TARGET: $70.00/bbl – $73.50/bbl

PRICE: $71.65/bbl

OPEC+: Much Ado About Nothing

The front-month February 2025 Brent Friday morning was roughly where it started the week, with a brief rally in between. At the time of writing, Brent was trading at $71.65/bbl and within the target range between $70.00/bbl and $73.50/bbl forecast in this week’s Brent forecast released on Monday. While we had the release of key PMI data out of the US and China this week, the main focus was on the OPEC+ meeting on Thursday. The lack of sustained price direction this week suggests that risk-takers’ positioning has changed very little. This afternoon, the release of US payroll figures could shift expectations around future Fed policy and, thus, risk appetite. Key to this week’s developments were therefore:

·OPEC+ meeting delays the unwinding of voluntary cuts to April 2025

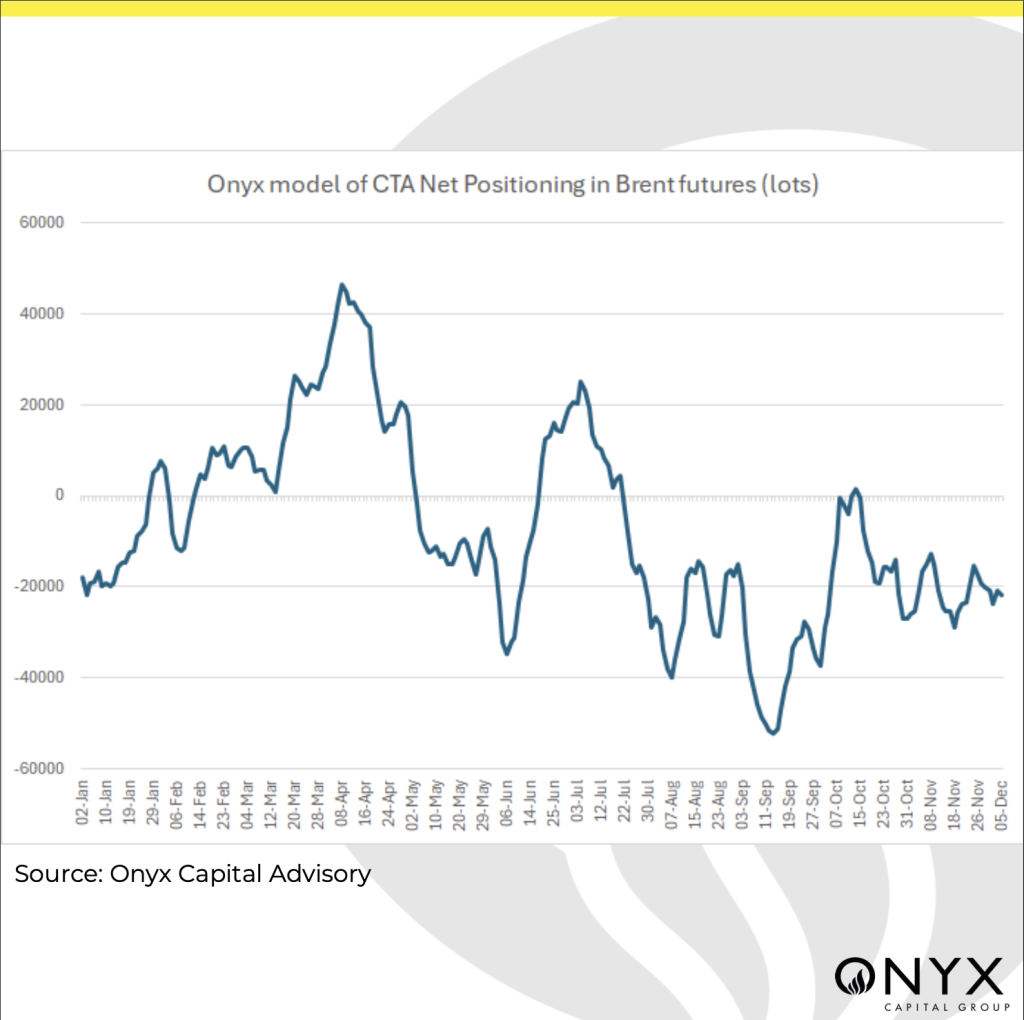

·Positioning: CTA still on the sidelines and still biased on the short side

·US macro data does not press the Fed to speed up the pace of rate cuts

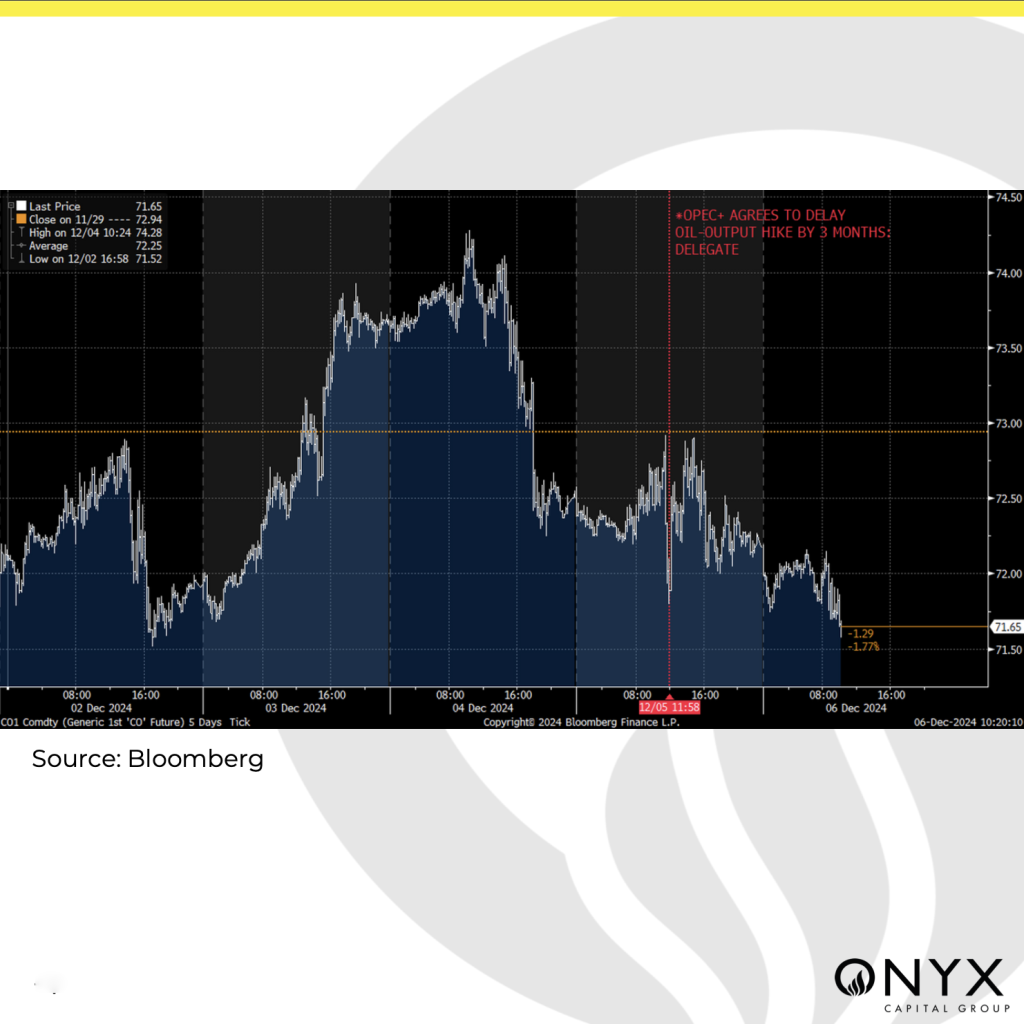

OPEC+ held a ministerial meeting on Thursday to decide whether to keep the status quo on its current supply policy. The swift outcome of the meeting confirmed what the consensus had been thinking all along. OPEC+ delayed the unwinding of voluntary cuts for a third time to April 2025, and it plans, if market conditions allow, for the 8 OPEC+ members to start unwinding these discretionary cuts incrementally thereafter. The duration of the tapering of cuts was extended to the end of 2026. The UAE, which had been granted a production increment of 300 kb/d in 2025, would delay a rise in its output till after Q1 next year. With oil prices just about hovering above $70/bbl, a weak short-term macroeconomic outlook and a fair amount of uncertainty for the world economy when President-elect Trump takes office in January, OPEC+ has bought itself some time to gain more clarity. The market’s reaction to the decision was volatile, declining to $70.81/bbl intraday to quickly bounce back above $72.50/bbl, only to finish slightly lower on the day. The whipsaw, in part, could have been provoked by option hedging flows around the