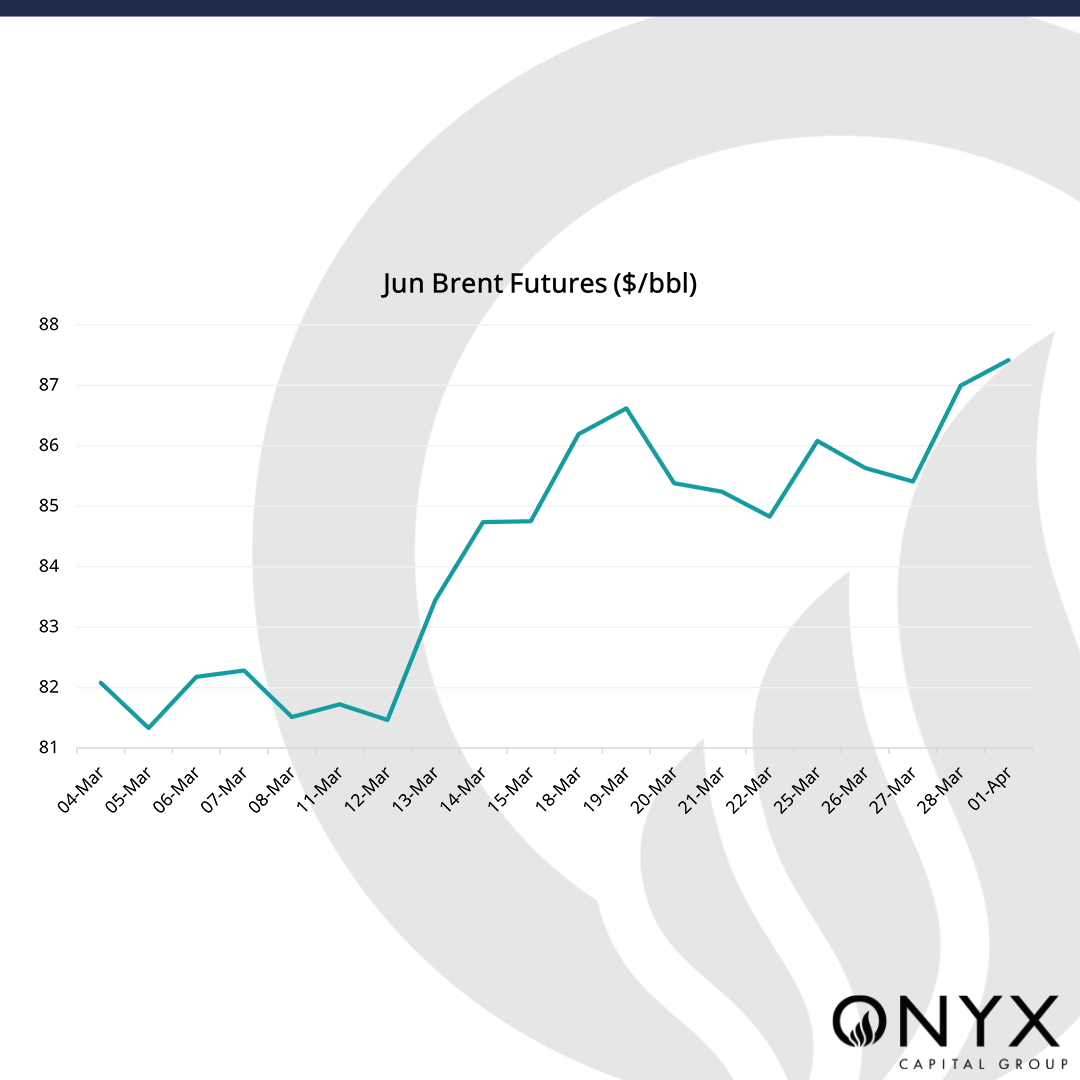

After a rangebound week, with Jun Brent futures oscillating around the $85/bbl mark, Brent futures strengthened in the lead up to the Easter bank holiday weekend. Support continues to be found, surpassing the $89/bbl mark on Apr 02.

