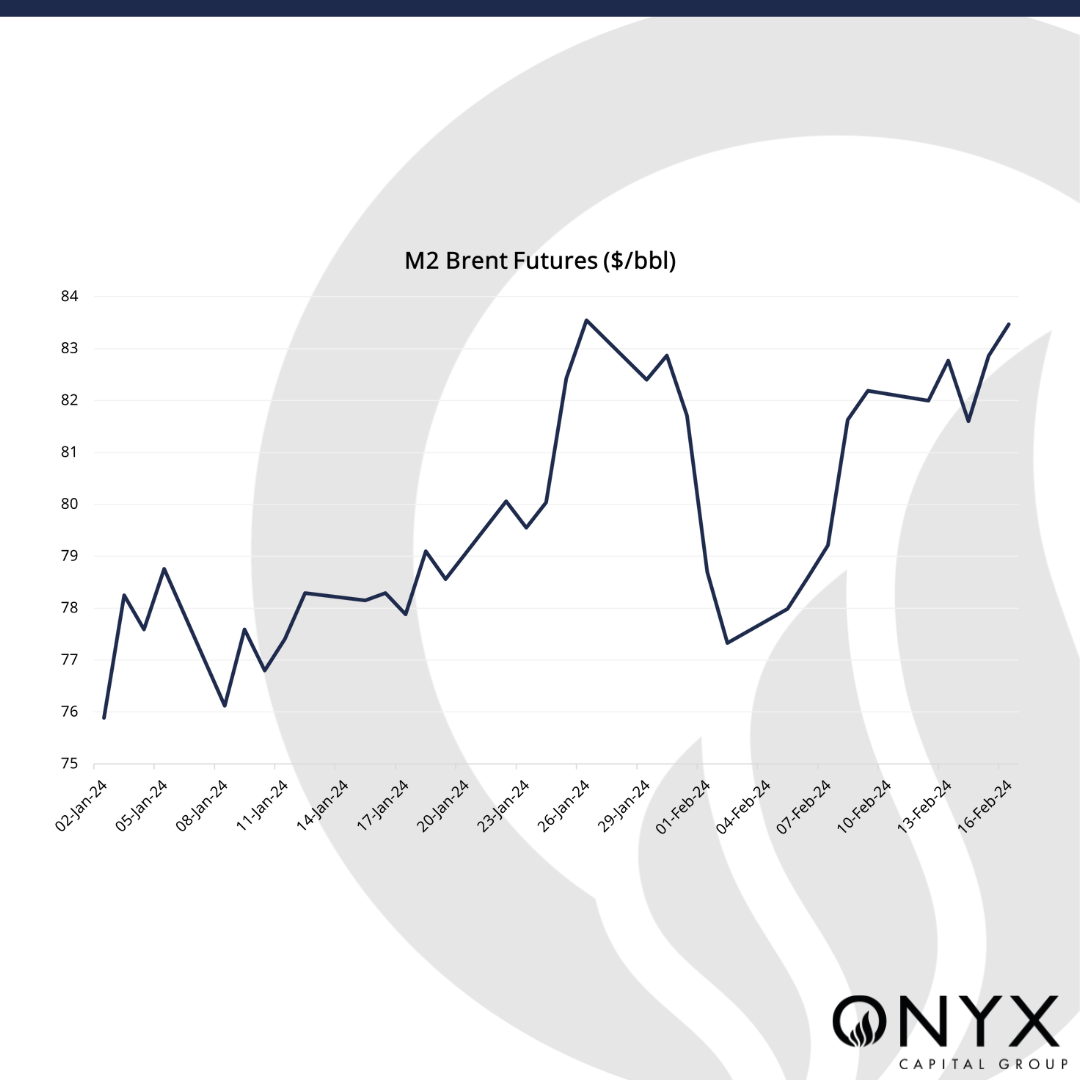

Oil prices were seen hovering around the $82.75/bbl handles on Monday morning after last week witnessed the Brent futures for the Apr contract rise by over 1%, following a 6% gain in the previous week.

Prices witnessed these gains alongside persistent tensions for shippers taking the Red Sea route, with the Houthis claiming responsibility for an attack on an India-bound oil tanker and the growing risk of conflict escalation in the Middle East amid Hezbollah reportedly firing “dozens of rockets” at a northern Israeli town in response to the killing of 10 civilians in southern Lebanon.

In addition, while the market will continue to await directional cues from the Asian market, where players will be returning today after a week-long holiday over the festivities of the Lunar New Year, a hopeful demand picture has been emerging in China. China’s tourism revenue over the holidays has reportedly surged by 47.3% year-on-year, exceeding levels seen before the pandemic, and indicating that consumption in the world’s second-largest economy may be improving.

