Baby, it’s cold outside – especially in Europe where the recent snow forecasts are set to test out energy systems for the second year without Russian supplies. As terrible as this weather has been for tourists (note: the author of this article comes from a tropical country), it decidedly marks a start to the long-awaited winter heating demand season – and European gasoil appears ecstatic.

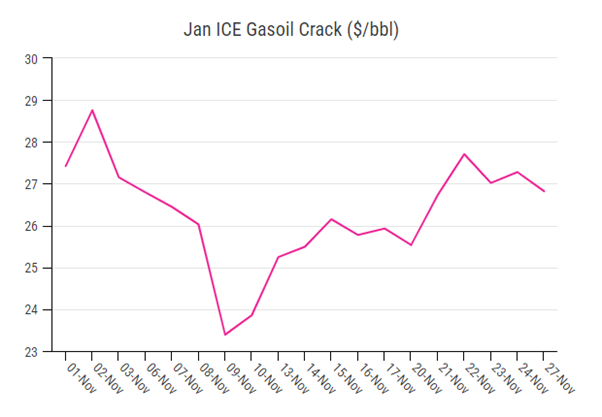

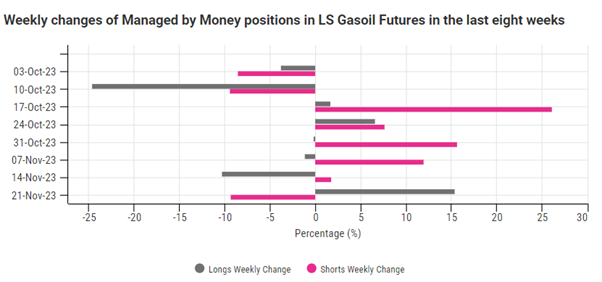

The ICE LS Gasoil cracks have witnessed a slow, steady albeit incredibly choppy rise this past month. The Jan-24 crack went from $23/bbl on Nov 09 and is currently flirting with the $27-28/bbl handles. CFTC COT data on ICE low sulphur gasoil further cemented this bullish sentiment in European gasoil with 15% more length being added to money-managed ICE LS Gasoil Futures w-o-w compared to a 10% decline in bearish speculators.

How sustainable is this strength though? For one, the bulls from the CFTC data have been largely absent prior to this week. The week to Nov 14th saw a 10% decline in long positions whereas short speculative positions found a muted rise (at 2%). For all we know, this bull play may very well be a short term phenomenon before the gasoil bears take over again.

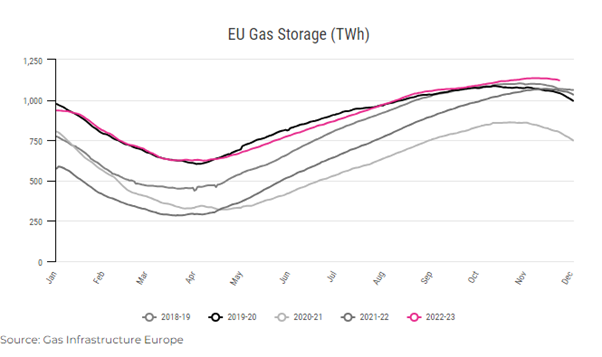

That leaves the question of winter heating demand. While *cue Ned Stark’s voice* winter is definitely coming, gasoil might be a little late to the race. Ever since last year’s energy crisis, the EU has been stocking up on natural gas. As per a report by Gas Infrastructure Europe, EU supplies are a little over 98% at capacity despite a recent draw this past fortnight. As a result, while temperatures have dropped in the Northern Hemisphere, gas-to-oil switching has been limited.

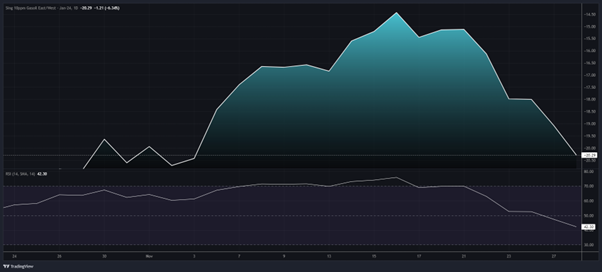

Further cementing this notion is the narrative behind the weakness noted in the Sing 10ppm gasoil. The story goes that Asian gasoil fundamentals have been plagued by weak arbitrage economics alongside lacklustre local demand in Asia. As per S&P Global Commodity Insights data, the benchmark FOB Singapore 10ppm sulphur gasoil cash differential reached a six-month low, trading at a discount of 31 cents/bbl at the Asian close on Nov 21, a tumble down from the $1.55/bbl premium it clocked in at the start of the month. This crash down stems out of East-West arbitrage lanes being shut in spite of the bullish sentiment in ICE LS Gasoil Futures. Traders are further witnessing barrels stuck in the East of Suez, bloating the region and driving down prices.

The Sing E/W has also eased off accordingly from around -$14.43/mt on Nov 16 to the -$19/mt handles on Nov 27. With a Relative Strength Index (RSI) value of 42, the Sing E/W has plenty of room for further downward traction.

If the cold spell continues or strengthens, European households might be compelled to add gasoil to their heating mix, increasing gasoil heating demand despite the high natural gas stocks. Notwithstanding this, we cannot discount the concerns presented by the strength of this year’s El Nino phenomenon, which is now expected to last until at least next April, giving way to concerns of 2024 being warmer than 2023. If the concerns come to fruition, we may instead encounter muted heating demand and rising distillates stocks – bringing bearish tides for gasoil.

A small gleam of hope for gasoil bulls stems from the ongoing discord between Russia and India regarding the currency India pays for Russian crude. India is a vital exporter of middle distillates to Europe – with its exports rising from 1.1mbbls in January 2022 to 7.4mbbls in April 2023. Ironically, India’s middle distillates production requires it to buy sanctioned Russian crude oil, which it pays for using a combination of Chinese yuan alongside US dollars and UAE dirhams. India’s request to Russia, asking the latter to accept payment in Indian rupees, was denied by Russia – who said it could not accept a currency with little use outside of India. The clash, seemingly muted, led to two major Russian oil companies threatening to divert around a dozen India-bound tankers elsewhere, after which the cargoes were paid for in a combination of the Chinese yuan, the Hong Kong dollar and the UAE dirham. However, India continues to be wary of using China’s, a regional rival, currency, which may spark uncertainty over its distillates exports to Europe – possibly keeping the gasoil bulls satiated this winter.

Hence, while the CFTC COT data has showcased an immense rise in support for gasoil, the data unfortunately remains the tip of the (fundamental) iceberg. It will be interesting, however, to see how European gasoil fares as we continue descending into winter.