We are looking for the front-month December 24 contract to finish the week between $69-74/bbl with the drivers dictating the rangebound regime essentially unchanged:

- Escalating geopolitical tensions with a low probability of regional conflict

- COT positioning and investor risk appetite post-stimulus measure

- US-based fundamentals

Geopolitical tensions in the Middle East moved a notch higher. Israel has stepped up kinetic action in southern Lebanon, culminating with the assassination of Hezbollah Leader Hassan Nasrallah. It does not appear that Israel is done with strikes in Lebanon and elsewhere where Iran’s proxies operate. The widely-held consensus is that Iran does not want to be involved in direct confrontation with Israel, and any retaliation would continue to be conducted through its proxies. At the current juncture, the probability of a wider regional conflict and, thus, risk to oil supply and transit is still considered low. This may change if Israel were to conduct a ground incursion in Lebanon, and upward pressure on Brent’s flat price may mount.

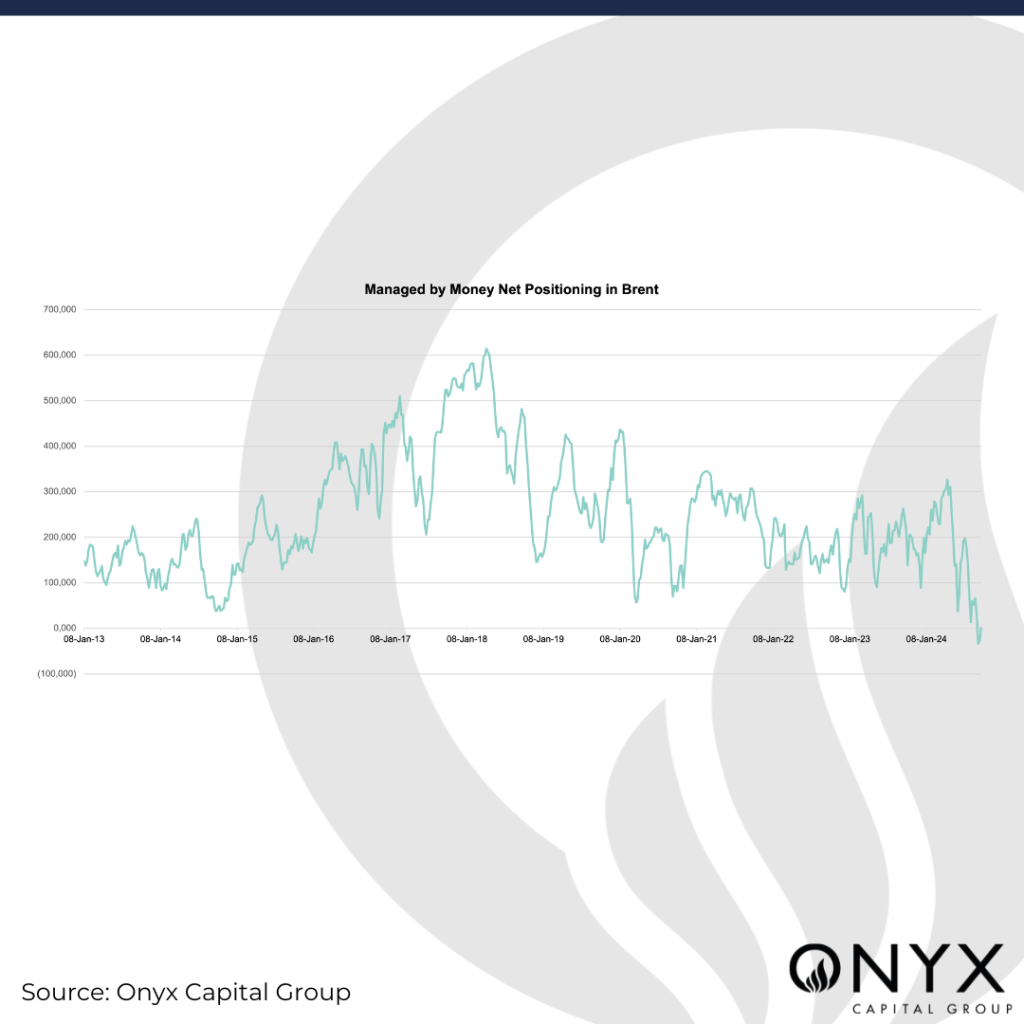

COT data and Onyx CTA positioning data show the market remains very short overall. There has been a small recovery in net length in the week to 24 Sep. Managed by money positions have flipped back to their normal positive levels, although they remain low at +970kb.

Total OI in Brent futures for the week to 27 Sep fell by 2.18%, which is the largest drop in OI in Brent structure since July. Investor hesitancy to deploy risk when it comes to oil remains, even in the aftermath of the Fed implementing a bod 50 bp cut to its policy rate and China announcing a raft of monetary and fiscal measures. Macro risk is still a pervasive market feature, and adverse headlines could lower oil prices – albeit briefly in our view – under $70/bbl.

Fundamentally, the return of Libyan barrels seems priced in. Today, it was reported that Libya’s eastern-based parliament approved a new central bank governor, ending a standoff over control of oil revenues and allowing for a full resumption of the country’s oil output. Stocks of crude oil in the US commercial inventories and Cushing OK are extremely low but within historical ranges. Therefore, the US inventories and exports released by the EIA for the week to 27 September may spur some supply-side worries, although the impact of Hurricane Helene may have weakened demand in the US last week. We expect there to be a creep-up in prices ahead of the geopolitical event looming – but this and the EIA data release on Wednesday may act as a liquidity event in the thinner and more balanced market, allowing for better selling.