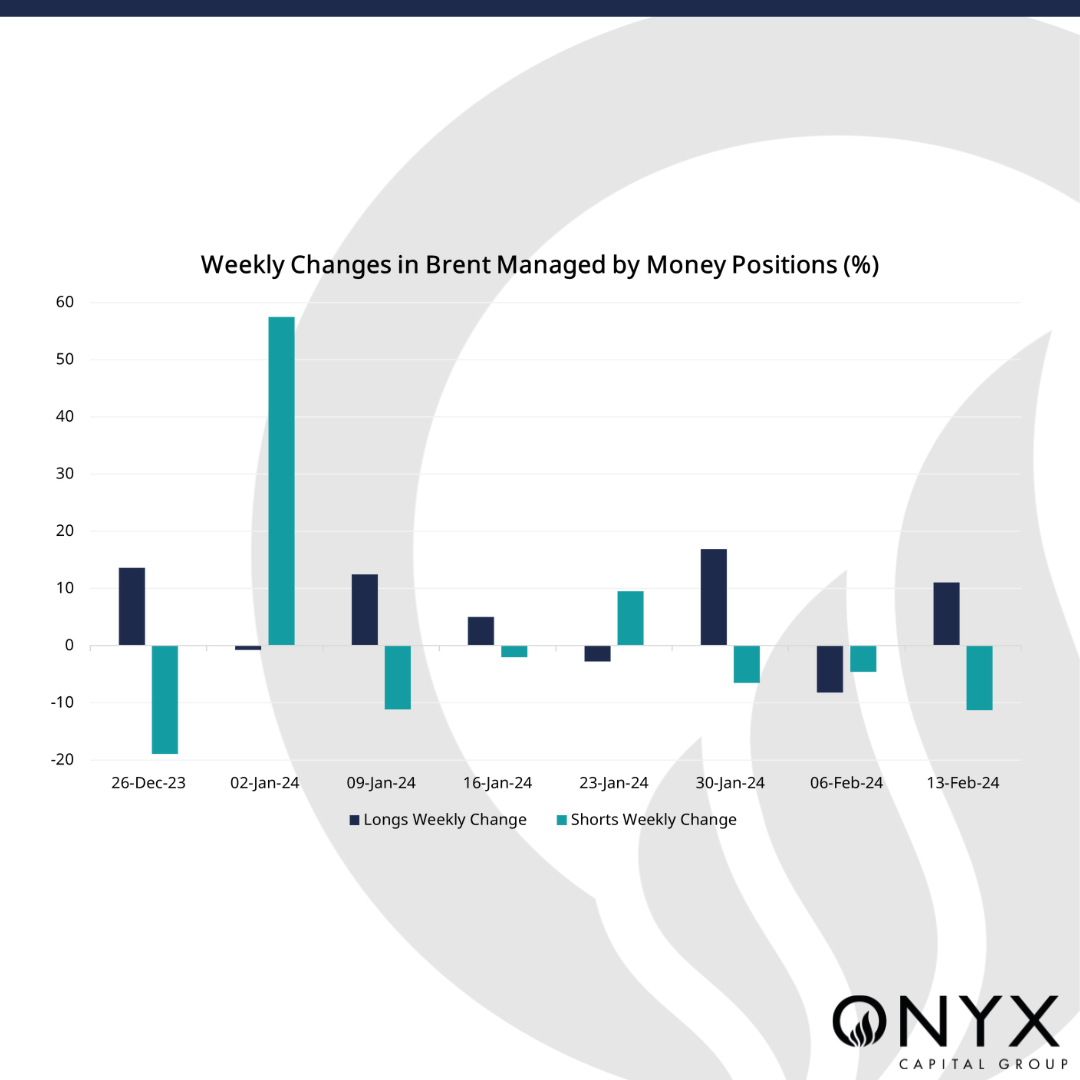

CFTC data for the week to February 13 showed a rise in open interest by 2.42%, the highest w-o-w increase in a month, whilst displaying the aforementioned bullish sentiment through long-positioned money managers entering en-masse and adding to their positions by 11% week-on-week. On the other hand, their bearish counterparts removed a further 11% from their positions in the same week, showcasing a removal of these shorts for the third consecutive week. This positioning change drove the long:short ratio to 5.34:1.00 in the week to February 13, the highest it has been since the end of October 2023.

Finally, trading activity in refined fuels is swelling up to the highest observed in multi-years. The most active contracts have been the CME’s RBOB (gasoline) futures and heating oil futures, along with ICE’s gasoil futures, which are up by nearly 40% from a year ago. Amid stronger refinery margins, we expect this to support refinery hedging, which would typically entail buying more crude.

In addition, the focus will remain on economic data out of the US, where substantial gains in the cost of services have facilitated a higher-than-expected rise in producer prices in January. The PPI rose 0.3% over January, its most significant month-on-month rise in five months. Adding to this is CPI data last week coming out higher than expected, with the annual rate of inflation sitting at 3.1% in January against an anticipated 2.9%. Despite this, we maintain our hopeful outlook on oil prices this week considering comments made by San Francisco Fed President Mary Daly over the weekend. Daly reiterated that the expectation of three rate cuts was a “reasonable baseline” for the outlook of monetary policy this year.

In terms of a price target for the benchmark crude futures, we predict prices to hover close to the $85/bbl handles this week, but anticipate that they could rise to the $88-90/bbl levels in the near future. For them to reach these levels this week, we would expect a further indication of a dovish US Fed alongside strong results this Wednesday, when 15% of S&P500 companies are due to report earnings.