TARGET PRICE: $83/bbl – $85/bbl

PRICE: $85.80/bbl

Return of the pre-weekend bulls?

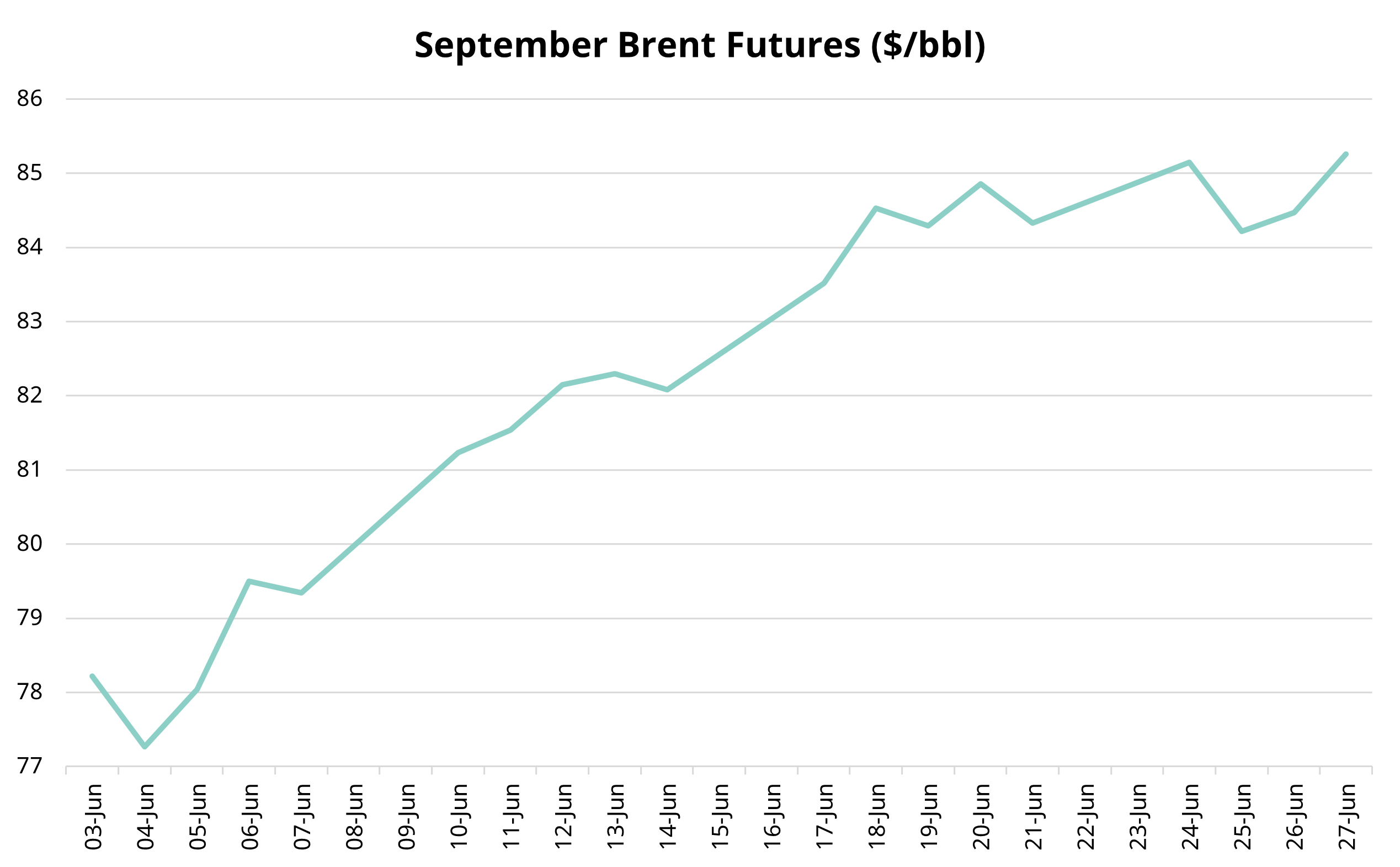

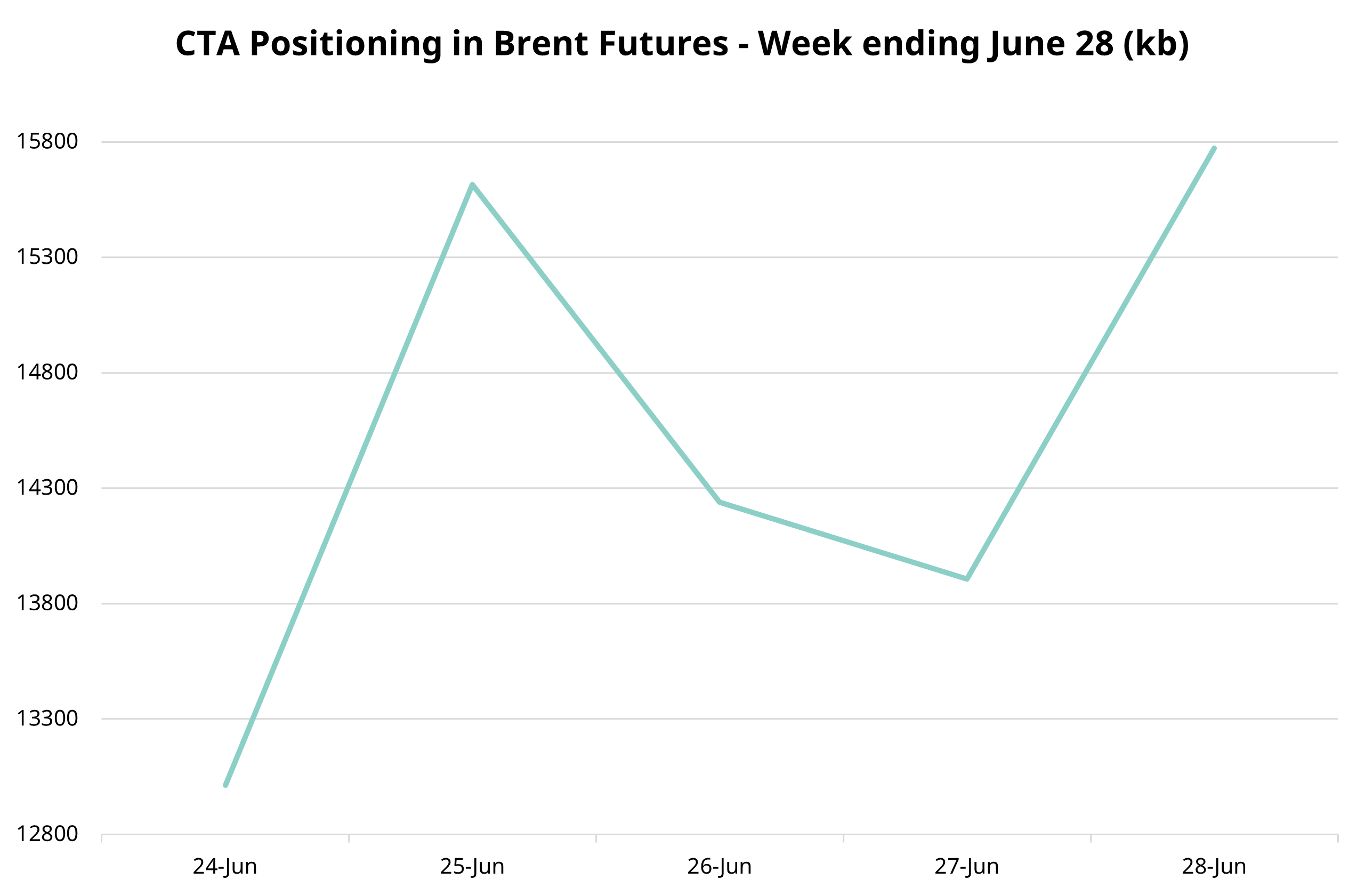

On Monday, we forecast short-term bearishness to take the benchmark Brent crude futures to $83-85/bbl by the end of this week. We now see the September futures contract hovering just above this range, at $85.80/bbl as of 08:50 BST (time of writing), while the August contract sits at $86.90/bbl ahead of today’s expiry. However, the September futures flat price fell $84.15/bbl on Thursday afternoon but rallied sharply in the following Asian open – likely because players covered short positions before the weekend. This removal of risk is evidenced in Onyx’s CTA positioning model, which highlighted declines in net length in ICE Brent futures from 15.6mb on 25 June to 13.9mb on 27 June before rising again to 15.7mb on 28 June.

A key reason for our bearish prediction on Monday was the US dollar’s strength, especially relative to other currencies amid the political turbulence in France. The yen came off to 159.94 per dollar in early trade on Monday—its lowest level since 29 April. The US dollar index (DXY) rose to over 106 on Friday morning. However, it witnessed incredible choppiness and dipped from 106 to 105.70 on 27 June morning, ahead of the US presidential debate. While there is typically a negative relation between the USD and oil prices, the correlation in daily returns between the two of late does not show strong evidence of that; thus, oil is holding up in spite of a strengthening greenback. The market will now be awaiting today’s US core PCE inflation data for further cues on USD volatility and sentiment. The data may also provide participants with a temperature reading of when the US Fed could begin cutting interest rates – which would also spook strength out of the US dollar.