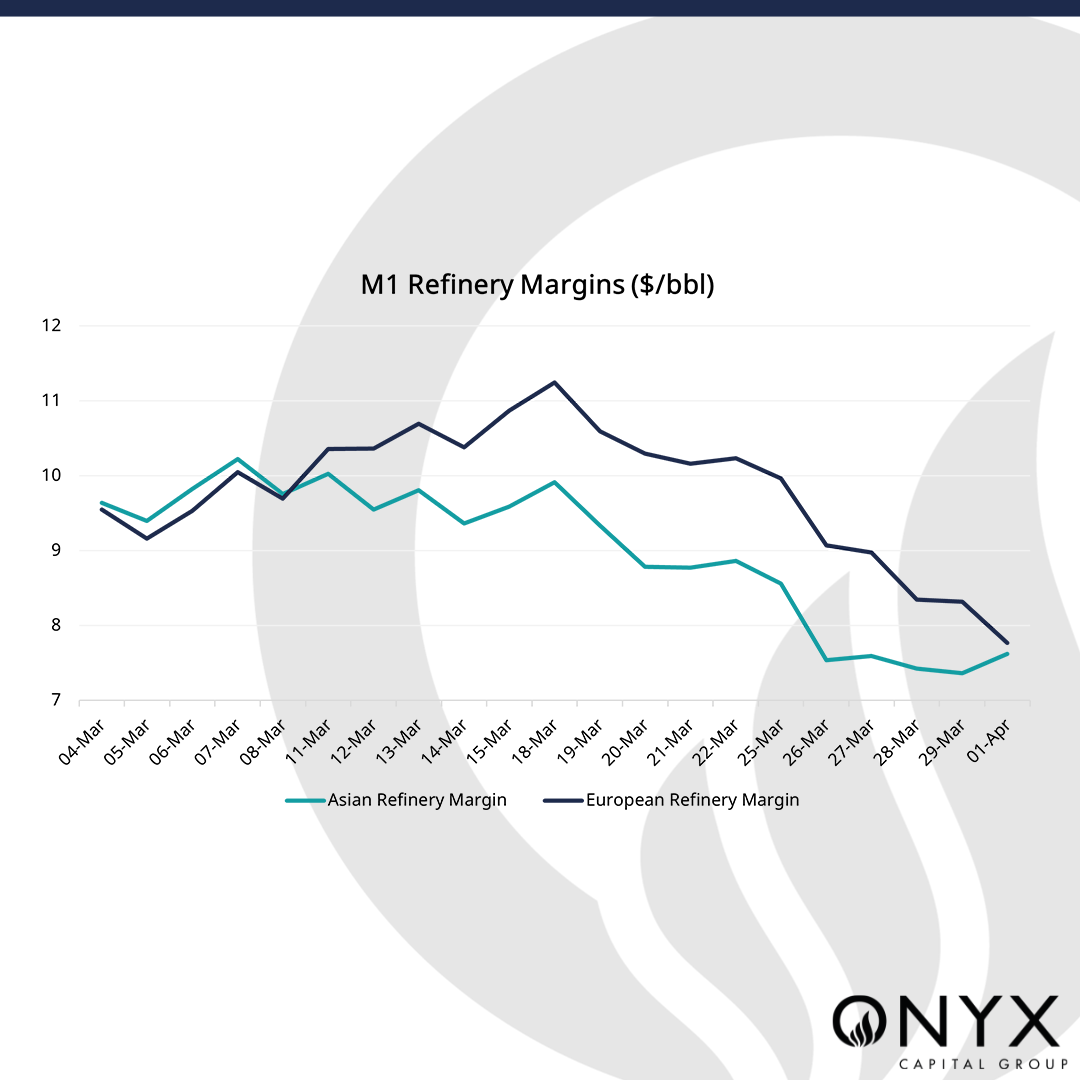

The rolling front month Brent futures contract rose to its highest level since the end of October on the back of invigorated demand signals, further escalating Middle East tension and improving global macro data. On Mar 27, the Biden administration awarded contracts to buy 2.8mbbls of oil at a price of around $81.30/bbl in order to refill some of the SPR. This headline likely balanced out the EIA announcing that crude oil inventories grew by 3.17mbbls on the week, against median estimations of a 1mbbls draw. Refinery utilisation also rose by 0.9% to 88.7%. However, in the past few days both Asian and European margins have come off to $7.62/bbl and 7.77/bbl respectively, having been around $8.50/bbl and $10/bbl a week prior.

On Apr 01, Iran’s Revolutionary Guards declared that seven officers had been killed as part of an Israeli strike on the Iranian consulate building in the Syrian capital, Damascus, further increasing tensions. Moreover, over the Easter long weekend, unexpectedly strong manufacturing data has emerged from the US and China. Chinese data kicked off with both manufacturing and services PMIs printing above expectations at 50.8 (vs 50.1 expected) and 53.0 (vs 51.5 expected) – a sign of slowly waking up from its trance. The US swiftly followed this, announcing an expanding manufacturing sector for the first time since Sep’2022, with the PMI coming in above 50 at 50.3 (vs 48.3 expected). On Apr 02 Petroleos Mexicanos has cancelled contracts to supply its flagship Maya crude oil to non-Mexican refiners, with exports usually equating to 600 kbbls/d – opting to prioritise the production of domestic gasoline and diesel ahead of the presidential election on Jun 02.

Looking ahead to this week, we forecast this support to be maintained. However, expect prices to find some resistance around the $90/bbl mark as it bids to pass this level for the first time since the early stages of the Israel-Hamas war, with the market looking to price in these further geopolitical risk developments – especially the situation in Iran, and the more convincing macro outlook. Apr 03 will mark an important day with OPEC+ ministers coming together. However, no changes are expected ahead of the full OPEC+ meeting scheduled for June 01, as well as EIA inventory and European CPI data set for release.

It will also be important to monitor Russia’s behaviour. There have been reports that the nation is having a much harder time moving oil with sanctions biting harder, in turn affecting shipping and obtaining insurance for vessels. Rosneft and Indian Oil Crop are also yet to renew an oil supply deal that expired in March, with the Indian refiner turning its attention to the spot markets. As a consequence, we could see more American crude moving into both Asia and Europe. Finally, there has been news of UNIPEC buying two VLCC’s of North Sea crude, Johan Svedrup.

With this in mind, we hold a bullish view and forecast Brent prices to print between $90-92/bbl.