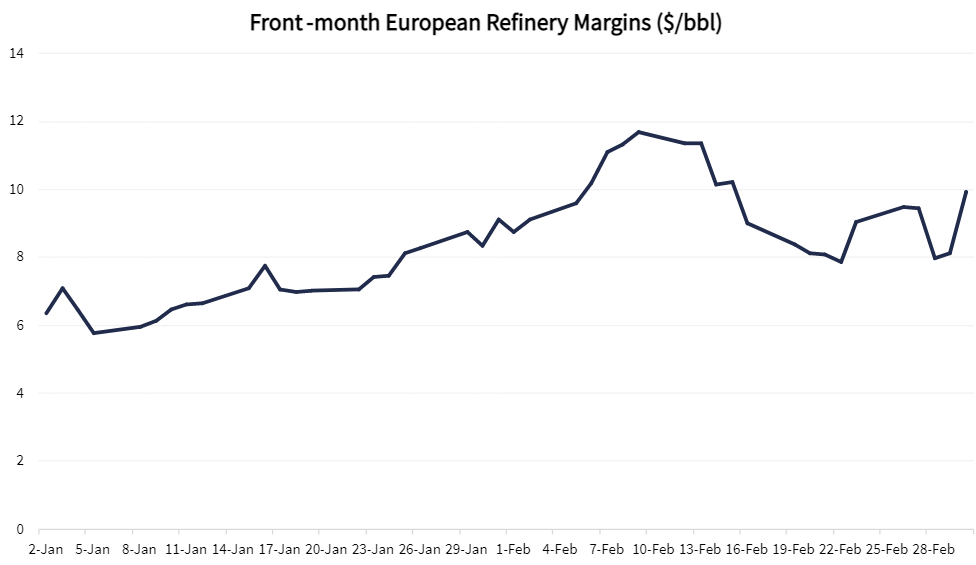

Throughout January, refinery margins saw an immense rally in which European gasoline and gasoil rallied in tandem (figure 4). These came on the back of both Red Sea tensions affecting trade flows and market accumulation of summer length in the paper. In turn, stronger crack spreads and margins would lift refinery demand for light sweet crude grades (figure 5).

Figure 4: Front-month European Gasoline and Gasoil Cracks

Figure 5: Front-month European Refinery Margins

During February, Totsa was the major buy-side aggressor in the physical window, relentlessly bidding WTI Midland cargos and subsequently supporting physical differentials. With the North Sea crude market characterised by a herdy mentality, other players subsequently joined in on the bullish action. A rising Totsa (tide) lifts all bulls (boats).

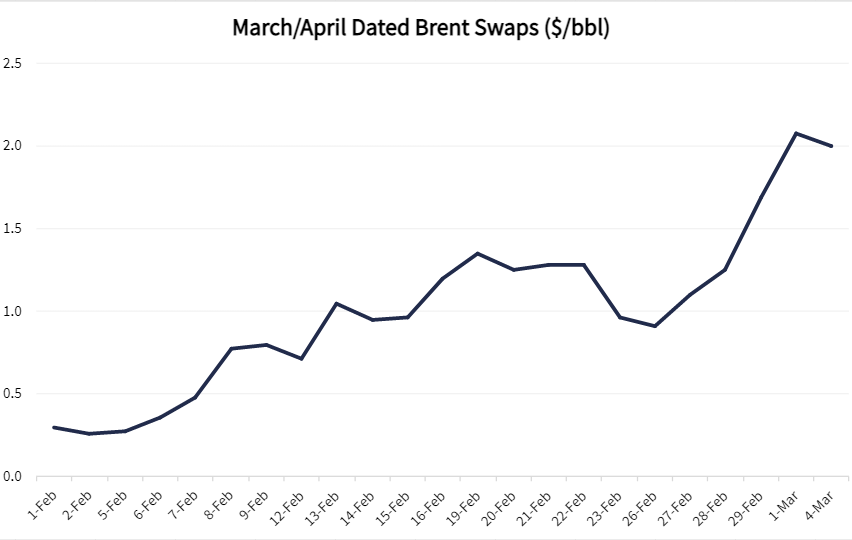

As physical strength persisted, March Dated structure rallied aggressively, epitomised by the strength of March/April Dated (figure 6). With the market initially demonstrating a bearish bias, many existing shorts were flushed out during the rally, exacerbating upwards price action.

Figure 6: March/April’24 Dated Brent Swaps

Going into March, however Dated finally saw a trend reversal (figure 2). On the back of continuous offers in the physical, structure has sold off and physical differentials have been hammered. With the April-loading cycle now entering pricing, market sentiment is bearish once again as spring refinery maintenance enters the fray.

Now, the market is bearish for the third consecutive month. Is this a case of The Boy Who Cried Wolf, or is the Third Time’s the Charm?

Just Understand Oil

For the non-oil or non-commodity finance bros, Brent and WTI futures are often their first introduction into the oil market. The same applies for the wider public that may digest news mainly from mainstream news outlets like the BBC, Telegraph, or the Guardian.

From a layman’s perspective, crude oil prices have been stagnant this year, yet a closer inspection reveals a very lopsided market in the niche futures. Here, there is no shortage of opportunities for traders to express their intricate view, based on space (geography), time (spreads), and products (blending).

Yet, with so much crude oil in the world priced against Dated Brent, the events in the niche corner of the market truly have an outsized impact on our daily lives. With the commotion around Just Stop Oil wanting to stop new oil and gas production in the North Sea, they argue that this oil is “sold on the international market to the highest bidder”. Wouldn’t you then want to understand how these international markets work?