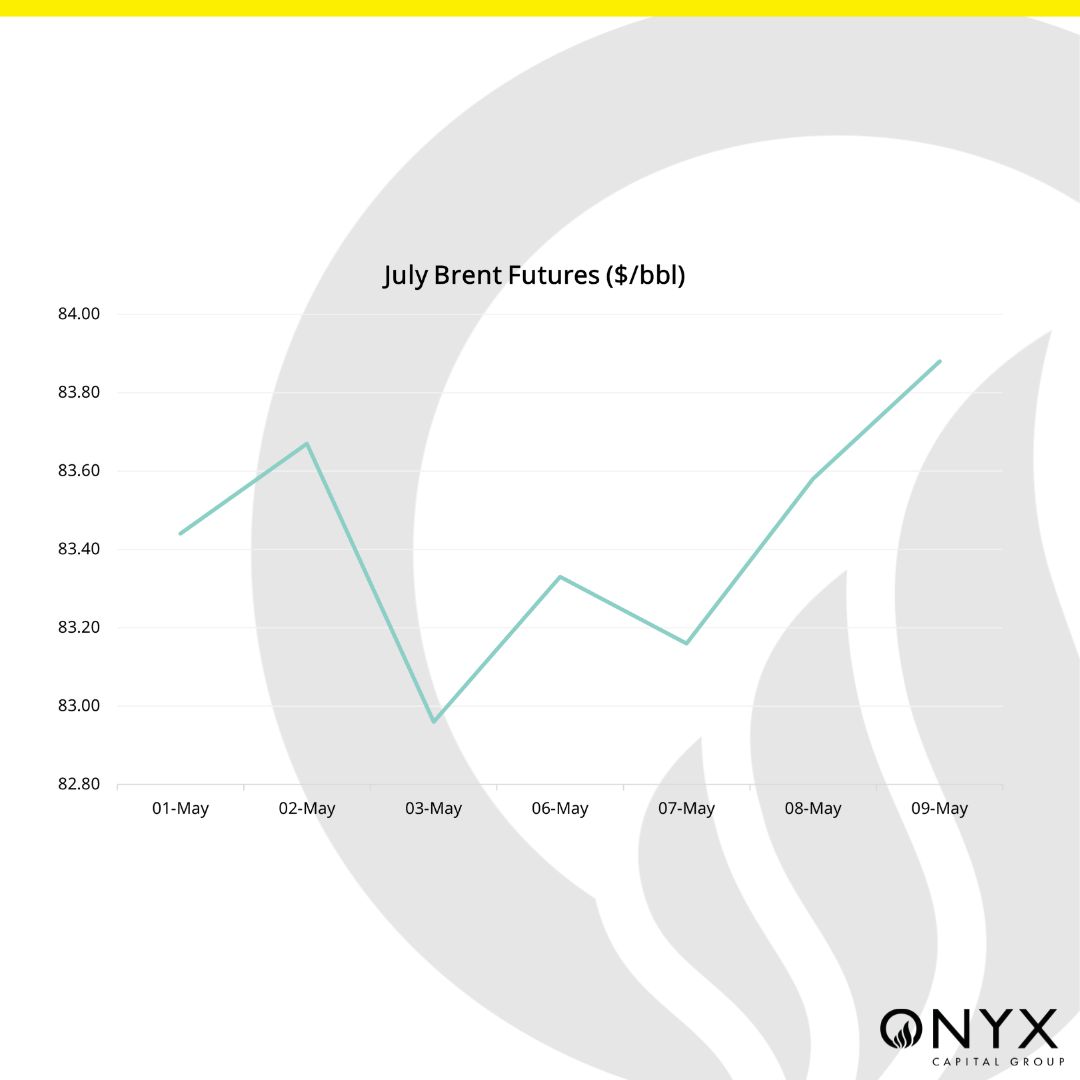

Jul Brent futures began the week supported to stable mid-$83/bbls amid the news of Saudi hiking OSPs for the third consecutive month, with Arab light for Jun delivery has increased by 90c/bbl to $2.90/bbl. The market returned from the thin volumes of UK’s bank holiday Monday with a bearish tone and flat price was pressured to below $82/bbl handles by early Wednesday morning. There has been a slew of poor macroeconomic data that has been peppered into the market in the past week. Last week ended with news that the weakness in the peripheries of the US job market (increasing part time jobs, less quits) has now reached the previously strong overall unemployment figures. The US was expected to create 240k new jobs created in April, but Nonfarm payroll rose by 175k. Further deterioration of the economic surprise index suggests the dollar and 10-year yields should both head lower.

