Finally, some strength!

At the start of the week, we forecasted that the front-month Brent futures contract would tick slightly higher through the week, but ultimately remain rangebound between $71-74/bbl. As of 20 Sep, 11:50 BST (time of writing), the Nov ’24 Brent futures contract was just above this forecasted range at $74.45/bbl.

Following a descent that took Brent briefly below $70/bbl, the past week has seen the North Sea crude benchmark regain some strength. The Nov’24 futures contract surpassed $75/bbl before retrenching on Friday, at the time of writing, to $74.57/bbl. Looking into what drove this bullish price movement this week, we see the following three factors stand out:

- The US Fed cutting interest rates by 50 basis points

- Profit taking by in-the-money shorts

- Heightened geopolitical risk in the Middle East

On Wednesday, the US Federal Reserve announced its first interest rate cut in four years, cutting the federal funds rate by 50 basis points to a range between 4.75% and 5%. We predicted on Monday that such a cut in interest rates may fuel hopes for rising US economic activity and support risk assets such as oil. The Nov ’24 Brent futures contract surged from $72.80/bbl an hour after the FOMC meeting on 18 Sep to $74.50/bbl the following morning.

Brent futures witnessed additional support from in-the-money shorts taking profit this week. Positioning became increasingly net short last week, with COT data for the week ending 10 Sep recording net negative positioning for the first time in history.

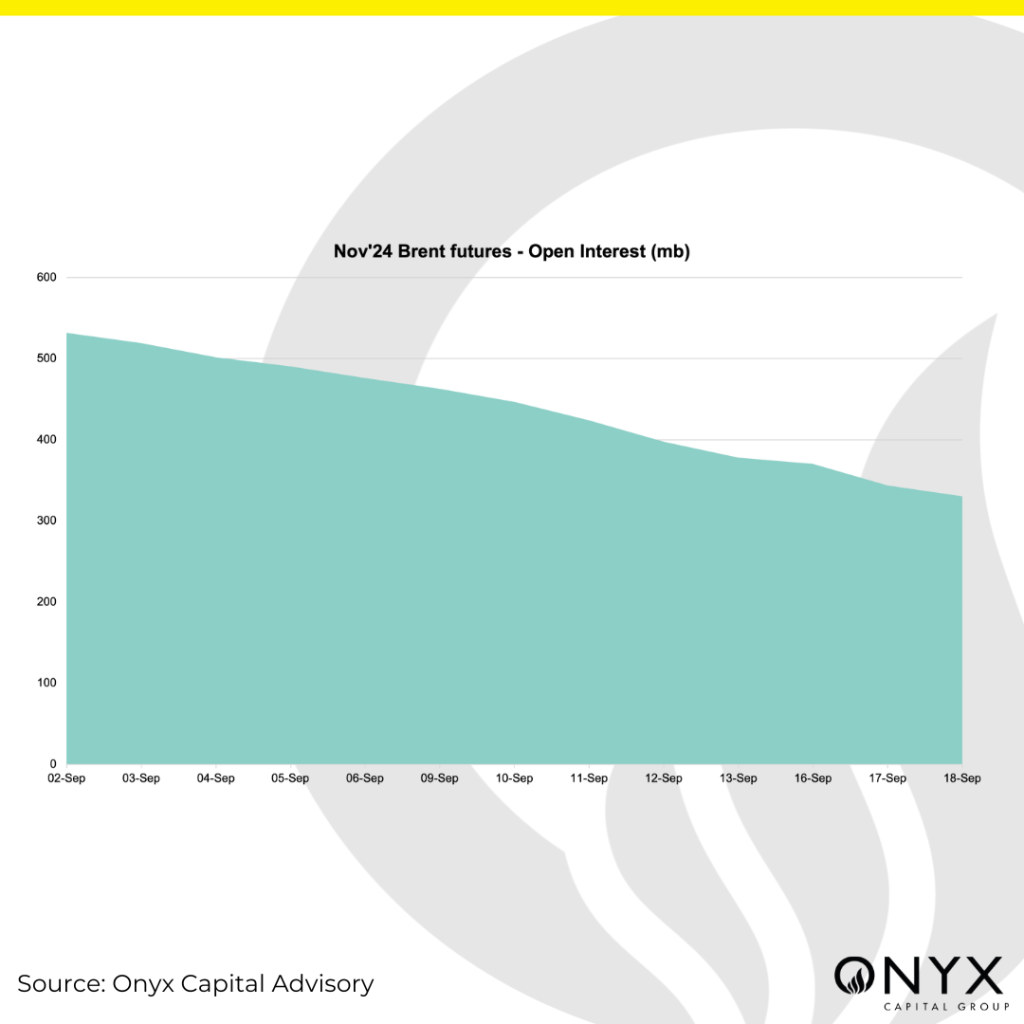

This net short positioning was likely a product of length stopping out, as indicated by a 14% w/w decline in the Nov’24 contract’s open interest to 424mb on 11 Sep. We saw a further 22% decline in the contract’s open interest to 330mb by 18 Sep – highlighting that Brent’s subsequent support may have resulted from these short-positioned players taking profit. We recommend monitoring the ICE COT data for the week ending 17 Sep – to be released today at 20:30 BST – to see how this profit-taking impacted money-managed net length.

Finally, the futures contract also saw a surge in volatility this week following an escalation of geopolitical tensions in the Middle East after hundreds of pagers belonging to the Lebanese armed group Hezbollah simultaneously exploded across Lebanon. Israel and its spy agency Mossad have been accused of orchestrating the explosion, which has so far killed 20 people and injured over 450 people, as per Lebanon’s health ministry. However, neither Israel nor Mossad has claimed responsibility yet. We have yet to see a disruption to oil supplies due to the war in the Middle East, but we expect a rise in the geopolitical risk premium attached to oil prices amid this recent development.

Overall, the Brent futures contract has seen a more supported week. Nonetheless, last week’s bearish drivers continue to linger, with weak demand from China’s slowing economy remaining a pressing issue. It will thus be interesting to see whether this week’s support was simply a market correction or whether we will continue to see support in the near term.