The Market Resets

Oil prices finally saw a cooling of the geopolitical risk premia tied to fears of an Israeli attack on Iranian oil and nuclear infrastructure, with the soon-to-be-prompt Jan’25 Brent futures contract falling from a close of $75.62/bbl on Friday to $72.25/bbl shortly after the market’s open on Sunday, ultimately sitting at $71.75/bbl on Monday 14:45 GMT (time of writing). We expect the contract to sit between $68-71/bbl by the end of this week and identify the following three potential drivers of price action this week:

- Iran and Israel reluctant to escalate the conflict further at this stage

- Focus returning to poor macroeconomic realities

- US “economic exceptionalism”, which may impact the Fed’s easing rate

The uncertainty in the Middle East hit a boiling point over the past few weeks, with increasing debate about whether Israel would retaliate against Iran by attacking the latter’s oil and nuclear infrastructure, a decision that could have compounded the regional escalation of the war in the Middle East. However, Israel’s attacks over the weekend struck military sites in Iran and stayed clear of energy facilities, cooling some of the geopolitical risk premium supporting oil prices. Israeli Prime Minister Benjamin Netanyahu called the attack “precise and powerful, achieving all its objectives”, while Tehran played the attack down as well, indicating that both sides are perhaps unwilling to escalate this conflict further, at this stage, which may take the market back to a pre-01 Oct status quo.

The market may thus return its attention to the poor macroeconomic realities igniting fears of a decline in oil demand. While China reported a slightly stronger Q3’24 GDP growth at 4.6%, the National Bureau of Statistics reported that China’s industrial profits declined by 27.1% y/y in September, their steepest fall this year (August: 17.8% y/y). The People’s Bank of China is reportedly conducting reverse repo agreements with primary dealers for up to one year to maintain liquidity in the banking system – potentially allowing institutions to free up longer-term liquidity. The market has yet to react to this new monetary policy development, although it may be worthwhile to monitor economic data to gauge the effectiveness of this new measure. The market will also be looking out for China’s official October PMI data out this Thursday. Eurozone flash PMI figures remain in contraction in October, with Germany sitting on a composite PMI of 48.4 (+0.9 m/m) while France’s composite PMI number fell to a nine-month low of 47.3.

Finally, the market will be awaiting the October Non-farm Payrolls and US unemployment rate out on Friday and its implications for the Fed’s monetary easing cycle. The Fed is likely to look past poor data which may be expected this month due to the hurricanes and the Boeing strike. At the same time, better-than-expected figures may slowdown the pace at which the Fed decides to ease, which may place downward pressure on risk assets such as oil. An added source uncertainty comes from the upcoming US election. Based on betting odds (and not national polls), the market is pricing a potential second Trump presidency, which many fear may generate more debt than a potential Harris presidency and cause inflationary pressures.

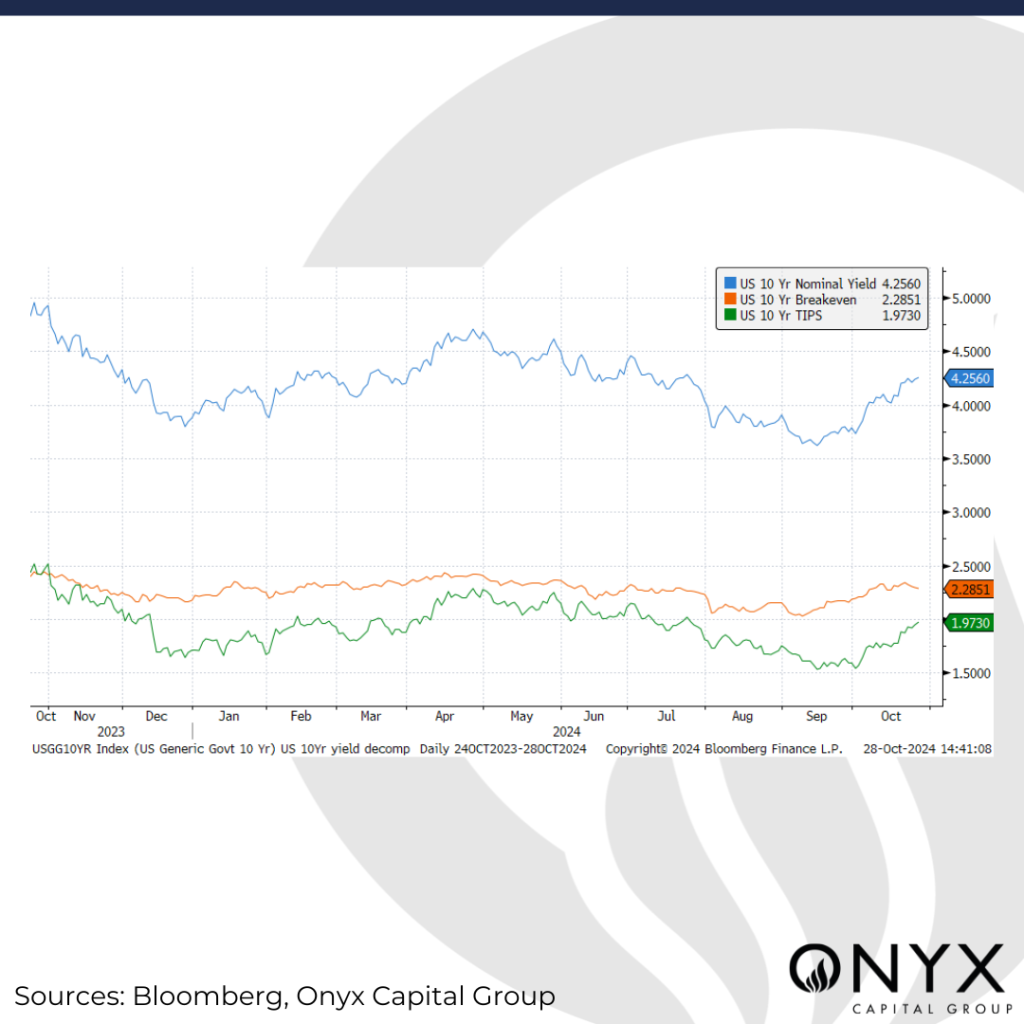

As a result, portfolio hedgers “dumped” their bonds, with this flow contributing to higher yields. Furthermore, rates of TIPs (a proxy for real interest rates) has improved due to the US’ “economic exceptionalism” as of late, driving nominal yields higher despite limited changes in market-based measures of US inflation expectations, such as the 5-year/5-year rate. Should this trend continue, it may keep the dollar supported and while the dollar’s usual negative correlation with oil is not as robust as it used to be, a stronger dollar for a longer period of time may not be good news for dollar-denominated assets like oil.