The recovery of Asian jet fuel markets has been gradual over recent months, yet recent trends have shown some signs of support. In the context of Asia, China’s role is pivotal as it constituted approximately 20% of the region’s international air traffic before the pandemic. As of September 2023, demand in China remained at a mere 54% of the levels seen in 2019. However, excluding China, the recovery across other Asian regions has been more robust, lending support to higher jet fuel prices in these areas.

Despite this, the overall demand for jet fuel and kerosene is anticipated to stay subdued towards the end of 2023. Currently, we are in a typical low season for travel demand, leading airlines to reduce both domestic and international seating capacity. However, there is an expectation of a significant reduction – approximately 26.3% in November compared to October – in China’s jet fuel exports, amounting to 1.4 million metric tons. This decrease is attributed to the near-exhaustion of nearly 80% of China’s export quotas, with a potential shortfall in quotas for the fourth quarter. Should other regional suppliers fail to offset this reduction, we foresee upward pressure on prices.

In parallel, kerosene demand has been further constrained due to the milder winter conditions brought about by the El Niño weather phenomenon, though industry sources anticipate a rebound in demand from November as temperatures look set to drop. Looking ahead, air travel patterns are expected to normalise in 2024, and concurrently, colder weather during that period should stimulate kerosene demand.

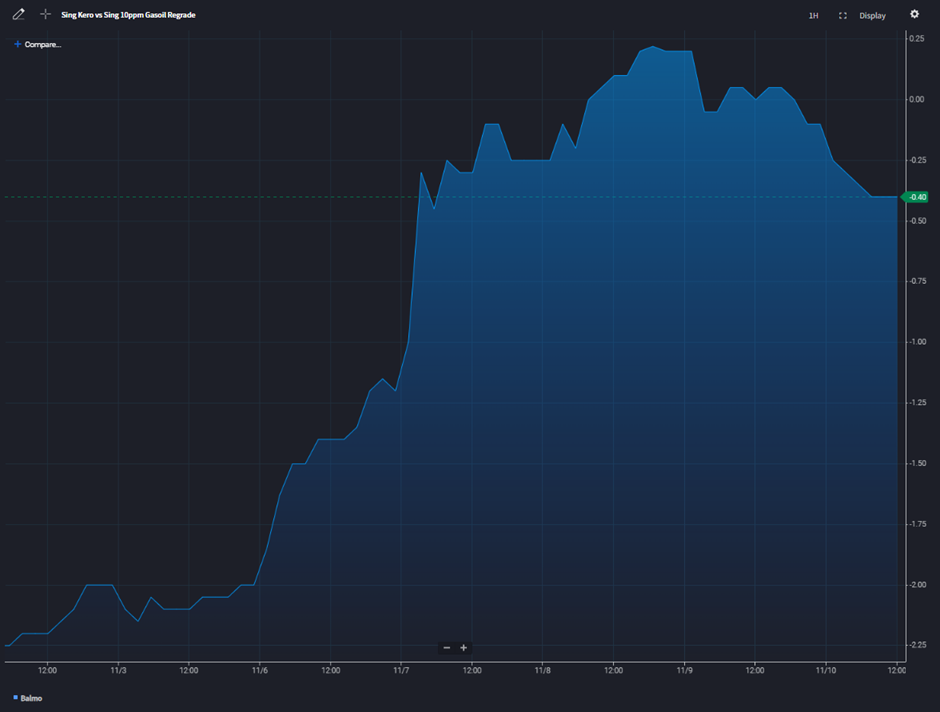

Regarding market dynamics, it has been a volatile week for regrade, especially in the front-month contracts. The Bal-Nov contract briefly reached positive levels before undergoing a sharp correction, a movement likely amplified by short-covering flows.

