Turbulent Times Ahead

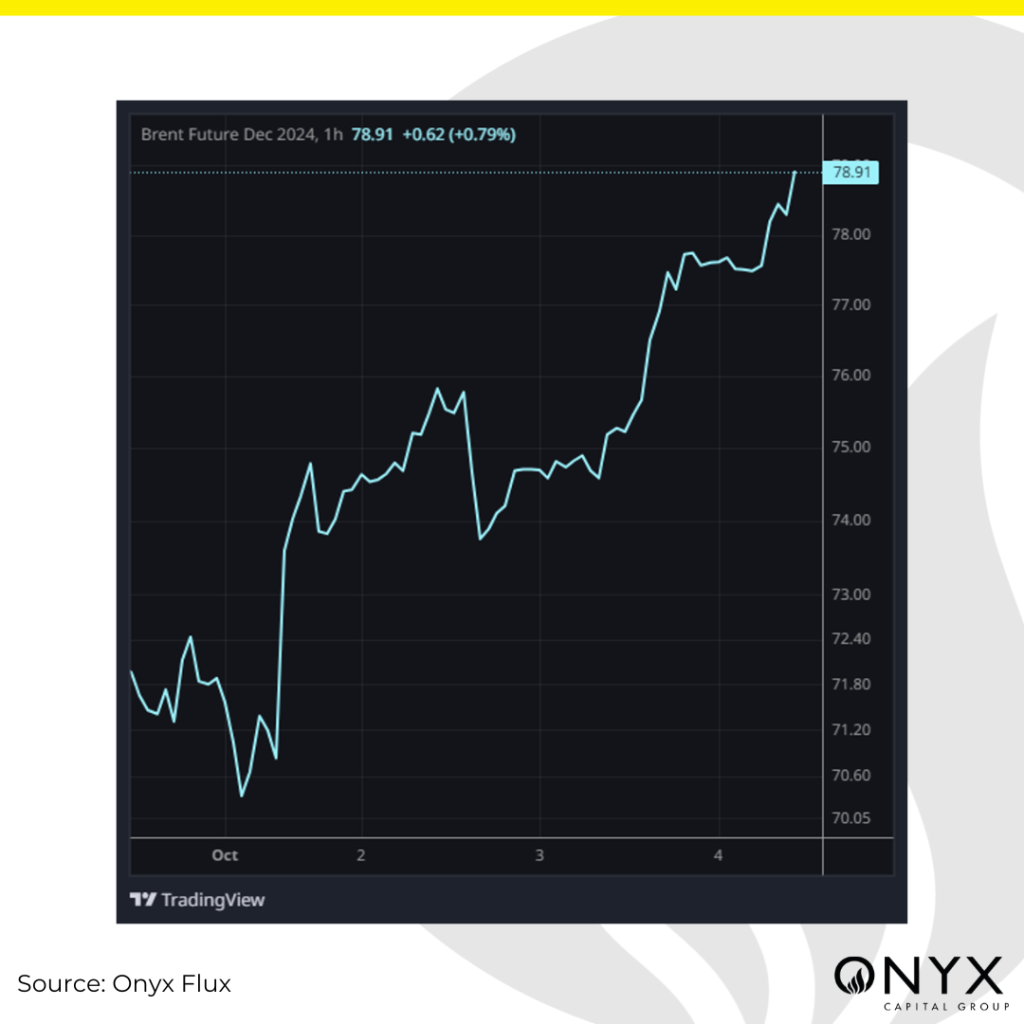

On Monday, we predicted the Dec’24 Brent futures to finish the week between $69-74/bbl amid an oversupplied oil market. However, the futures contract witnessed an injection of bullish sentiment due to growing concerns regarding the regional escalation of the war in the Middle East, and currently sits at $78.90/bbl (as of 11:47 BST, time of writing). As we outline this week in Brent, we underline the following three drivers that were critical for sentiment and price action:

- Worsening Israeli-Iranian tensions

- Libyan oil production

- US economic data

Nearly a year into the war in Gaza, deepening escalation between Israel and the Lebanon-based Hezbollah over the past fortnight has led to a rising Israeli offensive in Lebanon. Adding to this, Iran launched ballistic missiles at Israel late on Tuesday, leading to Israel’s promise of a “painful” response. The Dec ’24 Brent futures contract shot up from a brief dip below $70/bbl before noon to $74.80/bbl at 18:00 BST later on Tuesday. Adding fuel to the fire, US President Joe Biden stated on Thursday that the US was discussing whether it would support Israeli strikes on Iranian oil facilities as retaliation for the ballistic missile attack, significantly intensifying the geopolitical risk premium attached to the futures contract.

On the flip side, despite these growing concerns of a supply disruption from the Persian Gulf, oil prices remain below $80/bbl. This ceiling in price action may be a function of the still-concerning supply glut in oil globally. Libya’s state oil company declared on Thursday that the country was ready to resume total oil production – including production at its largest oilfield, Sharara – after nearly two months of shutting down operations amid worsening political tensions within the nation. Libya produces over 1.2mb/d of oil, and the Sharara oil field alone produces up to 300kb/d. In the West, the EIA announced a build of 3.9mb in US oil inventories – magnifying the view that oil may be oversupplied.

Nonetheless, the market remains tentative and will be waiting for Israel’s next move. In the meantime, in the financial sphere, the market will be awaiting today’s US Non-Farm Payrolls (NFP) data at 12:30 GMT. Median expectations stand at +150k, although a softer NFP reading may intensify belief of an additional 50bps rate cut in November, with the US overnight index swaps (OIS) pricing a cut of 31bps at the time of writing.