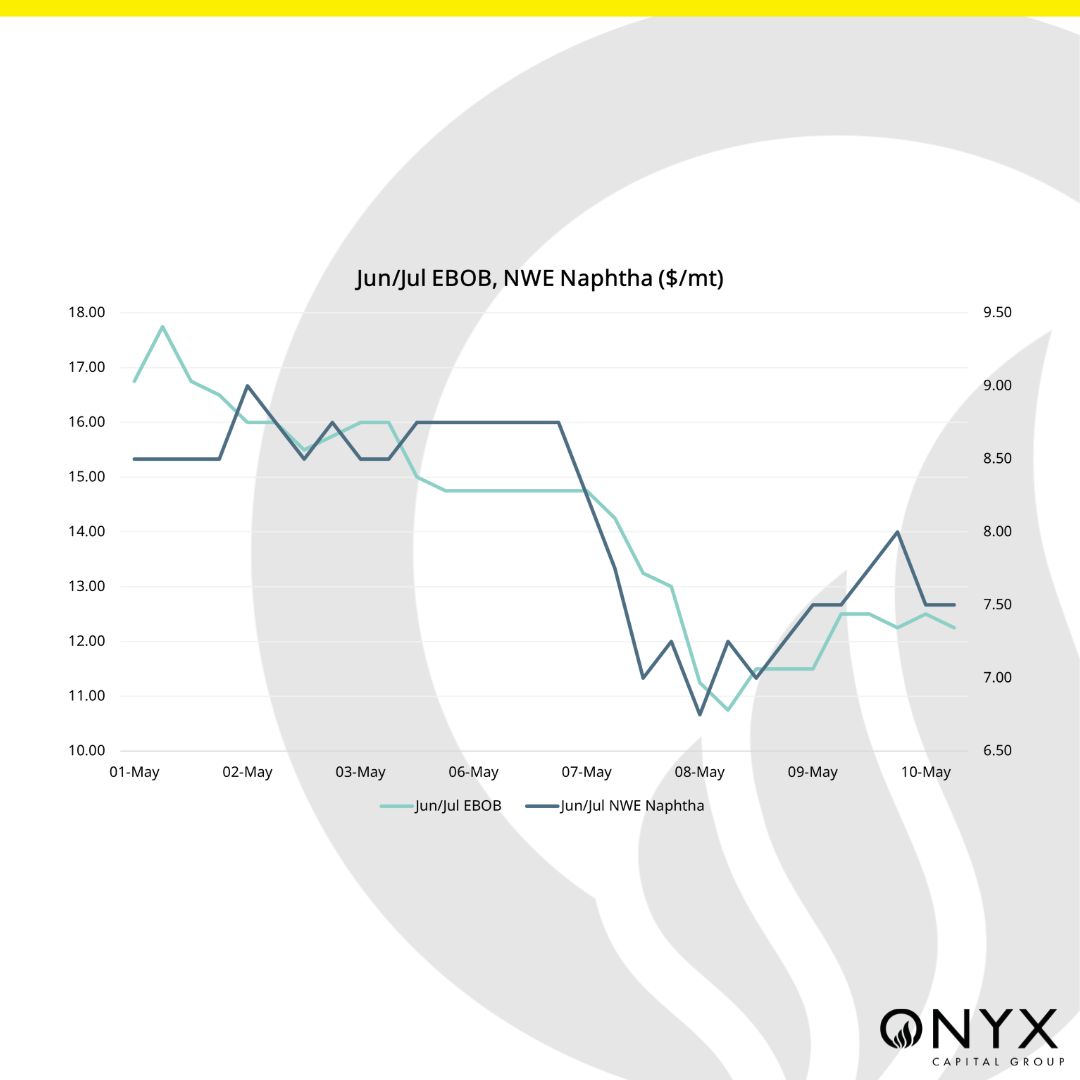

Refinery margins continue to stagnate with refined products suffering down the barrel. Gasoil remains in contango and lightends have seen a spectacular sell off this week. Poor margins further disincentivizes crude demand although the significant crash in the north sea crude physical differentials could potentially attract some buy-side interest. These sell-offs may have caused a more balanced market in the products, in particular those which have seen crowded Q3 saturation.

OPEC+ have started ‘suffering leaks’ ahead of the Jun 1 meeting and there was a slip in prices, initially, to OPEC refusing to comment on cut extensions. It seems the market is looking for a genuine demand signal currently and further supply constraints just don’t seem to match the current genuine concern over the macroeconomic health of the US, China and much of Europe. With all eyes on the demand picture, the EIA inventory changes provided the spur long layers needed to see some silver linings and flat price was supported to $84/bbl where prices have been supported since.