event, but from a sentiment point of view, the OPEC+ decision did not shift the fundamental outlook for prices to move strongly either way. Compliance with quotas remains a big challenge, with some producer group members, like the UAE, producing considerably above target or others, like Iraq, having to implement compensatory cuts for earlier overproduction. Has OPEC+ done enough to assuage market bears? That remains to be seen in view of the downside risk to demand outlook and robust growth in oil liquids supply in non- OPEC countries.

Regarding market positioning, the ICE commitment of traders data as of Tuesday of the previous week showed very little change in the net futures position of money managers on the Brent contract. The ratio of gross long-to-short positions trended at historic lows and was well below the levels commensurate with Brent pricing above $80/bbl. Looking at Onyx’s own proprietary CTA modelling, positioning as measured up to Thursday’s close of business did not witness much change. We estimate the net position of CTAs on Brent’s futures at a net short of -21.2 thousand lots, which compares with a net short of 20 thousand lots last Friday. We continue to expect these participants to remain hesitant to gain exposure to oil just yet and, given the weak fundamental outlook, to remain biased on the short side. In US data this week, we saw the release of the ISM indices. In November, the manufacturing sector showed improvement, indicating that the pace of contraction was considerably slowing. The service sector, on the other hand, disappointed expectations by declining but remained solidly in expansionary territory. All in all, this should bode well for this afternoon’s release of non-farm payroll data (13:30 GMT), expected at +218K, with unemployment at 4.1%. A strong print combined with expected resilient November CPI (due 11 December) could shift expectations around whether the Fed decides to cut its Fed funds rate at the next FOMC meeting on 17-18 December. This could keep yields up and the USD supported, potentially putting downward pressure on the oil prices in the afternoon trading session, bringing Brent closer to the lower end of our Brent forecast range for this week.