Powered by Volatility

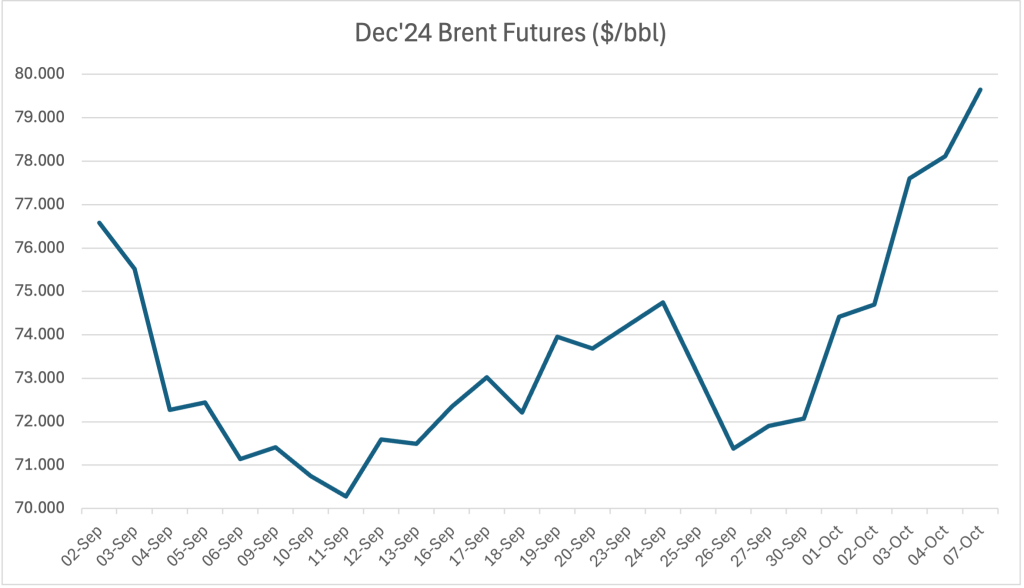

The Dec’24 Brent futures contract fell below $78.00/bbl on Friday evening but again rallied to $79.65/bbl on 07 Oct at 10:40 BST (time of writing). Volatility remains elevated in the benchmark crude futures contract, leading us to assume a broader range for Brent futures by the end of this week, estimated between $76-81/bbl. Vital drivers that we expect will impact this week’s price action include:

- Increasing geopolitical risk premia

- Positioning is still very short

- Poor demand and supply fundamentals

Amid the devastating regional escalation of the war in Gaza over the past fortnight, Israel bombed targets in Lebanon and the Gaza Strip on Sunday – ahead of the first anniversary of the 7 Oct attacks last year. Israeli Prime Minister Benjamin Netanyahu has vowed to retaliate against Iran’s recent ballistic missile strike on Israel, injecting uncertainty about the time and place of this retaliatory attack. For instance, Iran temporarily shut its airports on Sunday afternoon amid speculation of Israeli strikes in a raid targeted against the Iranian military, oil or nuclear production. In line with this, the implied volatility of 25 delta call Brent options climbed from 41.59 on 02 Oct to 52.55 on 07 Oct (at the time of writing), compared to a rise from 38.48 to 42.33 in 25 delta put Brent options, highlighting that more players are willing to take upside bets in oil prices.

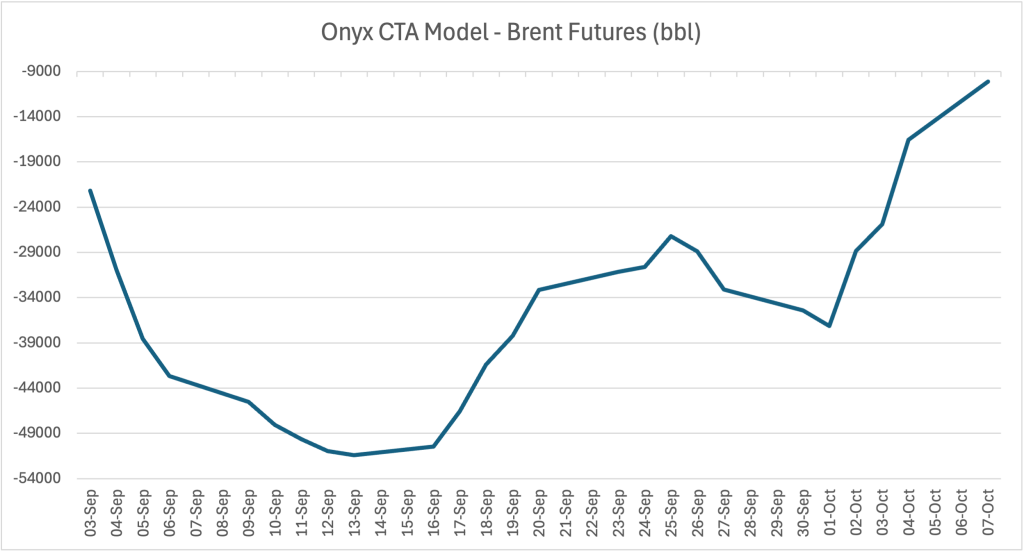

Interestingly, we continue to see ample room for these upside bets in Brent in the near future. Returning to the futures market, ICE COT data for the week ending 01 Oct showed a 21mb rise in net length to +22.2mb, highlighting that there remains room for further bullishness. Onyx’s CTA model also indicates that while CTA positioning in Brent climbed by 71% to -10.1mb in the week ending 07 Oct, net positioning remains highly short, increasing the probability of significant short covering on any additional news of oil supply disruptions.

Despite this resurgence in bullish sentiment, the still-concerning supply-demand narrative in oil continues to cap prices. We continue to see poor industrial activity in vital economies such as Germany, with the German economic minister expecting its economy to shrink by 0.2% in 2024, as per Bloomberg. In China, Goldman Sachs commented that China would need to unleash a more significant round of quantitative easing measures to escape its economic downturn. However, if China opts for another round of such measures, further bullishness may be injected into the benchmark futures contract. On the supply end, despite the rising geopolitical risk premium in oil prices, OPEC+ remains well equipped to compensate for a total loss of Iranian supply should Israel manage to, in a horrific case scenario for the war, impact Iranian oil severely.