Although Brent crude futures saw a solid start last week, price action closed below $80/bbl on Friday. Middle East geopolitical concerns have eased alongside poor Chinese demand sentiment, amid weaker-than-expected economic data. The Oct’24 contract is trading at $79/bbl as of 09:00 BST (time of writing), and we hold a neutral view for the week ahead, with a price target of $78-80/bbl. We will be closely keeping an eye on the following factors:

- Jackson Hole Symposium

- Geopolitical Risk

- Market Positioning

The markets are keenly anticipating the Jackson Hole Symposium this week. Jerome Powell will deliver a much-anticipated speech providing clues about a potential Fed rate cut in September. There is a greater significance to this year’s speech, which occurs in the context of the Fed funds rate being at a 23-year high. At the same time, the presidential election looms large, as the country’s economic health becomes a hotly-contested debate between Trump and Harris. US economic data paints a mixed picture. Despite a weaker-than-expected jobs report in early August triggering a global sell-off in risk assets, subsequent data indicating softer inflation figures and strong retail sales have alleviated some concerns. Recently, the oil markets have been increasingly sensitive to US economic data. As such, prices are likely to trend accordingly alongside the broader market’s reaction to the events in Jackson Hole this week.

Geopolitical risk concerns have eased as Iran has not yet delivered on a planned retaliatory attack against Israel. In the meantime, peace negotiations continue between Israel and Hamas. While there has been mixed rhetoric about this, the risk premia has waned, with sentiment subdued by the ongoing lack of retaliatory action by Iran and with no immediate perception of a threat to oil production, transport, or infrastructure in the region. With Ukraine’s incursion in the Kursk region of Russia, the market will be keeping tabs on whether this will facilitate Ukraine’s ability to target Russian oil and energy infrastructure – which has led to higher prices in the past. As the conflict evolves, the market will watch how the US presidential candidates react through their foreign policy proposals in relation to this conflict.

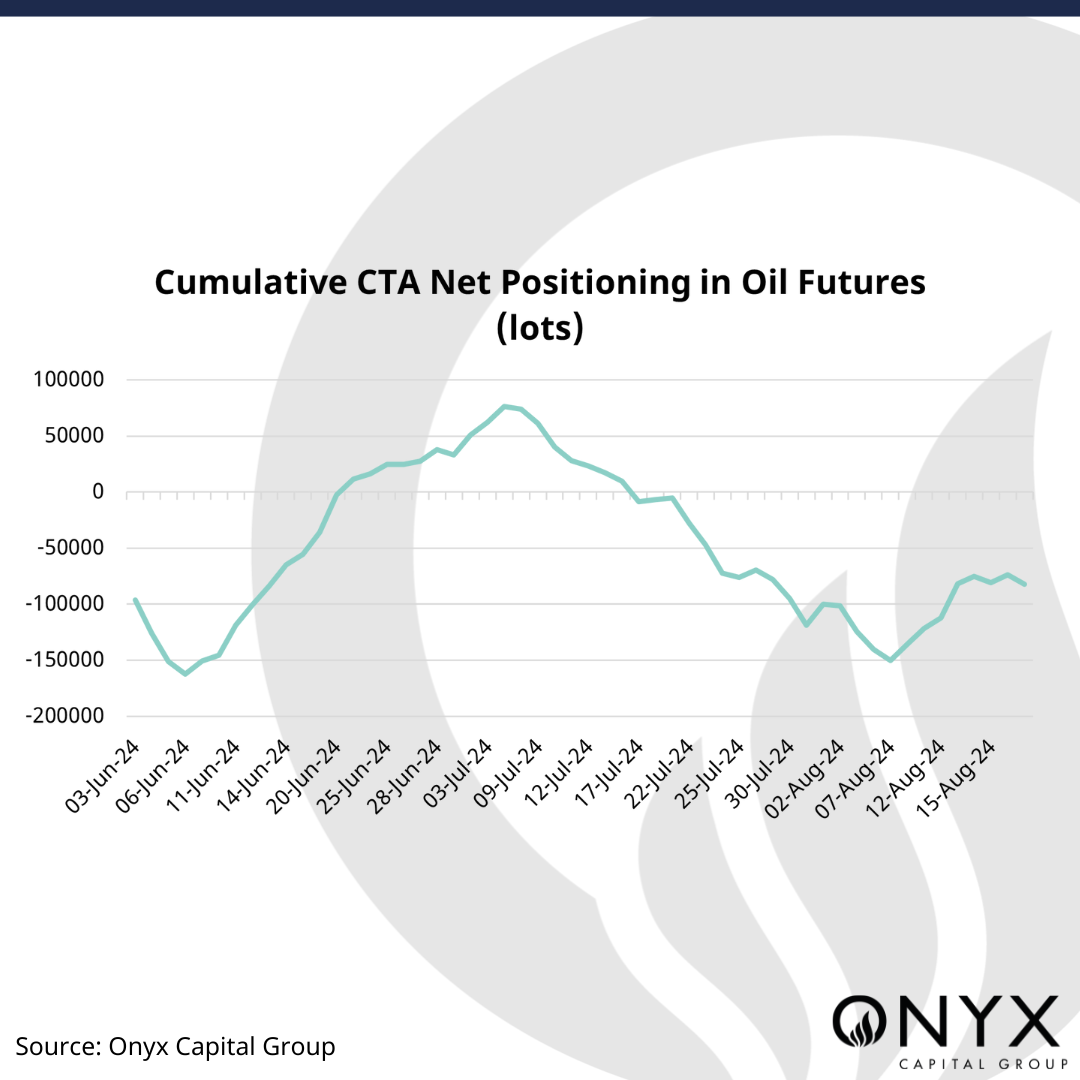

Finally, market positioning in crude oil futures indicates the capacity for further upside in price action. The latest CFTC COT data shows that money managers have been getting longer in crude futures, but this is mainly due to short-covering flows. In Brent and WTI futures, short positions declined by 54mb (-28%) while long positions increased by just 11.4mb (+3%) in the week ending 13 August. Barring the previous week (ending 6 August), outright long money manager positions are at their lowest level in the year-to-date, suggesting plenty of room for new speculative length to enter in the event of a bullish catalyst. Moreover, Onyx’s CTA model shows that CTAs remain net short at -82.2k lots across the oil futures benchmarks. Similarly, there is scope for additional short-covering flows if bullish factors materialise in the crude market.