Rebalancing in High Volatility

We expect Brent prices to remain in the low $80/bbls this week – despite a less saturated buy-side market – because of a slew of refreshed bearish bets from funds and negative net positioning by CTAs. This week, we expect to see a balancing of the market in the front amid softer prices; we expect volatility in the thinner market and for Sep’24 Brent to end the week between $83.00/bbl and $85.00/bbl.

- More balanced positioning

- Strong international physical crude markets

- China stimulus vs US pessimism

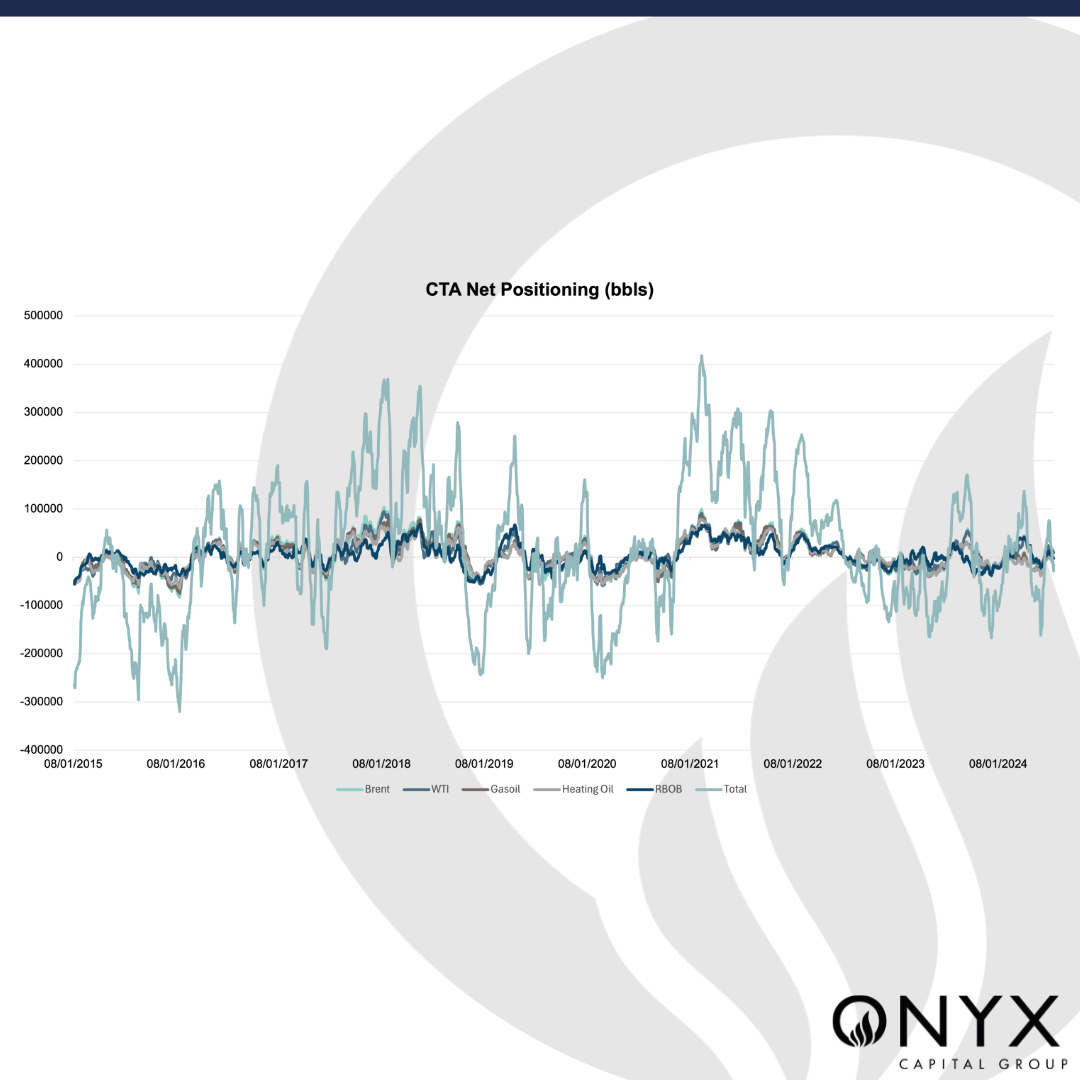

ICE COT data for the week to 16 July showed an increase in sell-side positions from managed by money players. Bullish funds increased their position by just 500kb, compared to the 18.6mb increase in short positions. Money managers’ net positioning fell over 18mb in the week, leaving the market more balanced. Interestingly, this is the fourth consecutive week that both long and short prod/merc players have removed risk in Brent – which is also contributing to low interest and a potentially thin market. Sep’24 is seeing an OI under 400mb on 18 July, although players are likely beginning to focus on Oct’24. The Onyx CTA model estimates that the total net positioning for a selection of futures has fallen into negatives. There is a chance that it may continue to plough down into deep negatives with the CTA selling momentum that has driven the market a few times this year, or it may steady out and leave room for a more balanced market.

The physical crude market has been robust both in the US and the North Sea. The Dated crude physical differential has been supported above a dollar for most of the month, with Brent spreads reaching new highs and the WTI spreads extremely well-supported. This physical strength brings with it a sentiment of tightness in the market. This is also supported by draws reported in the total US inventories and Cushing inventories of over 4.87 MB and 875kb, respectively. Larger-than-expected builds in products and dropping refinery utilisation is a concern with respect to crude demand. The 3:2:1 proxy US cracking margin has fallen to softer levels, which may make further increases in runs unlikely in the near future. However, it remains above $20.00/bbl, not disincentivising US production. We recommend monitoring WTI spreads during expiry on 22 July to see how well their strength holds up. More long-term pessimism has reared its head over the weekend as Morgan Stanley expects OPEC and non-OPEC supply to grow by about 2.5mbpd in 2025; this outstrips demand, and further bank long-term bearish news could add to a risk-off attitude in the front.

The People’s Bank of China (PBoC) recently cut both short- and long-term interest rates by 10 basis points, aiming for a 5% growth target. Despite this, the market reaction has been muted. In the US, the USD index has been softer – and with the market pricing in between 2 and 3 cuts this year, we may be unlikely to hit the lofty levels of over 105 in the USD index again this year.

This week, there are many important data releases from the US, with the Q2’25 GDP release on 25 July and the PCE data – a favourite inflation metric of the US Federal Reserve – released on 26 July.

There have been revisions down for the past GDP releases, so there may be some pessimism here. It will also be interesting to see if the weak US gasoline market will soften PCE and further support the Fed. We expect volatility following President Biden’s withdrawal from the November US election – especially when considering increased speculation, as the Democratic convention will only bring a definite nominee on 19-22 August. Also, the VIX Volatility Index jumped another 10% this past session. That brought the 2-day chart to 20.6% – the fifth biggest charge in a 48-hour time frame in 2 years.