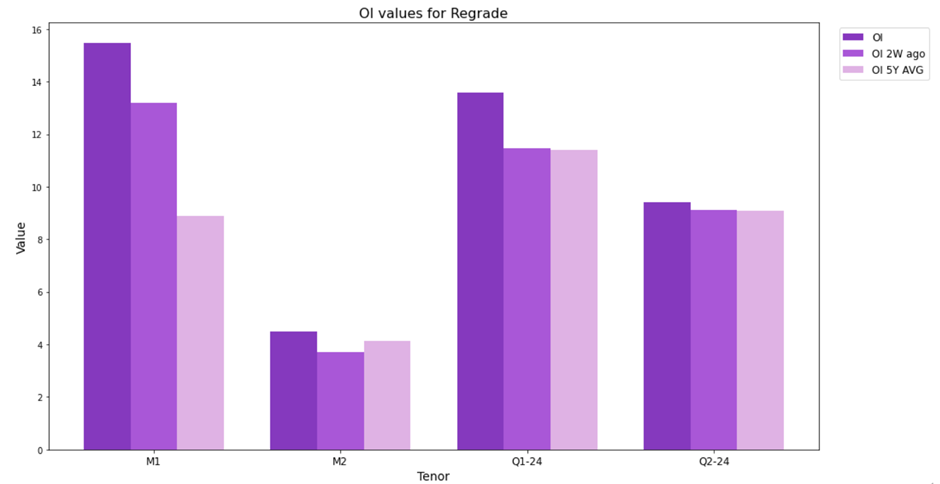

This volatility extended support to the December contract, though overall interest in this contract appears limited with the OI sitting almost 2mbbls below the November contract.

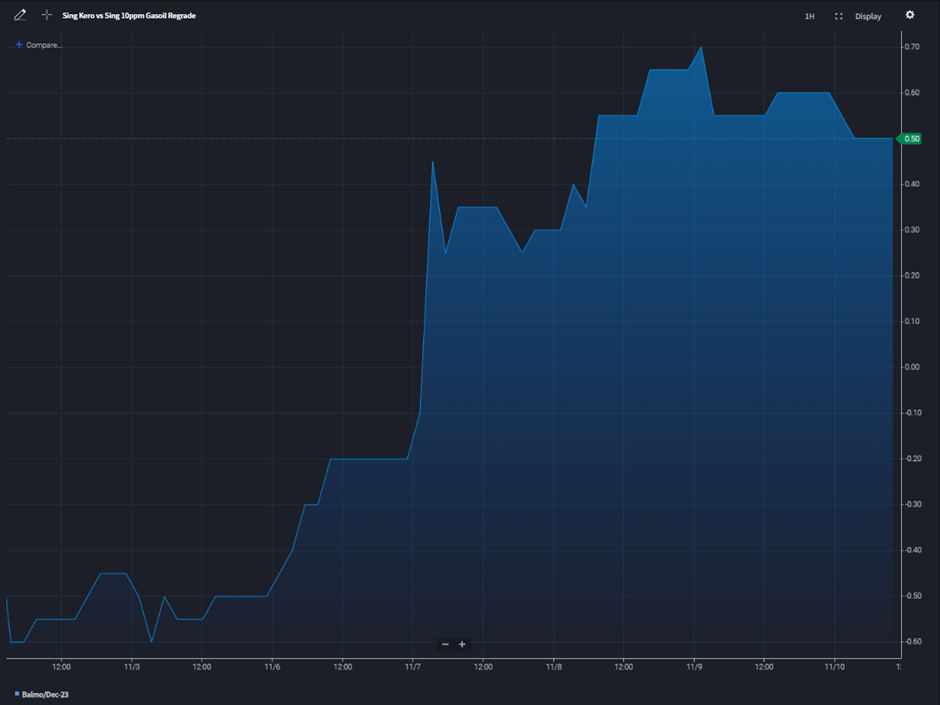

This is further highlighted by the sharp rally in the Bal-Nov/Dec Jet Diff roll which touched as high as 70c/bbl on the week though has retraced lower into Friday.