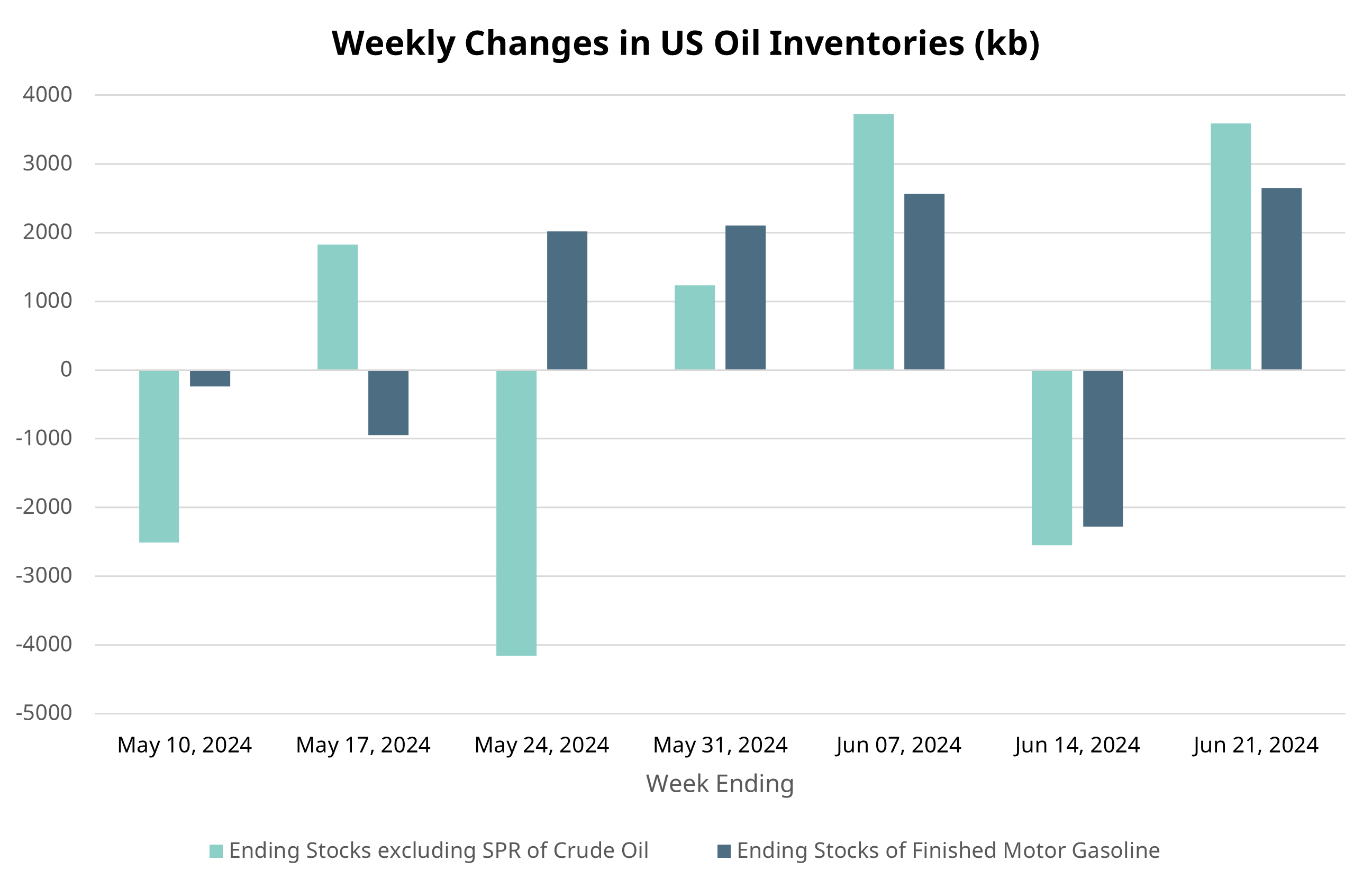

We further advised to keep an eye out for fundamentals in the United States. The bullish sentiment noted in Dated Brent this week, taking the difference between Dated Brent and Brent Swaps (DFL) in August to $0.75/bbl, would enable more cargoes to enter Europe from the US. Adding to the bearishness, June 26’s EIA announcement reported a 3.591mb build in US crude oil inventories against a forecast draw. In addition, the EIA reported a build of 2.654mb in US gasoline stocks at a time when one should instead be seeing draws in inventory due to seasonally higher summertime demand. The September Brent futures contract saw a sudden injection of volatility immediately after the announcement, with prices oscillating rapidly compared to the more quiet movement we saw earlier, but it ultimately fell just 20c to $84.45/bbl two hours after the announcement at 17:30 BST.