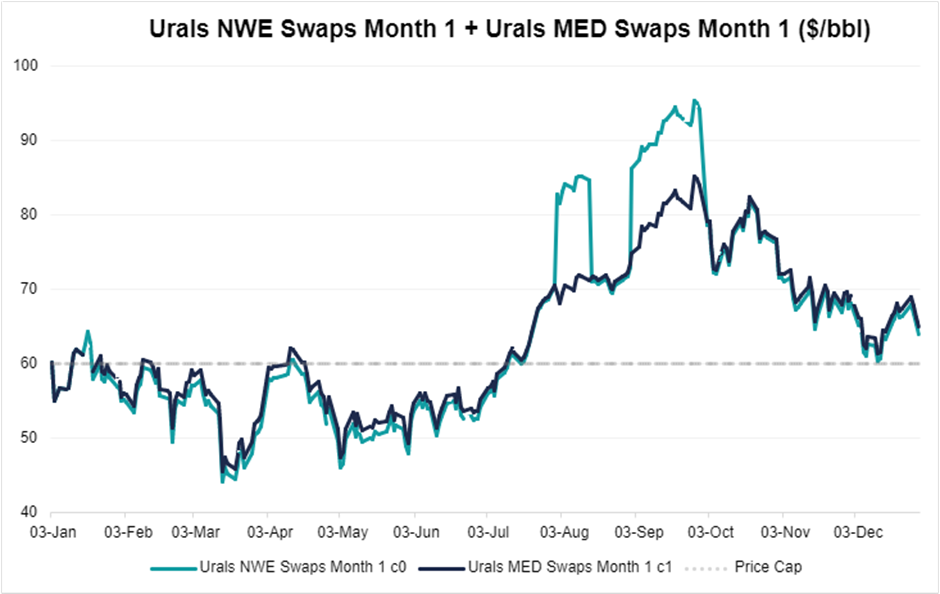

The market price of Russian Urals has seen a significant weakness since the end of October, dropping $24/bbl since the end of Oct to lows of $61.68/bbl observed on Dec 12. The price drop returns Russian crude near the $60/bbl price cap imposed on Russia by the G7 countries, but it its blatant lack of regard for the limit, raises questions as to the efficacy of the price cap and general sanctions as well as the health of crude amidst high production rates in the US and weak demand from China.

Russia saw very loose adherence to the price cap with sanctions proving ineffective as loopholes allowed Russian crude to jump to above 80/bbl levels, growing uninterrupted with the rest of crude prices to their peak when conflict erupted in the Middle East.

Image 1 – Price of Urals until Jan 01 2024 showing the ineffectiveness of the price cap

Russian oil was allowed and able to grow on the back of two strong sanctions evasion methodologies: the first is the refining loophole which allows Russian crude refined in an unsanctioned country to be brought unencumbered to the rest of the world as unsanctioned products. For example, the Bulgarian refinery Neftochim which was offered an exemption from the Russian import ban for domestic purposes has been the fourth-largest individual buyer of Russian crude, with Kpler shipping data showing over 374kmt of refined products sent to the EU and the US alone.

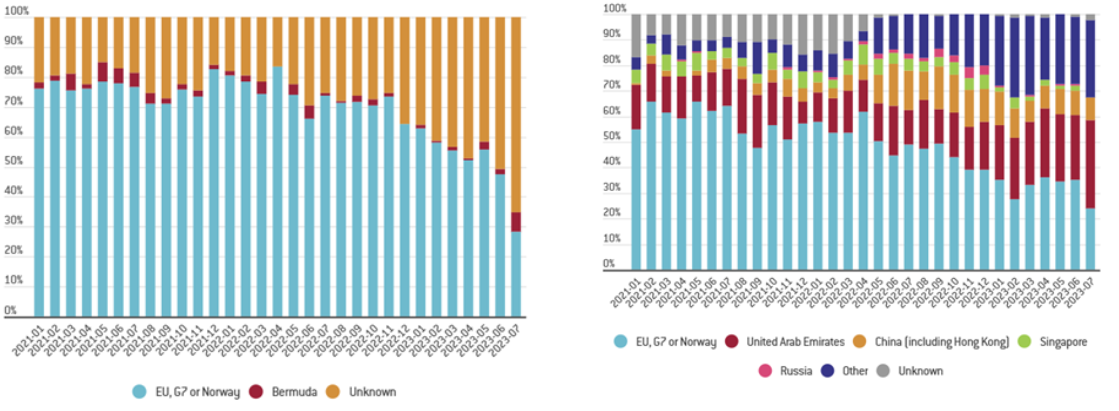

The second thorn in the regulator’s side is the Russian shadow fleet, comprised of around 600 ships, it embarks on a series of obscure laundering processes that look for insurance and operations from unregulatable black-market players. As seen in the below graphs Western insurance and freight operators are essential in the supply chain of Russian crude, with 30% of Russian vessels still insured by Europe or G7 countries and a 37% y-o-y increase in unknown companies replacing European insurers. Additionally, the rise of ship operators can be seen in the UAE (second graph) where brokering and operating companies are setting up, unimpeded by sanctions to deal with Russia. The UAE observed Russian crude shipped in its tankers rise by over 50% y-o-y as it becomes the hub for sanction avoiding in the oil markets.

