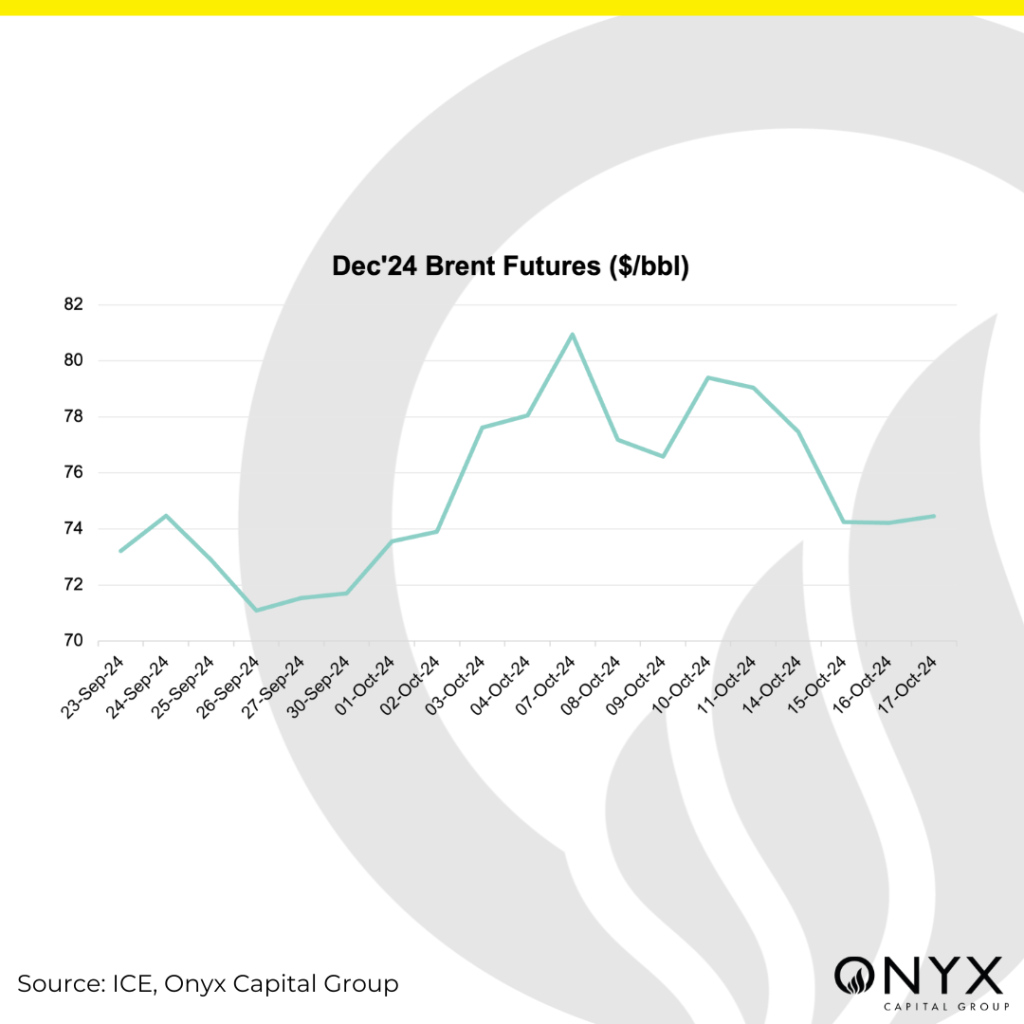

The Dec’24 Brent crude futures contract cratered by $3 overnight Monday (14 Oct) from around $77.50/bbl to $74.50/bbl, before trading rangebound for the remainder of the week between $74/bbl and $75/bbl. Prices are set for their biggest weekly decline since the week of 2 Sep. The key drivers influencing this week’s price action include:

- Waning Middle Eastern Geopolitical Risk

- OPEC and IEA Reducing Global Oil Demand Growth Forecast

- US Oil Inventory Draws

Crude oil prices slumped sharply on Monday evening following a Washington Post headline that Israel was intending to target Iranian military sites instead of its oil or nuclear facilities. Prices were previously supported as the market anticipated a retaliation by Israel against Iran, which may disrupt Iran’s oil production and export facilities. Israel’s seemingly more restrained intentions likely come after the Pentagon announced that it would send an advanced antimissile system and 100 troops to operate it. As a result of Israel’s reassurances, the market’s perception of a lower likelihood that Israel’s retaliation would cause supply disruptions has reset the price action lower. On 17 Oct, it was reported that Hamas’ leader Yahya Sinwar was killed in Gaza. Geopolitical uncertainty continues, as the killing has raised fears of regional escalation amongst the belligerents, with peace negotiations becoming more distant.

OPEC and the IEA this week both cut their global oil demand growth forecasts, with China’s economic troubles the common denominator. In OPEC’s Oct’24 monthly report, it reduced its forecast for global oil demand growth from 2.03mb/d to 1.93mb/d for 2024. Poor Chinese demand growth accounted for the bulk of this downgrade, from 650kb/d to 580kb/d. Meanwhile, IEA’s Oct’24 monthly report showed that global oil demand is expected to increase by 860kb/d in 2024, down from its 900kb/d forecast in the Sep’24 report. According to the agency, China, which accounted for 70% of global demand growth in 2023, is set to contribute only 20% to this year’s increase – noting the country’s slowing economic growth and rapid transition towards electric vehicles as the main factors. On 18 Oct, China reported a Q3 GDP growth of 4.6% y/y, higher than market forecasts but marks the slowest annual growth rate since Q1’23.

A bullish reading of the latest EIA stats on 17 Oct supported crude oil prices. US commercial crude inventories during the week ending 11 Oct recorded a 2.2mb draw, which contrasted API estimates of a 1.8mb build. In addition, gasoline and distillate inventories saw 2.2mb and 3.5mb draws, respectively. The IEA reported in their Oct’24 monthly report that OECD industry stocks fell counter-seasonally in August, and preliminary data suggest stocks have fallen further in September. Industry stocks are well below their 5-year average, and US commercial inventories account for around 40% of OECD stocks. Hence, the simultaneous draws in both crude oil and refined products can be interpreted as a bullish indicator – and if this trend continues, then it would limit the downside to oil prices.