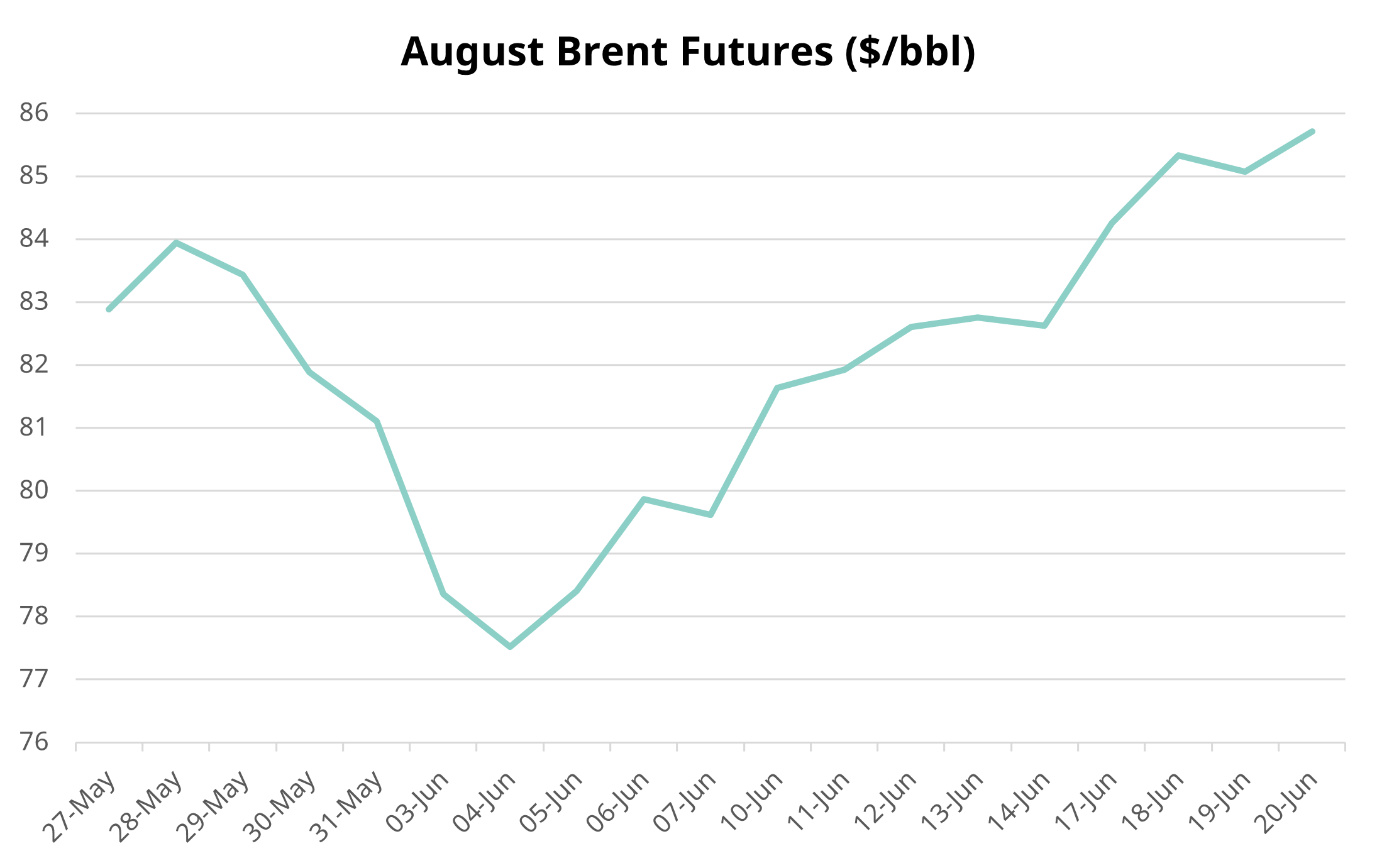

TARGET PRICE: $82/bbl – $84/bbl

PRICE: $85/bbl

Is Summer Demand Finally Here?

The crude oil futures market is on track for its second consecutive weekly gain on signs of better demand as Brent futures rallied to seven-week highs.