Image 3 – Country of origin of takers carrying Russian crude oil

The US Senate pledged to take further action to enforce the price cap, issuing a fresh wave of sanctions on December 1st. The new sanctions identified 3 takers (0.5% of the total shadow fleet) and the UAE-based Sterling Shipping company that operates the ships. Although the price of Urals has been on a downward trend since the harsher sanctions push the efficacy is still not clear.

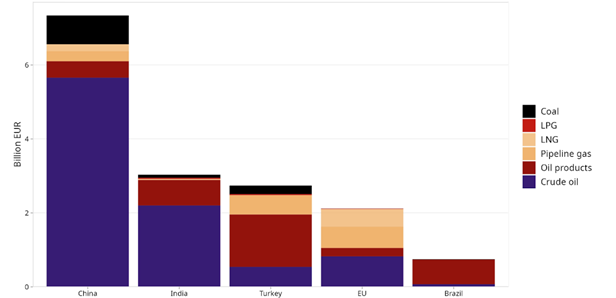

In the first half of 2023, China and India were Russia’s main customers with sanctioned Urals trading at a severe discount to Brent or WTI. China replaced Saudi Arabia with Russia as its main source of crude, seeing an 11.7% year-on-year increase in imports. Turkey was also a benefactor of the re-directed Russian oil, with 25% of Russian oil products exported to Turkey (the largest importer since the sanctions). Needless to say, Russian oil was well supported leading up to Q4.

Yet from October 8th, Russian Urals saw a 30% price decrease from its highs, compared to a 16.5% decrease in Brent prices and a 23.7% reduction in WTI, demonstrating a significant weakness in the Urals market relative to the other benchmarks, attributed to wavering demand numbers from the largest purchasers of Russian crude. Import data shows Indian crude oil imports fell 6.9% in September to 17.42Mmt and China seeing a 25% slump in independent refinery importation of any crude.

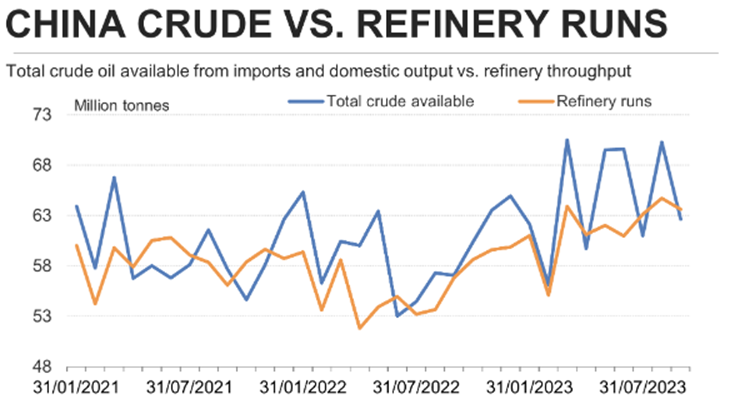

Additionally, China was seen to have been boosting its stockpiles, despite refinery production rising 28% in the year, total oil supply remained 0.7mbbl/d higher than refined output suggesting strong reserves built in 2023. But with stocks so high on the back of the cheap Urals, imports saw stagnation, with the Chinese government keeping import crude quotas at 203.6 million mt and containing crude levels for Q4. At the same time, the Chinese government was seen to increase the import quotas for fuel feedstock, for 2023, suggesting China is increasing its refining capacity, reaping the benefit of low Russian prices. to sustain its economy and will continue to see limited Chinese imports onto the end of 2023.

With the cataclysmic drop in demand for Russian crude as well as US sanctions adding strong downward pressure to the Urals market, India has expressed renewed interest in further imports. Data from Kpler and Vortexa has already flagged a 9 and 5% respective increase in November shipments from Russia to India after India’s autumn refinery maintenance season came to an end. Turkey has additionally is likely to see a rise in Russian product imports with a private Russian oil producer signing a deal with the Turkish firm SOCAR to supply 200,000bpd to the STAR refinery in Alaga, Western Turkey. With the 600-odd dark market ships still in full effect it will be interesting to observe if the renewed targeted sanctions will affect the upcoming demand uptick for Russian Crude. Urals at the time of writing come in at -$19.76/bbl under Dubai and -$16.49/bbl under WTI.