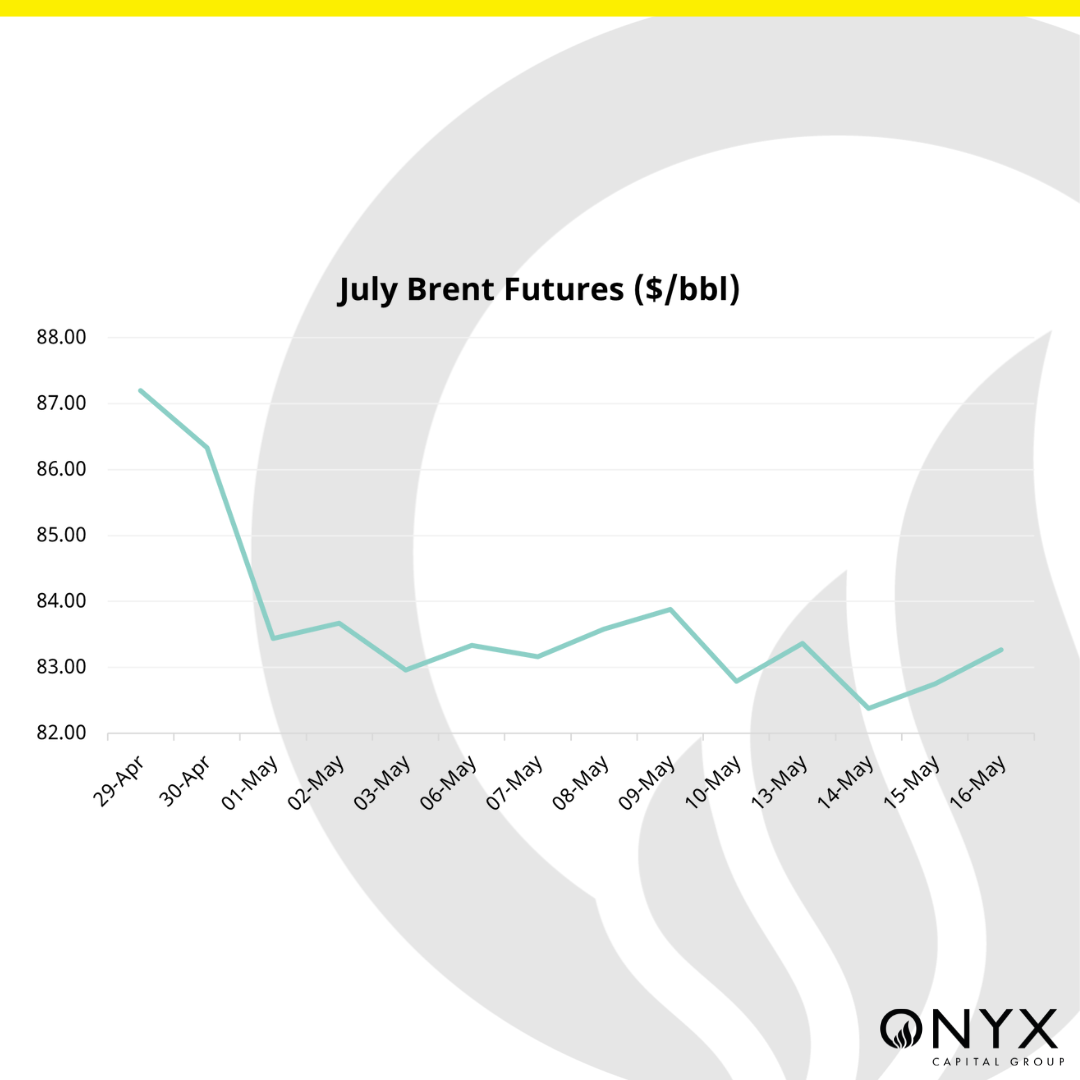

July Brent futures saw a relatively rangebound week, and remains supported around the $83/bbl handles – where it has been trading since the beginning of May. The previous sell-off had the hallmarks of a de-risking event and was amplified by CTA selling, with CFTC data highlighting that crude futures (Brent and WTI) saw the largest decline in net positioning since October 2023. Prior to that period, the market was optimistic about $100/bbl crude; however, that narrative was put to rest by deteriorating gasoline cracks and the downwards correction following the Cushing squeeze. The recent washout of speculative length has led to a soft reset in market positioning, creating capacity for either new buy-side or sell-side flows.