We initially held a neutral view as we forecast August Brent futures to end the week between $82/bbl and $84/bbl. The contract quickly rose to $85/bbl on Tuesday and has since stabilized at this level. The key factors that supported the crude rally this week are:

- Market positioning

- Strength in the underlying physical crude market

- Weather and geopolitical risk

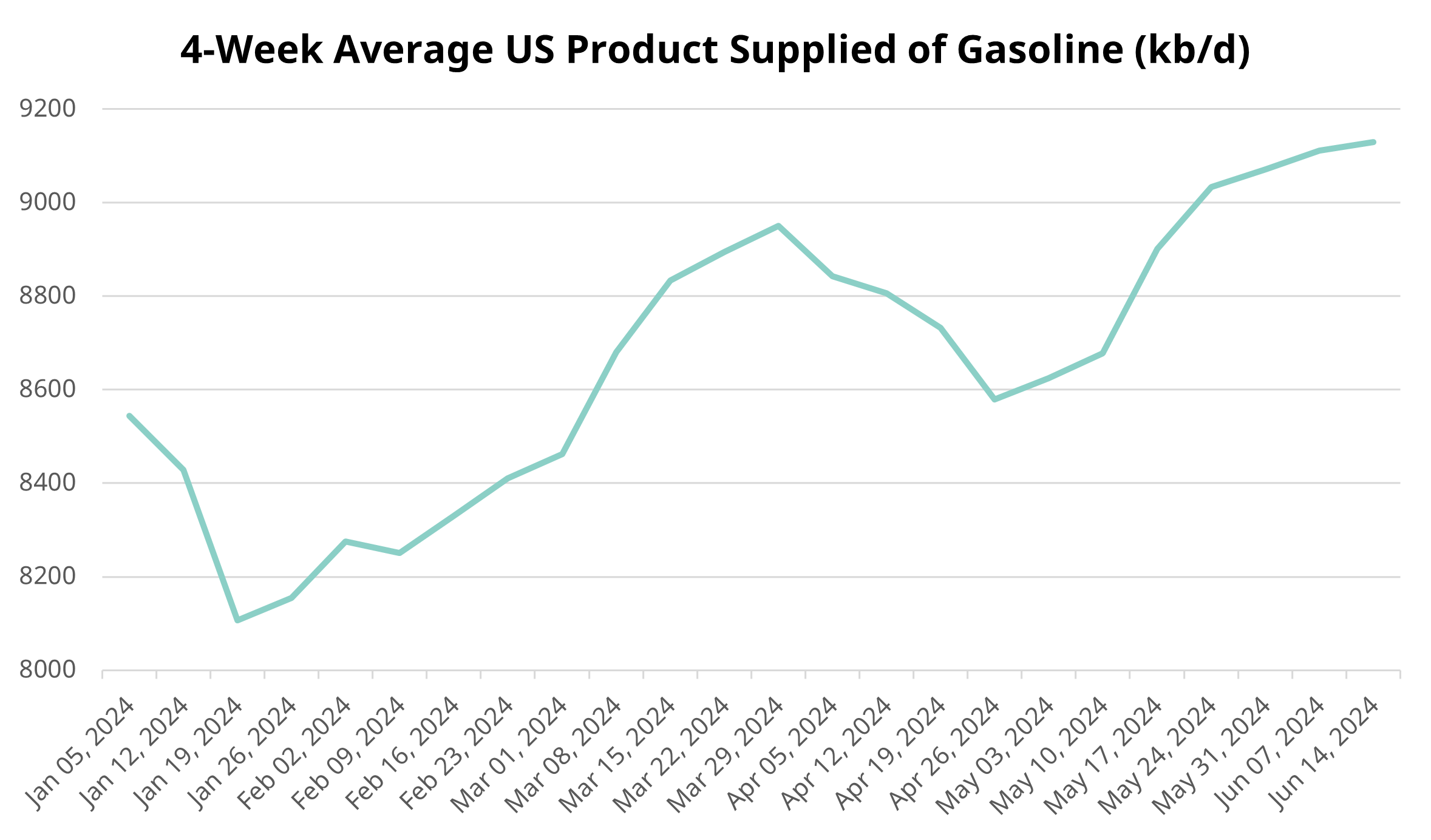

- Higher US gasoline demand

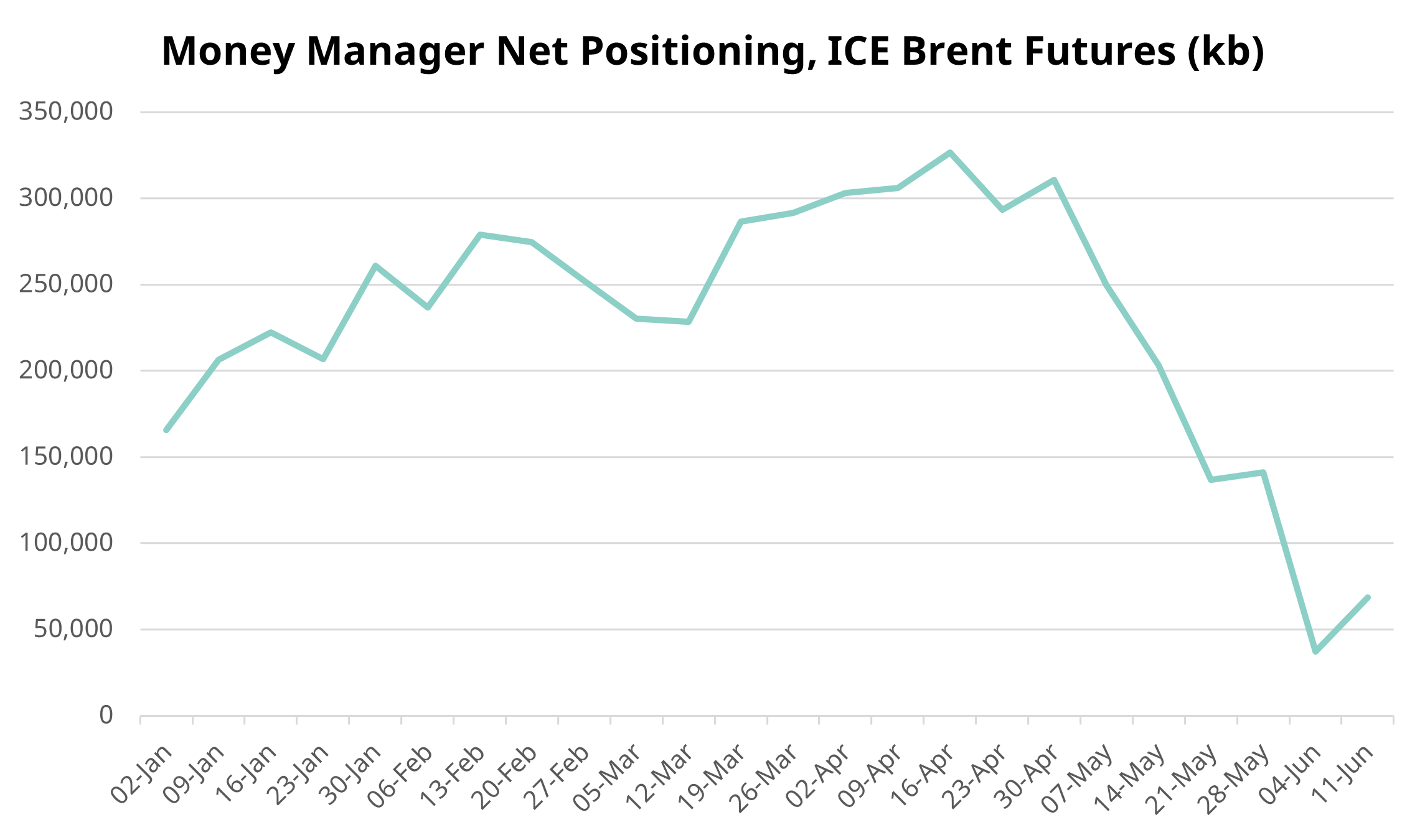

Following OPEC’s attempt to reassure traders of their flexibility in bringing barrels back to the market, the market has reset higher, with fickle short positions quickly liquidated. The initial sell-off was likely overdone, with speculative shorts unwinding their positions as total shorts fell by 38.6mb (-22.8%) in the week to 11 June. At that point, total outright shorts still exceeded September 2020 levels. Over this period, speculative long positions declined for the sixth consecutive week. Given the prevailing market positioning, shorts were vulnerable to a squeeze, and short covering flows likely exacerbated the recent upward move.