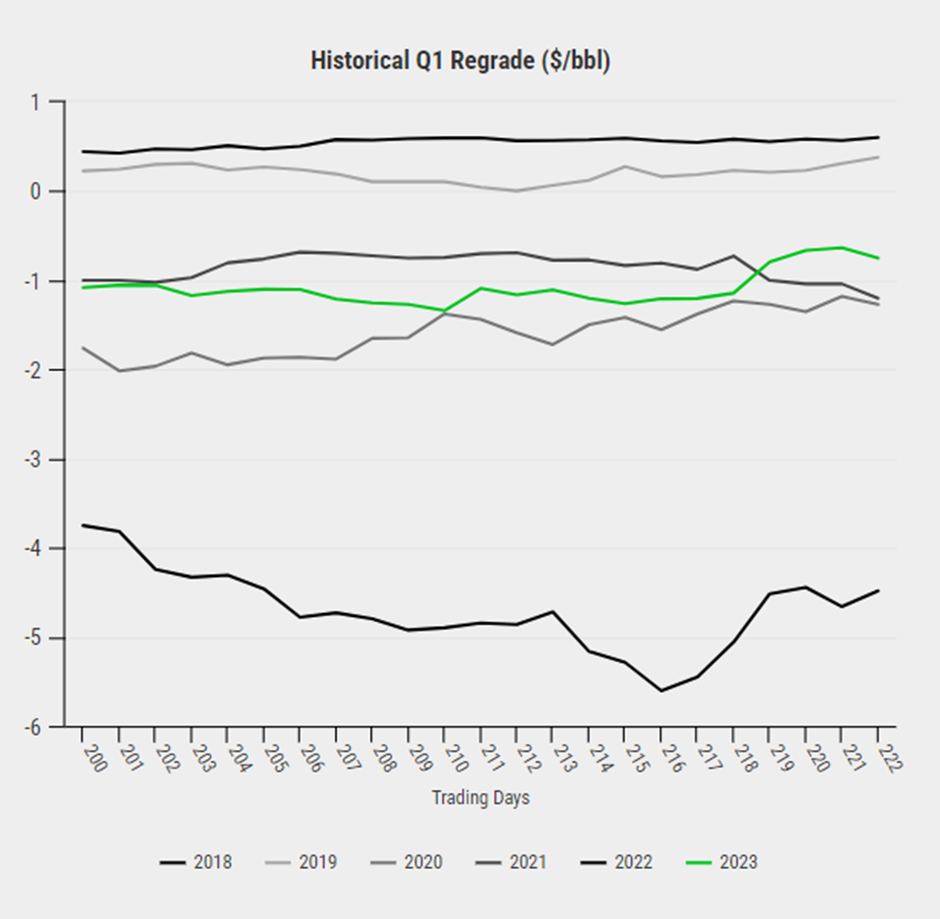

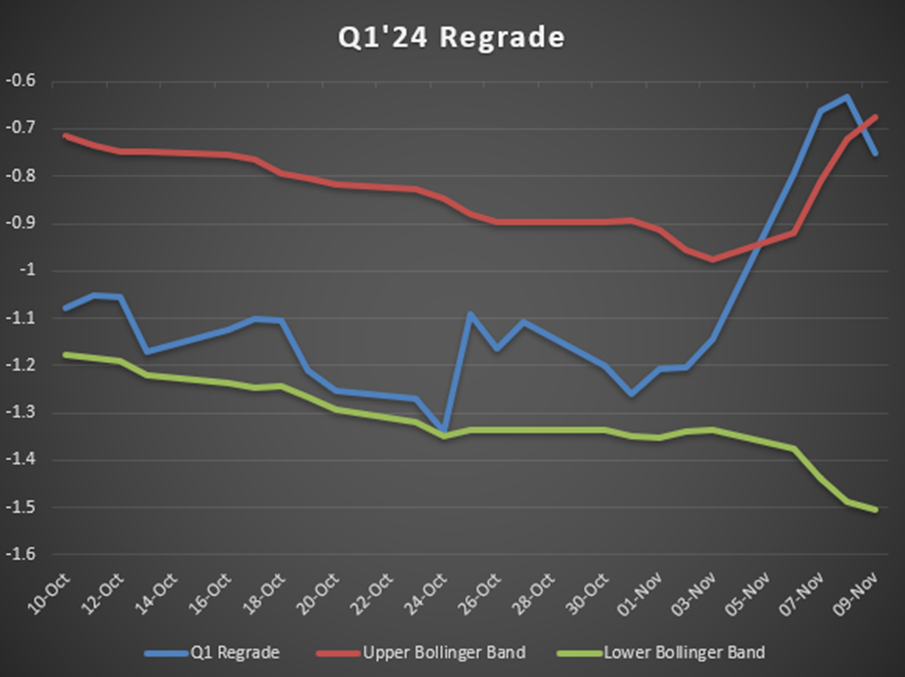

Q1’24 will be an interesting part of the curve to watch. The Lunar New Year sees millions of people travel domestically and internationally to celebrate with family and falls between late January and early February and we could start to see people looking to add length in kerosene in this part of the curve in the next few weeks. Notably, the Q1’24 regrade has recovered higher than the pandemic years but continues to lag 2018 and 2019 levels and this could start looking like an attractive level for bulls to enter long.

Temperatures are set to decline in Japan in the week from Nov 12th and given Japan is one of the world’s largest consumers of kerosene, this has strong implications for the market. Interestingly, prices right now have just corrected from overbought territory with the RSI also falling below 70, potentially as players look to start taking a more risk-off approach into the end of the year.

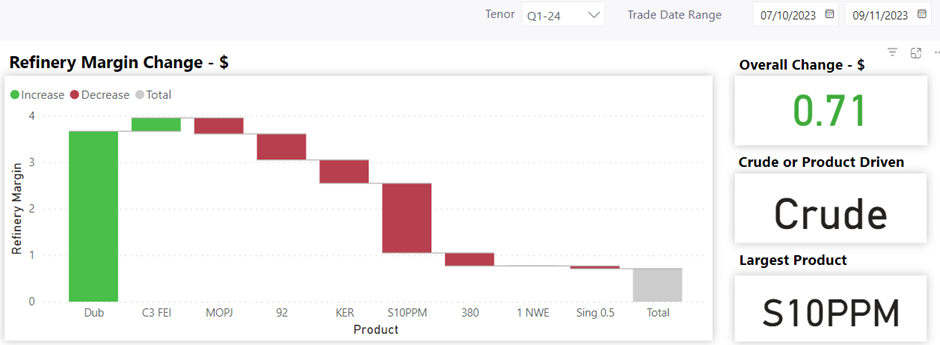

As we look ahead to 2024, the strategic decisions of refineries will be pivotal in shaping the dynamics of the kerosene market. Given that the cost of refining is intrinsically linked to crude oil prices, the prioritisation of jet fuel production by refineries could significantly influence market trends. A critical factor to monitor will be the outcomes of the forthcoming OPEC+ meeting. Should Saudi Arabia and Russia maintain their current production cuts, we could witness a sustained elevation in crude oil prices and thus if refineries adjust their output to favour jet fuel production, we could see regrade prices narrow given the tighter gasoil supply at a higher production cost.

Looking at the Onyx Asian Refinery Margins Dashboard highlight the FEI bolstering margins for Q1’24, largely due to soaring prices on the back of reduced Panama Canal transits. In contrast, the Singapore 10 ppm Gasoil margins are weighing down overall profitability. This divergence may prompt refineries to favour Kerosene production in the new year, as they adapt to shifting market dynamics and margin opportunities.

As 2024 approaches, the strategic shifts by refineries, influenced by crude oil price trends and margin considerations, will be crucial in determining market dynamics. The interplay of regional demand fluctuations, particularly with upcoming events like the Lunar New Year, and the anticipated colder weather in key markets like Japan, will further shape the market’s trajectory.