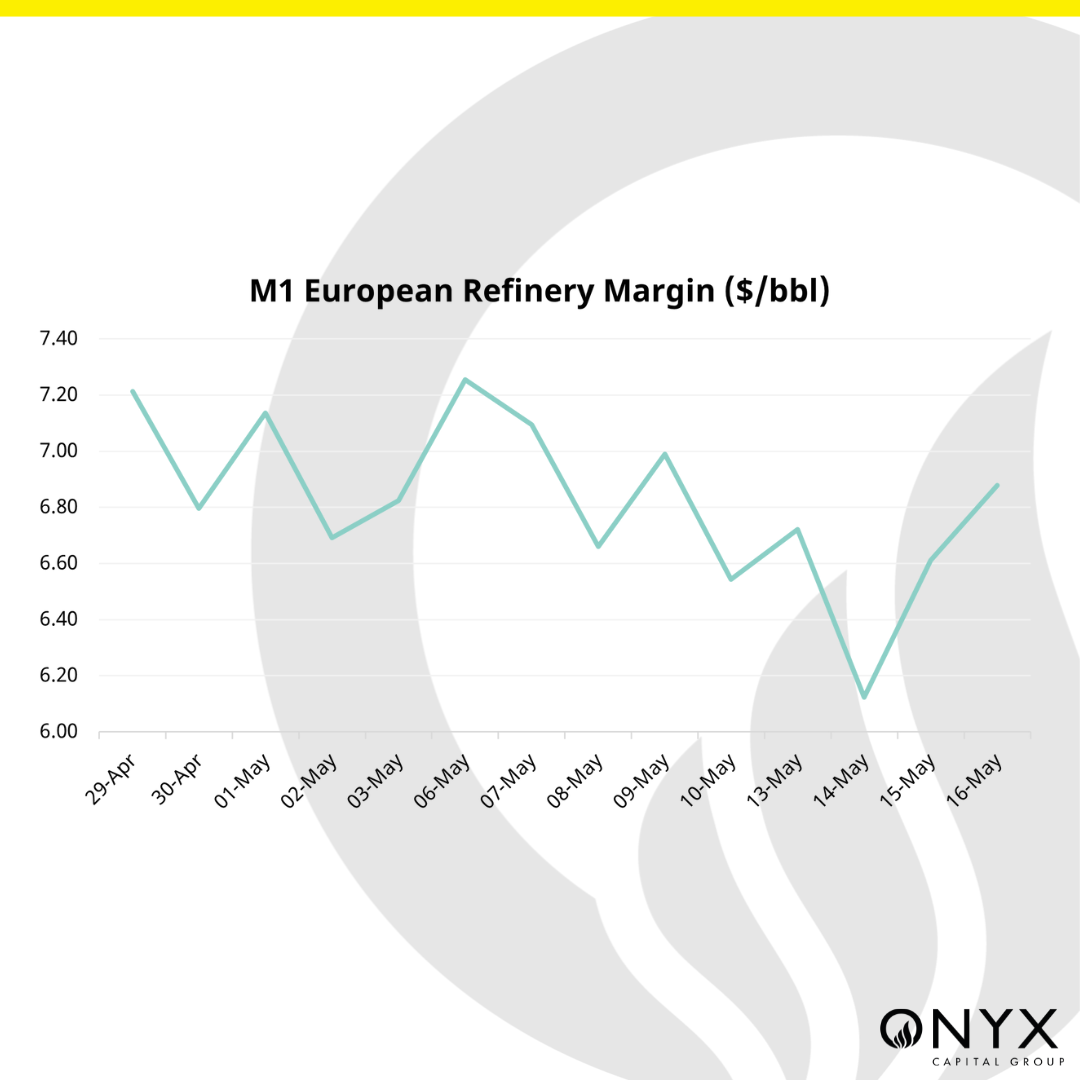

The fundamental picture remains tentative amid sluggish refinery margins. Biodiesel and renewable fuel oils are rapidly increasing their share in US transportation fuels, reducing the demand for petroleum diesel. Meanwhile, gasoline inventories have depleted slower than expected as refiners increase their run rates in response to stronger margins. With the Memorial Day holiday in the US coming up, the data stemming from summer driving season will be closely watched. Following the recent gasoline sell-off in both the US and Europe, market positioning is now balanced enough to allow for new buy-side volumes.

On the macroeconomic side, the much-awaited US CPI data showed inflation had fallen slightly to 3.4% in April, in line with economists’ expectations. This has prompted the market to price in a higher probability of the Fed lowering interest rates, whilst US stocks set new highs and government bond yields fell. Policymakers continue to walk on a tightrope between simultaneously lowering inflation and achieving a soft landing. Falling crude prices will provide temporary relief on this front. OPEC+ are banging the drum, and the market closely awaits the outcome of its June 1 meeting – with the scenarios being either the extension, unwinding, or removal of the existing 2.2mbpd voluntary cuts.