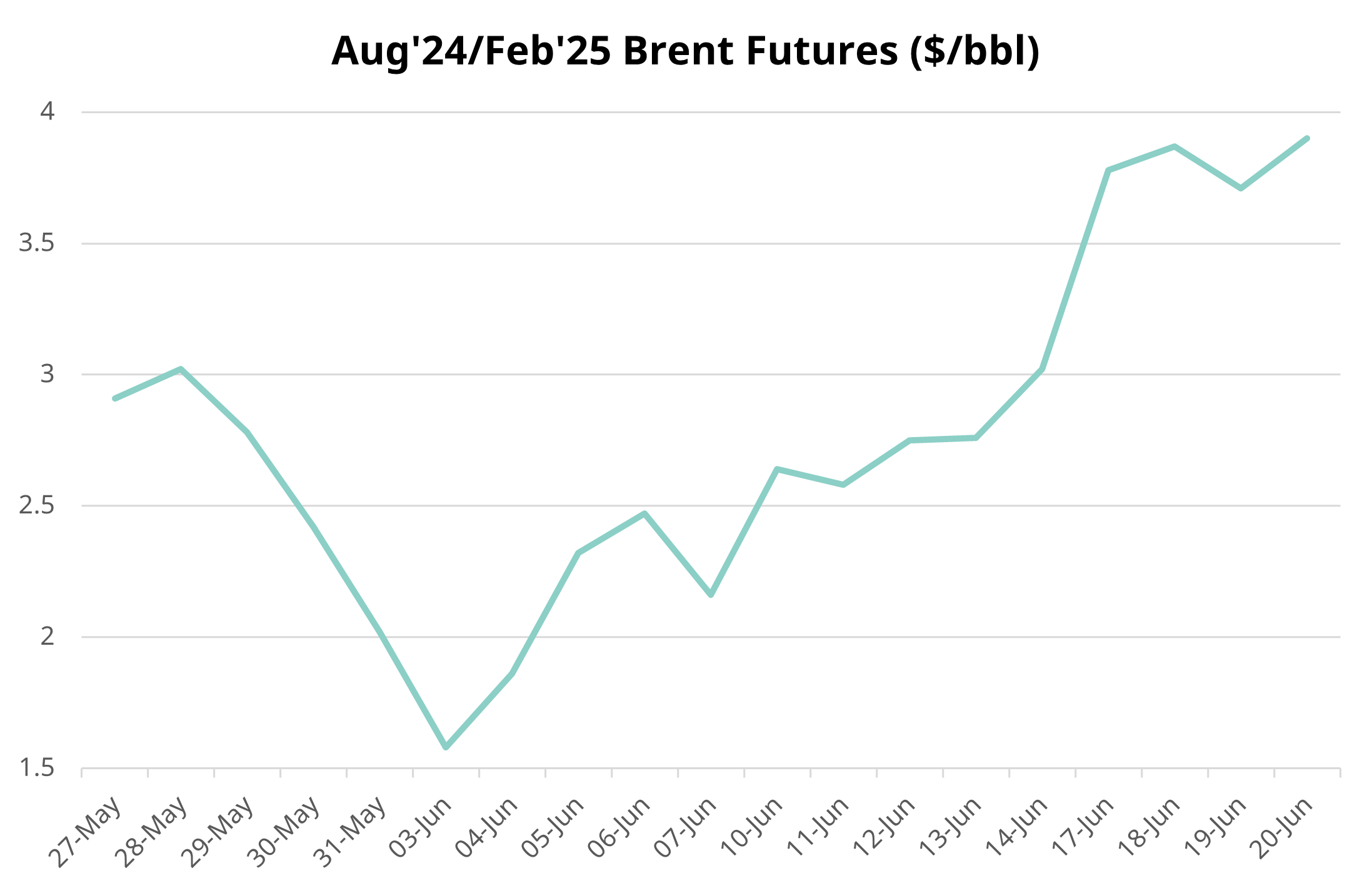

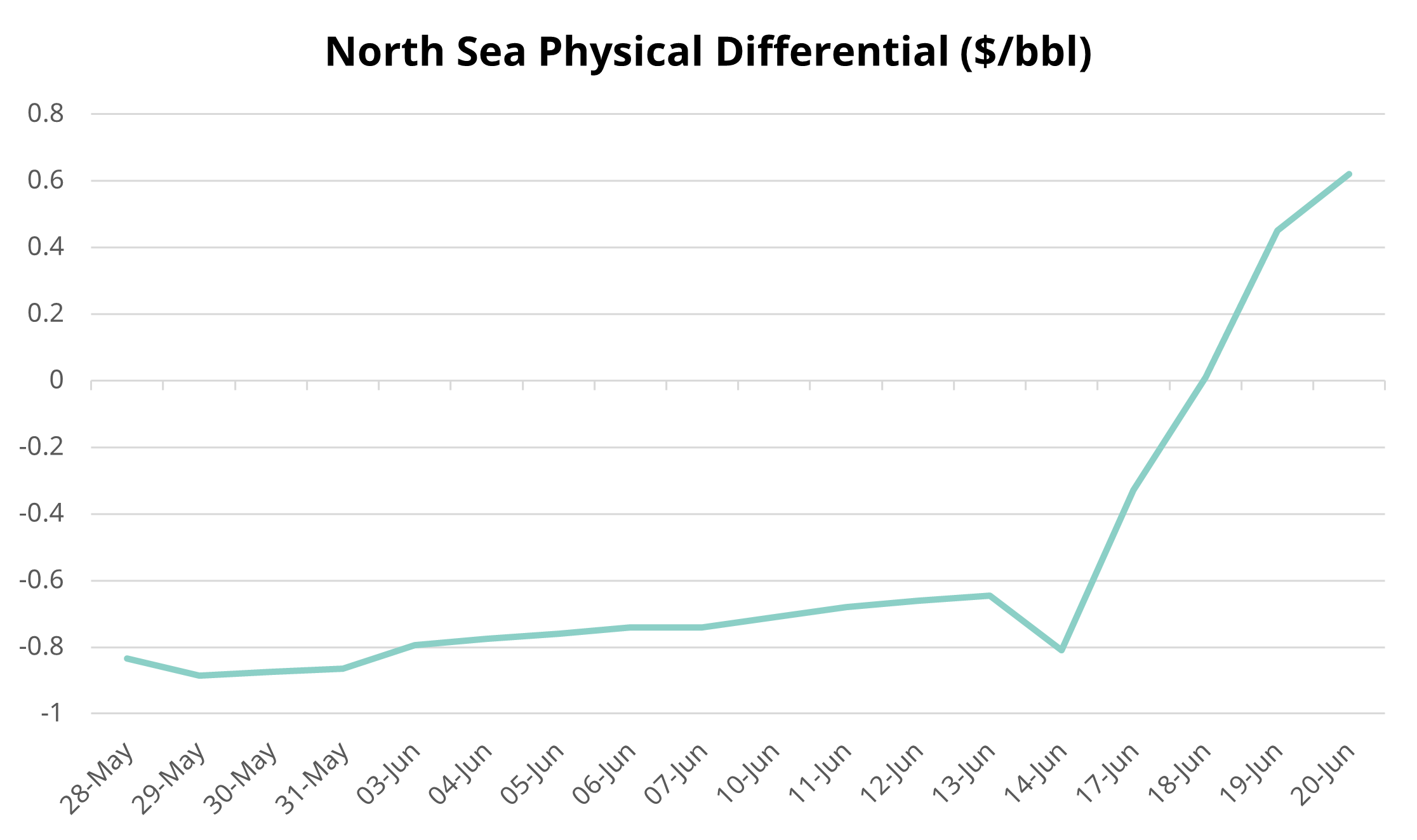

This week, sentiment has completely flipped in the underlying North Sea physical crude market. The Dated Brent structure has flipped from contango into backwardation for the first time in a month. In line with this, Brent spreads rallied aggressively as the market anticipated a more rapid drawdown of global crude inventories. The previous overhang of North Sea cargoes was quickly cleared, with Trafigura and Gunvor being relentless buy-side aggressors across the BFOETM grades in the Platts’ physical window. In a week, the North Sea physical print rose from -$0.81/bbl on June 14 to $0.62/bbl on June 20, highlighting the extraordinary reversal in market sentiment.

Hostilities between Israel and Hezbollah have risen, with Israel’s military saying that operational plans for an offensive in Lebanon had been “approved and validated.” This week, at least two refineries in southern Russia were targeted and received damage in an overnight swarm attack from drones. Meanwhile, Tropical Storm Alberto has disrupted various Gulf of Mexico oil terminals in Mexico and the US. This highlights the adverse risks to oil infrastructure posed by the Atlantic Hurricane Season, which can be a catalyst for bullish price action.